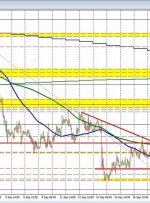

US Dollar Vs Euro, British Pound, Australian Dollar – Price Setups: EUR/USD is testing key support, while GBP/USD has fallen under a vital floor. AUD/USD is back at the lower end of the recent range; USD/JPY eyes psychological 150.. What’s next for EUR/USD, GBP/USD, AUD/USD, and USD/JPY? Recommended by Manish Jaradi Improve your trading with