[ad_1] © Reuters. FILE PHOTO: Woman holds U.S. dollar banknotes in this illustration taken May 30, 2022. REUTERS/Dado Ruvic/Illustration/File Photo By Jamie McGeever ORLANDO, Florida (Reuters) -The rise in U.S. rate cut expectations for next year seems to have prompted hedge funds to cool their optimism on the dollar, potentially weakening a key plank of

[ad_1] Article by IG Chief Market Analyst Chris Beauchamp Dow Jones, Nasdaq 100, Nikkei 225 – Analysis and Charts Dow rally sees slower going The rally has slowed in recent days, though sellers have been unable to establish control even in the short-term timeframes.Further gains continue to target the summer 2023 highs above 35,600, while

[ad_1] GOLD PRICE (XAU/USD), AUD/USD FORECAST: Gold prices climb and challenge technical resistance on the back of falling U.S. yields and U.S. dollar softness AUD/USD also pushes higher, breaking above its 200-day simple moving average This article looks at key technical levels to watch on XAU/USD and AUD/USD this week Most Read: US Dollar Forecast

[ad_1] Share: Unilever is a multinational consumer goods corporation. Unilever products include food, condiments, ice cream, coffee, cleaning agents, pet food, beauty products, personal care and more. Founded 1919 by the merger of the Dutch margarine producer Margarine Unie and the British soapmaker Lever Brothers, it is headquartered in London, UK. Unilever is a part of FTSE

[ad_1] Share: EUR/JPY faces a slight downturn but manages to stay above the crucial 163.00 level. The pair touched a three-day low at 162.15, yet a ‘hammer’ pattern in today’s trading indicates potential buyer intervention around the Tenkan-Sen level of 162.37. A move below 163.00 might lead to a further decline towards the

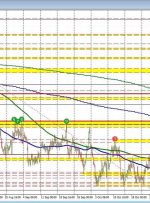

[ad_1] Today, the AUDUSD has moved up from a swing area support between 0.6445 and a 0.6455 (see red numbered circles on the chart below). The subsequent move to the upside took the price back above its 100-day moving average of 0.64874 (blue overlay line on the chart below). That moving average is – and

[ad_1] Share: The AUD/JPY saw a late break higher in Friday’s broad-market sentiment recovery. The Aussie is catching a bounce from the 200-hour SMA and a rising trendline. The technicals are leaning bullish with more upside on the cards, but headwinds remain. The AUD/JPY snuck over the 97.50 level just ahead of the

[ad_1] S&P indexes moving above its 100 day moving average The S&P index is currently trading near session highs, up 60.44 points or 1.39% at 4407.92, and in the process has broken above its 100-day moving average of 4402.47 (see the blue line in the chart above). The last time it traded above this moving

[ad_1] S&P 500 Analysis Is bad news good news again? Sentiment appears to have shifted A dovish perception of the recent FOMC meeting buoyed risk assets as rate cuts shift closer Longer-term trend may be at risk but a number of key technical levels appear in the interim The analysis in this article makes use