CRUDE OIL PRICE OUTLOOK

- Oil prices fall for the second day in a row, but the fundamental outlook remains constructive

- Geopolitical tensions in the Middle East continue to be supportive of some energy commodities

- This article looks at the key technical levels for oil to keep an eye on in the coming days

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Australian Dollar Forecast – AUD/USD Rallies Off Support but Trend Remains Bearish

Crude oil prices, as measured by WTI futures, retreated on Tuesday, extending their decline for the second day in a row after last Friday’s massive rally. News that the U.S. may strike a deal with Venezuela for sanction relief weighed on the commodity, but geopolitical tensions capped the downside.

The White House and the Maduro administration have been working on an agreement that would open the door for more Venezuelan crude to enter international markets in exchange for a commitment to freer and democratic presidential elections in the Latin American country next year.

While this potential deal could contribute to bolstering worldwide supplies, it is unlikely to bring about substantial changes in current market dynamics, given the considerable hurdles that Venezuela’s energy sector confronts due to prolonged neglect and underinvestment in the industry.

Focusing on other major catalysts, the situation in the Middle East remains supportive of energy markets. Although Israel has postponed its potential invasion of the Gaza Strip, a ground incursion into the coastal enclave remains a looming possibility.

Eager to gain a better understanding of where the oil market is headed? Download our Q4 trading forecast for enlightening insights!

Recommended by Diego Colman

Get Your Free Oil Forecast

Any escalation of the Israeli-Hamas clash could raise the geopolitical temperature in the region, especially if it draws in other actors like Iran. This could result in new constraints on global energy supplies, contributing to ongoing strength in oil prices.

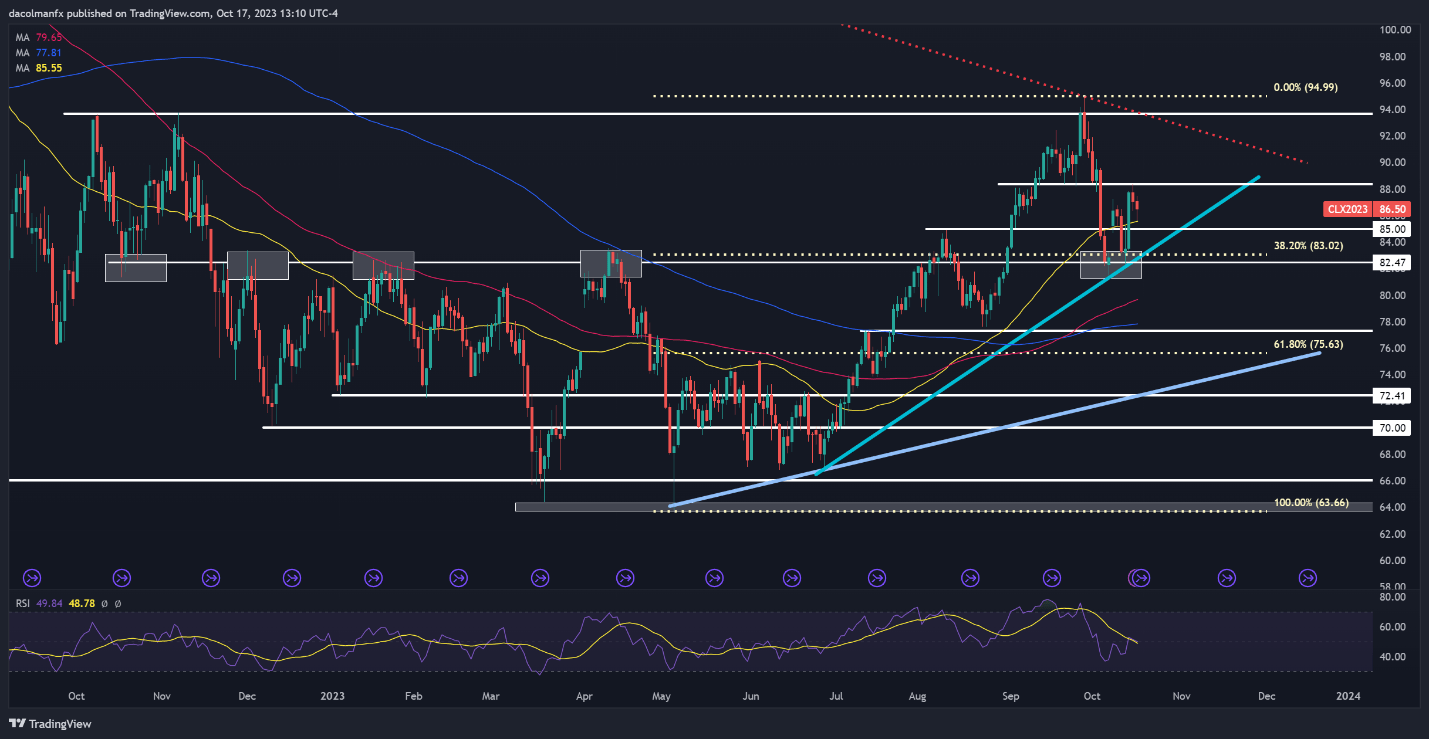

From a technical standpoint, WTI futures started to move lower this week after failing to clear resistance at $88.50. If the pullback accelerates in the days ahead, initial support rests in the $85.50/$85.00 range. On further softness, the focus will turn to a short-term uptrend line near the $83.00 level.

On the other hand, if oil manages to resume its trek upwards, overhead resistance appears at $88.50. Although it may be difficult for buyers to take out this barrier, a breakout could reinforce bullish momentum, setting the stage for a move towards $93.80.

Become a savvy oil trader today. Don’t miss the opportunity to learn key tips and strategies – download our ‘How to Trade Oil’ guide now!”

Recommended by Diego Colman

How to Trade Oil

CRUDE OIL TECHNICAL CHART

Light Crude Oil Futures Chart Created Using TradingView

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0