Renko Charts MT4 Indicator – ForexMT4Indicators.com

[ad_1] Renko charts, a popular technical analysis tool, have gained significant attention among traders in the financial markets, particularly in the realm of forex and stocks. Renko charts offer a unique perspective on price movements, which can assist traders in making more informed decisions. In this article, we will delve into the intricacies of the

[ad_1]

Renko charts, a popular technical analysis tool, have gained significant attention among traders in the financial markets, particularly in the realm of forex and stocks. Renko charts offer a unique perspective on price movements, which can assist traders in making more informed decisions. In this article, we will delve into the intricacies of the Renko Charts MT4 Indicator, exploring its features, benefits, and how it can empower traders to enhance their trading strategies.

Understanding Renko Charts

What Are Renko Charts?

Renko charts are a type of financial charting tool used for analyzing price movements. Unlike traditional candlestick charts, which focus on time intervals, Renko charts concentrate solely on price changes. Each brick on a Renko chart represents a fixed price movement, disregarding the time factor. This characteristic helps traders identify trends and patterns more clearly.

How Do Renko Charts Differ from Traditional Candlestick Charts?

In conventional candlestick charts, time is a critical factor. New candles form based on a predetermined time frame (e.g., every 1 minute, 5 minutes, etc.), leading to irregular candle sizes. On the other hand, Renko charts create uniform brick sizes regardless of time, emphasizing price movements. This eliminates noise caused by insignificant price fluctuations.

The Mechanics of Renko Charts

Brick Size and Price Movements

The brick size in a Renko chart represents the minimum price movement required to form a new brick. Traders can adjust this size based on their preferences and trading strategies. A smaller brick size captures minor price movements, while a larger size filters out noise, focusing on significant price changes.

Building Renko Blocks: The Calculation Process

Renko blocks are built as bricks close above or below the previous brick’s high or low. If the price surpasses the previous high (for an upward movement) or falls below the previous low (for a downward movement) by the chosen brick size, a new brick forms. This process allows traders to easily visualize trends and reversals.

Advantages of Using Renko Charts

Filtering Market Noise

Renko charts excel in eliminating market noise and displaying only substantial price movements. This clarity helps traders identify true trends and potential reversals without distractions from minor fluctuations.

Clear Trend Identification

With Renko charts, trends become more apparent due to their uniform brick sizes. Traders can quickly spot upward, downward, or sideways trends, enabling them to tailor their strategies accordingly.

Incorporating Renko Charts into Your Trading Strategy

Support and Resistance Levels Reimagined

Renko charts offer a fresh perspective on support and resistance levels. As bricks form without considering time intervals, support and resistance become more pronounced, aiding traders in making precise entry and exit decisions.

Identifying Breakouts with Renko Charts

Breakouts are more evident on Renko charts, making it easier to spot potential entry points. A breakout is confirmed when the price surpasses the previous brick’s high (for an upward breakout) or low (for a downward breakout).

Combining Renko Charts with Other Indicators

Moving Averages and Renko

Combining Renko charts with moving averages can help traders confirm trends and filter out false signals. When Renko bricks consistently stay above a moving average, it indicates an uptrend, while bricks below the moving average suggest a downtrend.

Relative Strength Index (RSI) and Renko

Using the RSI alongside Renko charts enhances decision-making. Overbought and oversold conditions indicated by the RSI can be aligned with Renko brick patterns to identify potential reversals.

Risks and Considerations

False Signals in Choppy Markets

While Renko charts excel in trending markets, they can produce false signals in choppy or sideways markets. It’s essential to consider market conditions and supplement Renko analysis with other tools in such scenarios.

Overemphasis on Historical Data

Renko charts prioritize price movements, potentially overlooking critical fundamental factors affecting the market. Traders should maintain a holistic view by integrating fundamental and technical analyses.

Tips for Effective Renko Chart Analysis

Selecting Appropriate Brick Sizes

The choice of brick size depends on the trader’s goals and the asset being analyzed. Smaller brick sizes capture short-term price movements, while larger sizes focus on long-term trends.

Regular Monitoring of Renko Patterns

As markets evolve, so do trends and patterns. Regularly monitor your Renko charts to stay updated on price dynamics and adjust your strategies accordingly.

The Future of Renko Charts

Potential Integrations with Algorithmic Trading

Renko charts’ ability to filter noise and emphasize trends makes them compatible with algorithmic trading strategies. As automation gains traction, Renko charts could become a staple for automated traders.

Rising Popularity among Retail Traders

With the democratization of trading and increasing accessibility to advanced tools, Renko charts are gaining popularity among retail traders seeking a more accurate and simplified way to analyze price movements.

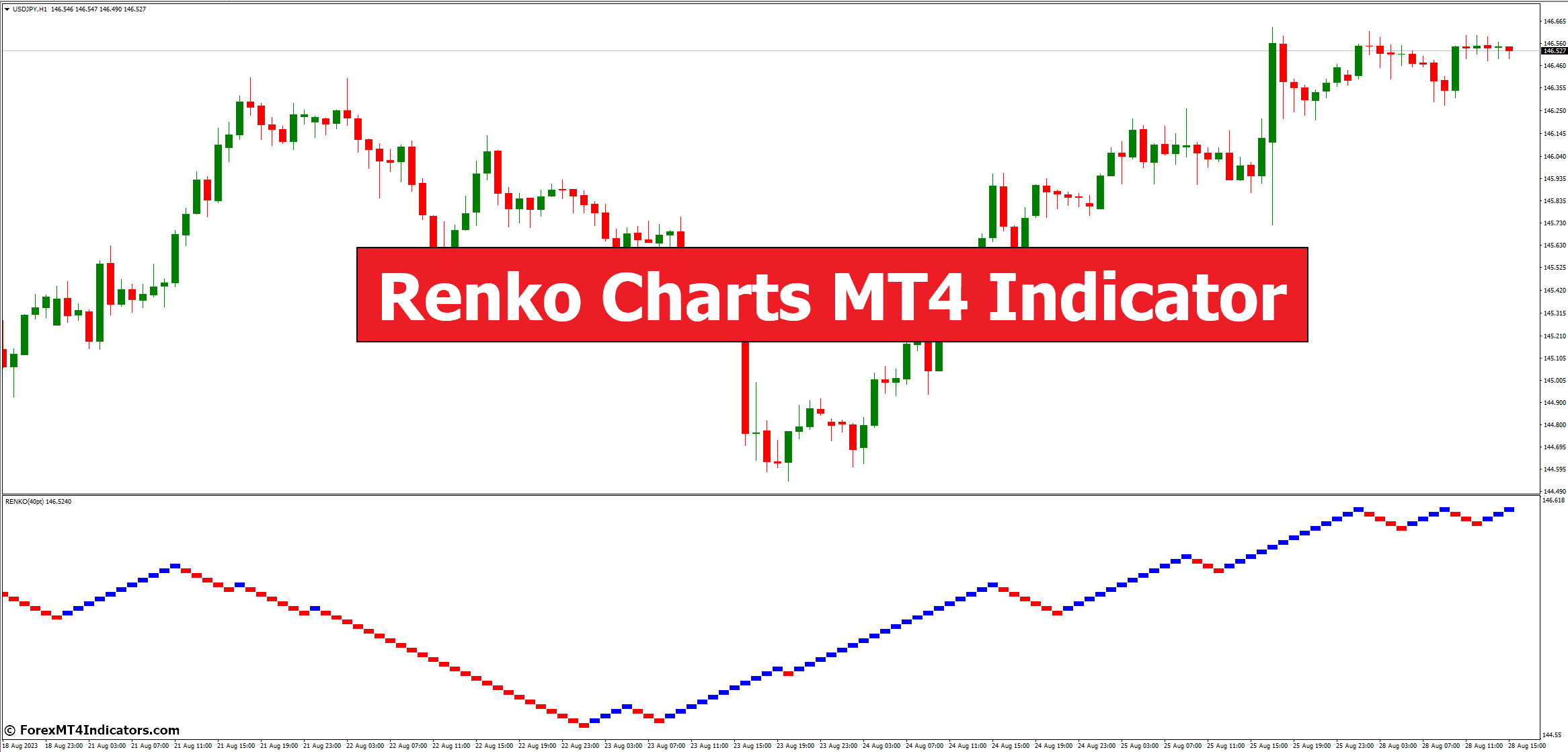

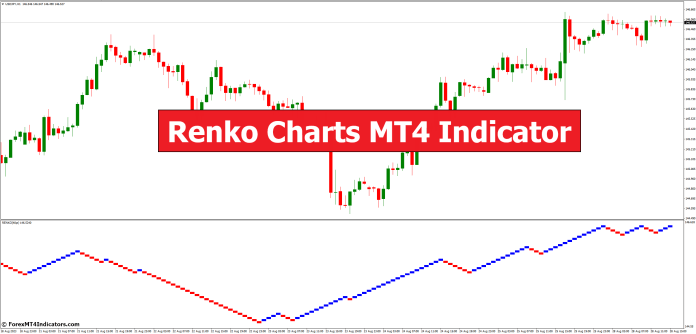

How to Trade with Renko Charts MT4 Indicator

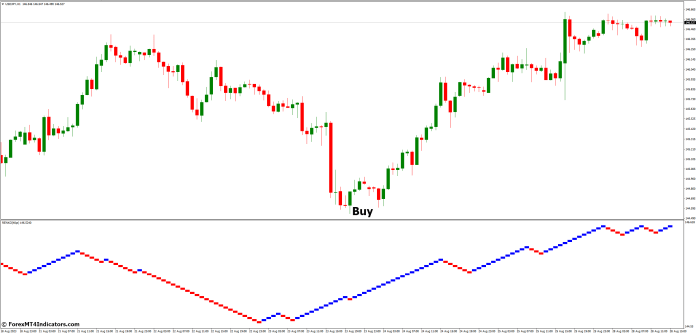

Buy Entry

- Identify a series of consecutive green bricks for an upward trend.

- Wait for a red brick retracement against the trend.

- Buy when the next green brick forms after the retracement.

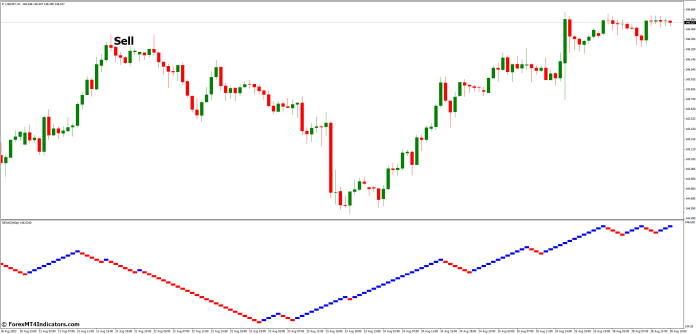

Sell Entry

- Spot consecutive red bricks for a downward trend.

- Wait for a green brick retracement against the trend.

- Sell when the next red brick comes after the retracement.

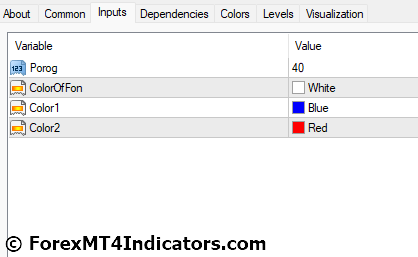

Renko Charts MT4 Indicator Settings

Conclusion

In the ever-evolving landscape of financial trading, the Renko Charts MT4 Indicator emerges as a valuable asset for both novice and seasoned traders. By focusing on price movements and eliminating time-related noise, Renko charts offer a unique lens through which to view market trends. When combined with other technical and fundamental analysis tools, the Renko Charts MT4 Indicator can empower traders to make well-informed decisions, enhancing their trading strategies and potential for success.

FAQs

- What is the significance of brick size in Renko charts?

The brick size determines the minimum price movement required to form a new brick on a Renko chart. It influences the chart’s granularity and the visibility of price movements. - Can Renko charts be used for day trading?

Yes, Renko charts can be highly effective for day trading, especially when combined with other technical indicators to confirm trends and entry/exit points. - Do Renko charts work well for all types of financial instruments?

Renko charts are versatile and can be applied to various financial instruments, including forex, stocks, commodities, and indices. - Are Renko charts suitable for beginners?

Yes, Renko charts can be beneficial for beginners due to their simplified focus on price movements. However, a solid understanding of trading principles is recommended. - Can I use Renko charts as my sole analysis tool?

While Renko charts offer valuable insights, it’s advisable to use them in conjunction with other analysis tools to obtain a comprehensive view of the market.

MT4 Indicators – Download Instructions

Renko Charts MT4 Indicator is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to transform the accumulated history data.

Renko Charts MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust their strategy accordingly. Click here for MT4 Strategies

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Renko Charts MT4 Indicator.mq4?

- Download Renko Charts MT4 Indicator.mq4

- Copy Renko Charts MT4 Indicator.mq4 to your Metatrader Directory / experts / indicators /

- Start or restart your Metatrader 4 Client

- Select Chart and Timeframe where you want to test your MT4 indicators

- Search “Custom Indicators” in your Navigator mostly left in your Metatrader 4 Client

- Right click on Renko Charts MT4 Indicator.mq4

- Attach to a chart

- Modify settings or press ok

- Indicator Renko Charts MT4 Indicator.mq4 is available on your Chart

How to remove Renko Charts MT4 Indicator.mq4 from your Metatrader Chart?

- Select the Chart where is the Indicator running in your Metatrader 4 Client

- Right click into the Chart

- “Indicators list”

- Select the Indicator and delete

Renko Charts MT4 Indicator (Free Download)

Click here below to download:

Download Now

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Charts ، ForexMT4Indicators.com ، Indicator ، MT4 ، Renko

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0