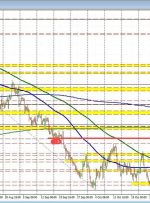

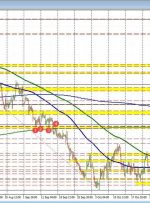

[ad_1] © Reuters. The currency pair continued its rise for the fourth day, buoyed by expectations around monetary policy on both sides of the Atlantic. The pound strengthened against the dollar, building on gains above its September high, as market sentiment turned cautious regarding further interest rate hikes by the Federal Reserve, according to minutes