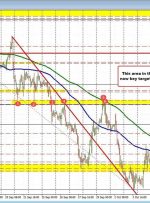

Euro (EUR/USD, EUR/GBP) Analysis Minutes Suggest the ECB is Content with Rates, Focused on the Economy ECB minutes revealed it was a close call to raise interest rates for the tenth and possibly last time, the last time the Governing Council met. The majority of officials anticipate that record high interest rates (4%) will play