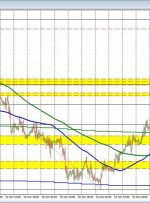

Article by IG Chief Market Analyst Chris Beauchamp Dow Jones, Nasdaq 100, CAC 40 Analysis and Charts Dow stronger in wake of Fed decision The index’s rally was given fresh impetus by the Fed decision last night, which saw a more balanced outlook from Jerome Powell. The index has climbed to its highest level in