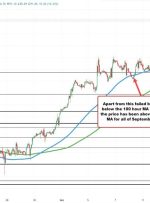

BITCOIN (BTC), ETHEREUM (ETH) KEY POINTS: READ MORE: EUR/USD Gets a Reprieve with the Dollar on Offer Today Download Your Free Complimentary Guide on Bitcoin Trading and Help Navigate Your Way Around the Complex World of Cryptocurrencies. Recommended by Zain Vawda Get Your Free Introduction To Cryptocurrency Trading Bitcoin has held up well over the

![Dow Futures (YM_F) looking for corrective rally soon [Video] Dow Futures (YM_F) looking for corrective rally soon [Video]](https://shmi.ir/wp-content/uploads/2023/08/Dow-Futures-YM_F-looking-for-corrective-rally-soon-Video-150x203.jpg)