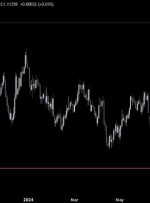

EUR/USD: Midpoint of the ‘Dull Period’ ● n the next part of the review, we will discuss how one crypto analyst used the term “dull period” in relation to the BTC/USD chart. The EUR/USD chart looks even more uneventful. While from 20 August until today, the pair fluctuated within the 1.1000-1.1200 range, last week it