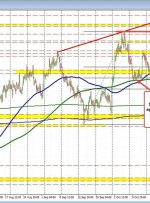

[ad_1] US Dollar Forecast – Prices, Charts, and Analysis Market traders now see 100bps of US rate cuts next year. Greenback trying to stem further losses. Recommended by Nick Cawley Get Your Free USD Forecast The US dollar is back at lows last seen six weeks ago after last week’s heavy sell-off. US Treasury yields