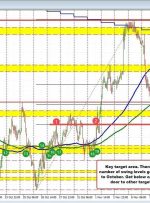

[ad_1] Share: Australian Dollar could continue its downward trajectory. Australia’s central bank adopted a dovish stance in their recent meeting. US Dollar seems lukewarm, despite the positive tone of US bond yields. The Australian Dollar (AUD) aims to continue a week-long slump while the US Dollar (USD) keeps weakening on Monday despite higher US