[ad_1] It’s a light data agenda ahead to open the week in Europe: This snapshot from the ForexLive economic data calendar, access it here. The times in the left-most column are GMT. The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next

[ad_1] © Reuters. In a week marked by financial developments, the Indian rupee closed higher on Friday, settling at 82.93 against the U.S. dollar, a weekly gain of 0.3%. This performance comes on the heels of an announcement by multinational investment bank JPMorgan, revealing its plans to incorporate India’s government bonds into its emerging market

[ad_1] XAU/USD PRICE FORECAST: Gold (XAU/USD) Bounces as the DXY Faces a Key Resistance Hurdle. The Higher Rates for Longer Narrative is Likely to Weigh on the Precious Metal Moving Forward as Fed Projections Price in Only 50bps of Cuts in 2024, Down from 100bps in June. IG Client Sentiment Shows that Retail Traders are

[ad_1] Share: The index trades within a tight range just above 105.00. The FOMC meeting will take centre stage later in the session. The Fed is expected to keep rates unchanged on Wednesday. The greenback attempts some consolidative move in the low 105.00s when measured by the USD Index (DXY) ahead of the

[ad_1] FOMC PREVIEW: READ MORE: Nasdaq 100, S&P 500 Forecast: US Indices Remain Indecisive Ahead of a Massive Week As we approach a busy week for Central Banks the US Federal Reserve (FED) Meeting is set to take place on Wednesday the 20th of September. The resilience of the US economy and the data of

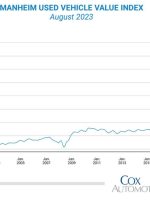

[ad_1] There might be a seasonal factor to the August bump, as this survey isn’t seasonally adjusted. “August brought a stop to wholesale price declines, though it was only a small reversal of the larger magnitude declines so far this spring and early summer,” said Chris Frey, senior manager of Economic and Industry Insights for

[ad_1] Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making