NFP to Revive EURUSD Downtrend?

[ad_1] Euro Analysis (EUR/USD, EUR/JPY) EUR/USD Driven by Countertrend Move is Yields, USD In an unsurprising fashion markets have cooled off in anticipation of today’s NFP print which was always going to be the standout event this week. Lackluster EU PMI data at the start of the week sent the euro lower against most of

[ad_1]

Euro Analysis (EUR/USD, EUR/JPY)

EUR/USD Driven by Countertrend Move is Yields, USD

In an unsurprising fashion markets have cooled off in anticipation of today’s NFP print which was always going to be the standout event this week. Lackluster EU PMI data at the start of the week sent the euro lower against most of its peers as the European economy stagnates. Europe’s largest economy, Germany is on the verge of recession with Q2 GDP coming in flat and Q3 not looking rosy by any stretch of the imagination.

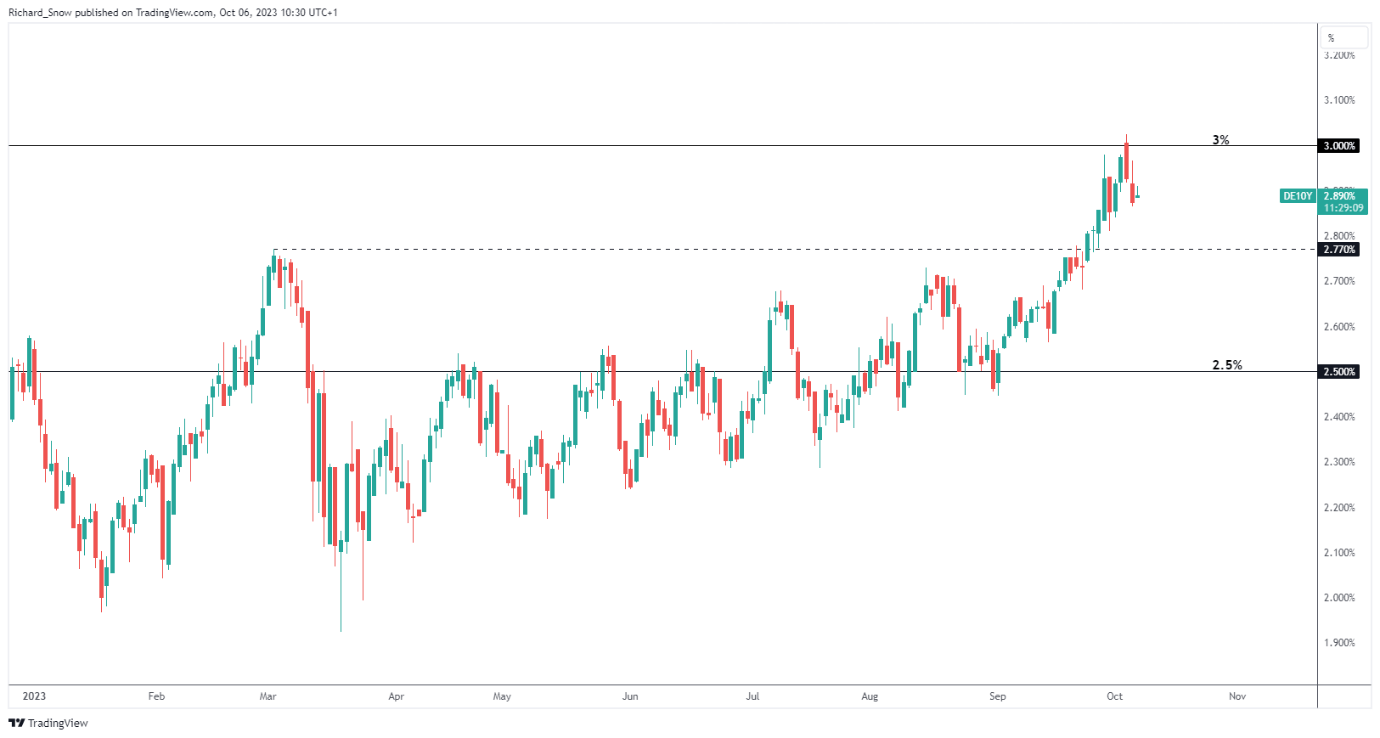

However, the driving force for global FX has been the latest development in global bond yields. US Treasury yields at the latter end of the curve (10, 20 and 30-year yields) have been surging in recent weeks. The German 10-year Bund yield has also risen to a large degree but has failed to outpace rising Treasury yields.

Our FX analyst Q4 forecast for the Euro can be downloaded below:

Recommended by Richard Snow

Get Your Free EUR Forecast

The concern with bond yields is the emergence of a ‘term premium’ as investors require greater compensation for having their funds locked in for longer periods due to the risk of increasing government deficit spending and ballooning debt servicing costs. Don’t forget the recent downgrade of US credit which adds further to the problem. Higher US yields elevate mortgage repayments which further constrains economic activity at a time when the Fed is looking to end the hiking cycle.

German 10-Year Bund Yield

Source: TradingView, prepared by Richard Snow

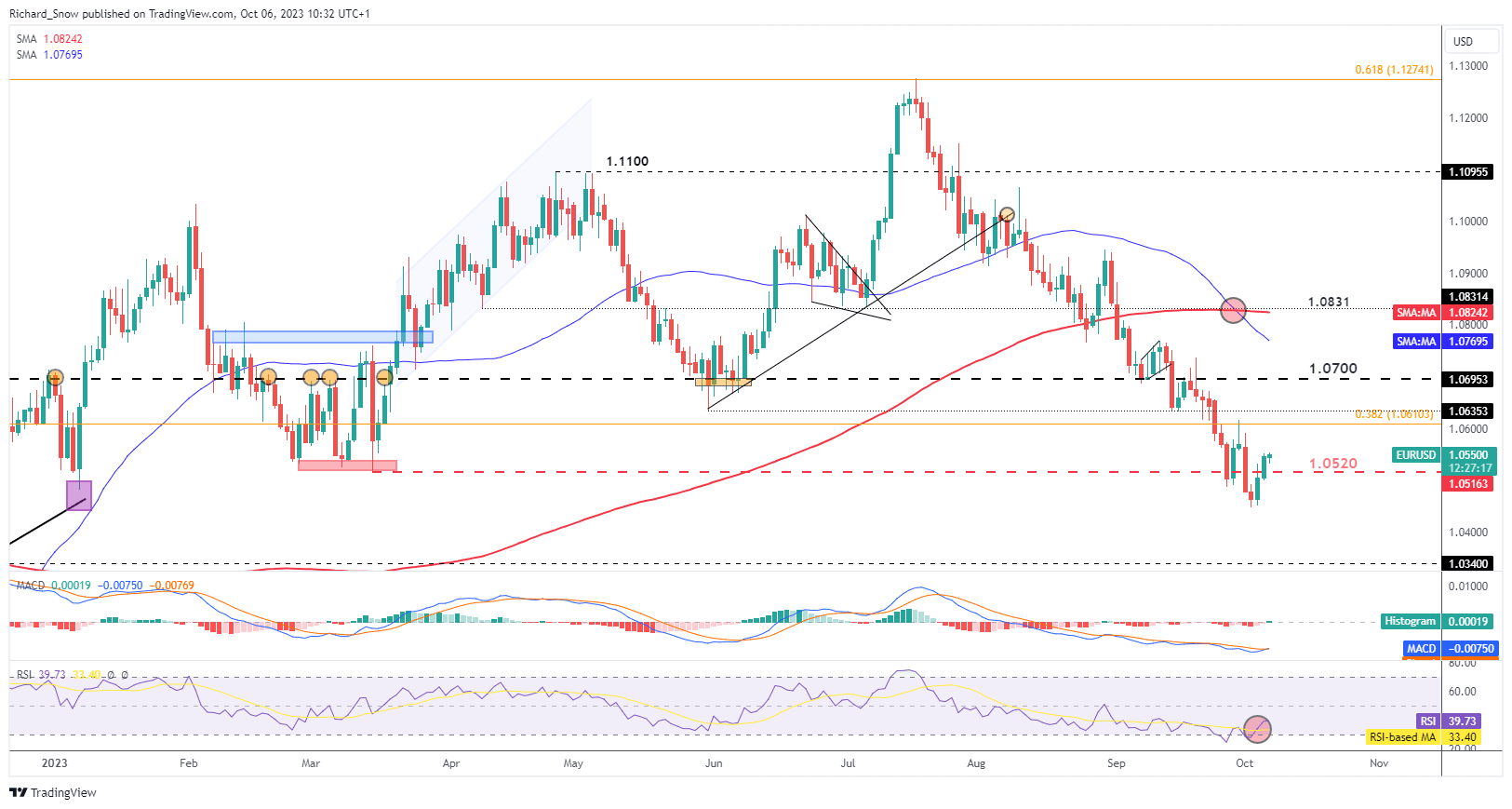

EUR/USD: NFP to Continue Long-Term Downtrend?

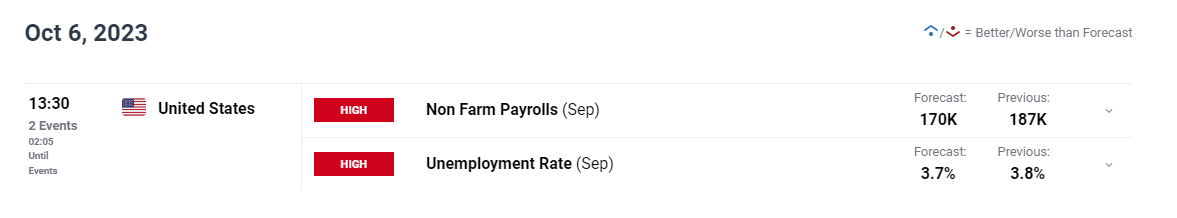

Non-farm payroll data later today has the potential to re-engage the EUR/USD downtrend should there be an upside surprise. However other labour data this week suggests an upside surprise is the least likely outcome.

On Tuesday, job openings shot up towards 10 million after experiencing some easing over the past few months but private payroll data from ADP disappointed (89K vs 153k). The outside chance of a hot NFP print is likely to inspire a continuation of the EUR/USD downtrend as yields and the dollar take center stage once again. A print in line or a sizeable miss could act to extend the pullback. Should there be more progress in US inflation (due next week) the pair may actually see a longer lasting correction.

Support comes in at 1.0520, followed by the recent swing low. Resistance appears at the 38.2% Fibonacci retracement at 1.0610.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

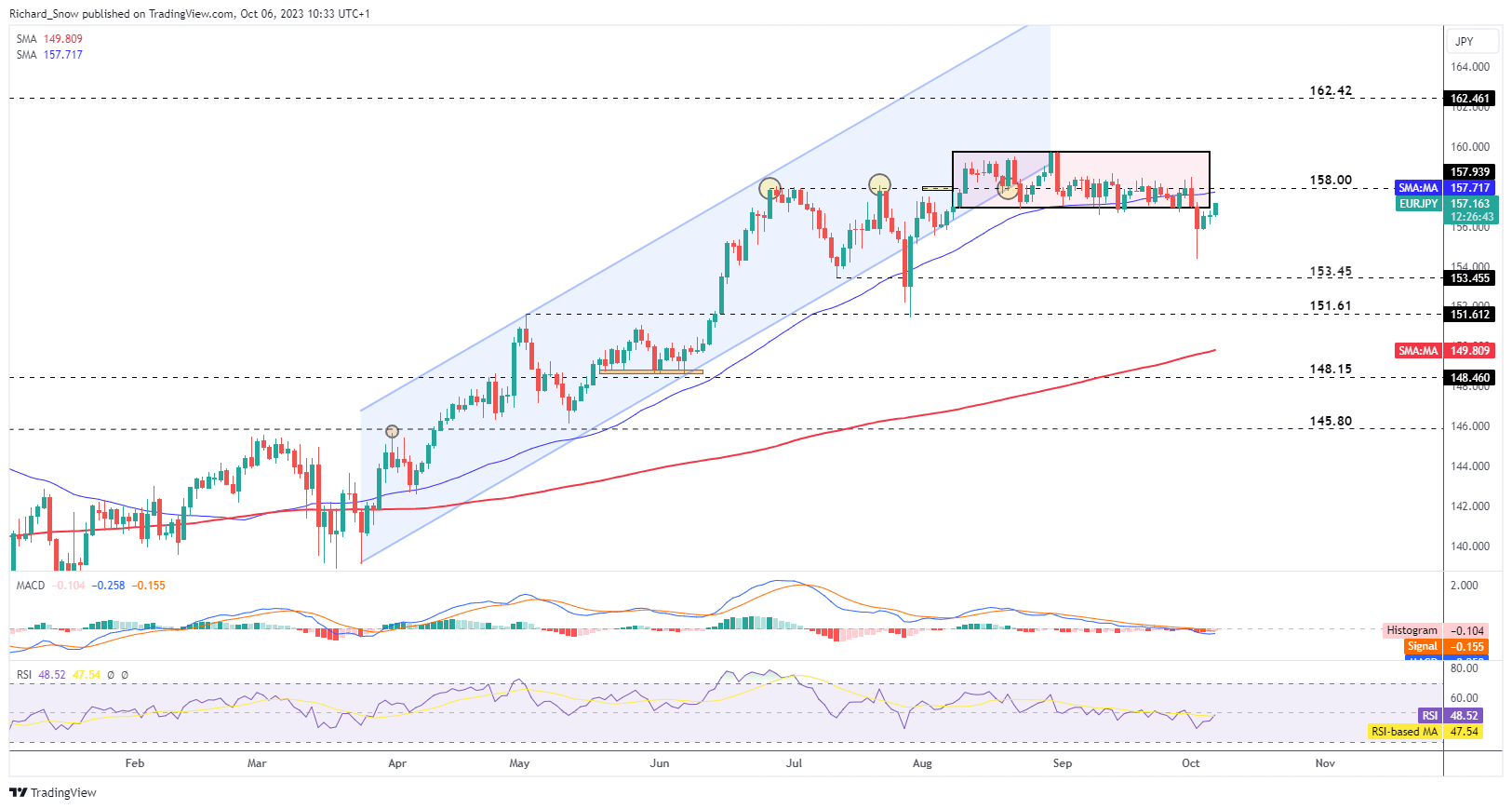

EUR/JPY: Range Breakdown Runs out of Momentum

EUR/JPY witnessed a sharp decline towards the end of last week as speculation built around possible FX intervention by Japanese officials. The countertrend moves experienced this week, now sees the pair trading higher, about to reenter the prior range of consolidation.

The threat of FX intervention still looms as the yen struggles to gain sustained traction. Something to note ahead of this afternoon is that prior FX intervention towards the end of 2022 took place in the latter stages of the London session and on a Friday too.

Resistance appears at 158 – a major level of resistance and support comes in all the way down at 154.40.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0