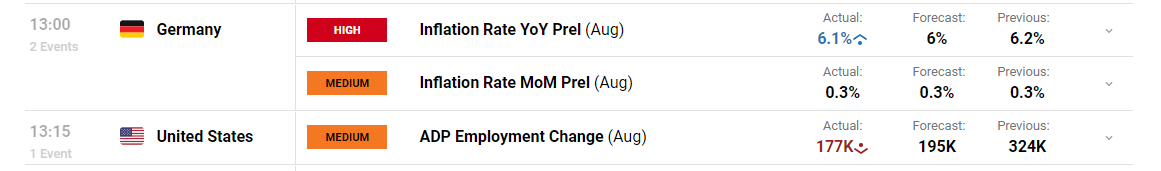

German Inflation Proves Stubborn, Narrowly Beating Forecasts

Inflation in Germany proved hotter than expected, coming in at 6.1% vs 6% but down from last month’s print of 6.2%. Higher inflation in Europe complicates the ECB’s task particularly after ‘sources’ indicated that the committee is leaning more to the dovish end of the policy spectrum ahead of the September meeting with markets pricing in a 50/50 split when it comes to hiking 25 bps or standing firm.

Customize and filter live economic data via our DailyFX economic calendar

US Labour Data Eases Ahead of NFP on Friday, US GDP Revised Lower

At the Jackson Hole Economic Symposium, Jerome Powell reiterated the Fed’s expectations that the labour market would need to ease in order to get inflation down to the 2% target. The tight labour market has contributed to sticky core inflation meaning the Fed may still have to use the remaining 25-basis point hike before year end.

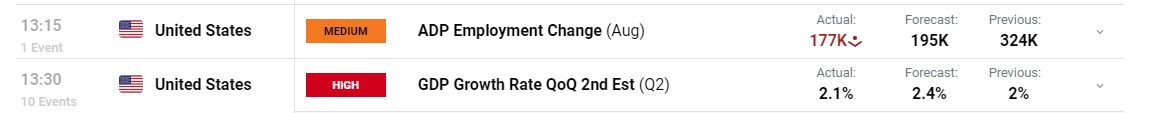

Yesterday, US job openings revealed 1.5 openings for every unemployed person, which is the lowest ratio since 2021 but still remains elevated. The release of ADP data just 15 minutes after the German inflation data revealed further signs of easing in the jobs market ahead of the much anticipated non-farm payroll data on Friday.

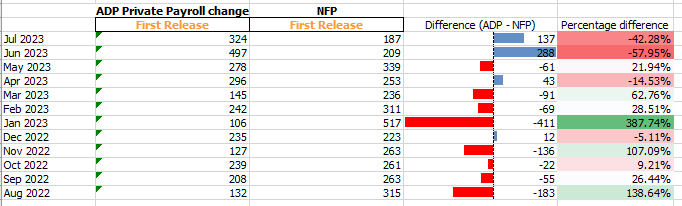

ADP data still appears to be a poor indicator of US NFP data even after the methodology change in August of 2022. While a larger sample size is needed to draw more accurate inferences, the initial data set has proven to show that ADP initially underestimated NFP data and more recent prints have over-estimated the more commonly referred to print.

ADP Remains a Poor Indicator of NFP Despite Methodology Change

Source: refinitiv

Recommended by Richard Snow

Introduction to Forex News Trading

The second estimate of US Q2 GDP revealed a more realistic figure of 2.1% after a massive 2.4% initially estimated.

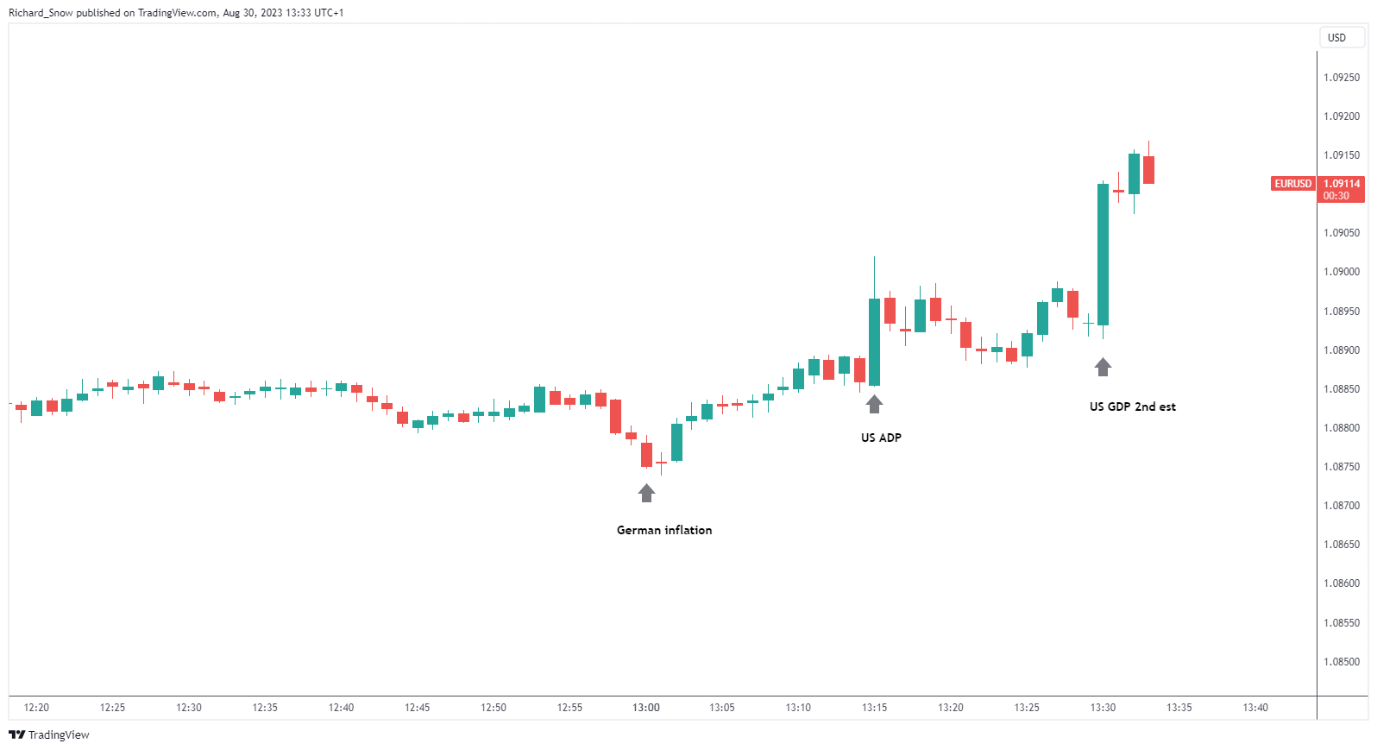

Immediate Market Reaction

The combination of a softer labour market and a US economy advancing forward at a more realistic pace, has seen the dollar surrender some ground.

The 1-minute chart shows the response in EUR/USD to the German inflation data (13:00), US ADP data (13:15) and the second estimate of US Q2 GDP data at (13:30). The net effect is a move higher in the pair.

EUR/USD 1 min chart

Source: TradingView, prepared by Richard Snow

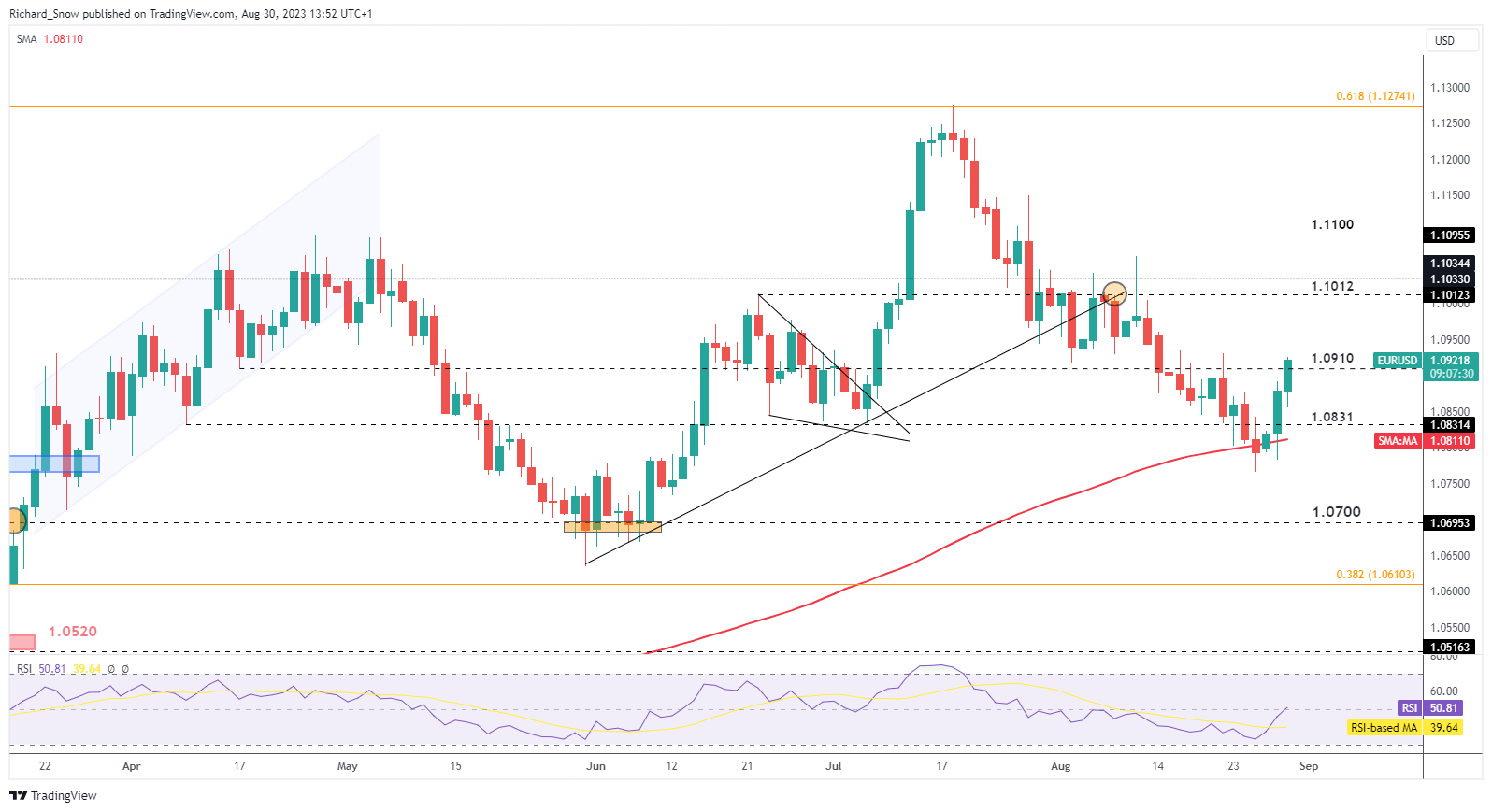

The daily chart shows the difficulty for the pair to continue the selloff after reaching the 200-simple moving average (SMA). The pair attempts to regain lost ground (from a euro perspective) as the high-flying US economic data appears vulnerable to downward revisions. Something to note is that the US economic surprise index has been heading lower – potentially indicating a tougher economic environment for the world’s largest economy. However, with US PCE data and FFP still to come this week, do not discount the possibility for dollar resurgence in the event those data points surprise to the upside.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Traits of Successful Traders

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0