How Will the US Dollar React to Fed Rate Decision Next Week?

[ad_1] US Dollar Scenarios Ahead of FOMC – Talking Points: The US dollar’s short-term uptrend remains intact ahead of the FOMC meeting. The Fed is highly likely to keep rates unchanged next week. The Statement of Economic Projection could be particular interest. How is the greenback likely to react? Recommended by Manish Jaradi Traits of

[ad_1]

US Dollar Scenarios Ahead of FOMC – Talking Points:

- The US dollar’s short-term uptrend remains intact ahead of the FOMC meeting.

- The Fed is highly likely to keep rates unchanged next week.

- The Statement of Economic Projection could be particular interest.

- How is the greenback likely to react?

Recommended by Manish Jaradi

Traits of Successful Traders

Market pricing based on the CME FedWatch tool suggests the US Federal Reserve is widely expected to keep the federal funds rate steady at its meeting on September 19-20. Moderating core inflation (notwithstanding the uptick in headline CPI last month), cooling labour market conditions, and stabilizing the housing market argue for a pause.

Meanwhile, Fed Chair Powell is likely to be balanced in his assessment, emphasizing data-dependency with regard to the near-term path of policy. His message could be similar to his message at Jackson Hole last month, where he left the door open for further tightening to cool still-high inflation and above-trend growth.

The bigger question is whether the Fed is done with rate hikes. Recent strong macro data raises the odds of a resurgence in economic activity, raising the risk of renewed price pressures. Hence, while the September rate decision could be a done deal, the November meeting could be a close call. In this regard, next month’s payroll and CPI data will be key before the November 1 FOMC meeting.

The key focus next week will be on the Summary of Economic Projections (SEP) which will be released along with the September FOMC statement. In particular, the 2023 median policy rate could show one more 25 basis-point hike to 5.50%-5.75%, in line with the June assessment. Increased interest would be on whether the 2024 median policy rate forecast is raised from 4.6% projected in June.

From a market perspective, the SEP could be a key driver. Even a 25 basis-point shift higher would still leave roughly 50 basis-points gap with the current dovish 2024 market pricing. Anything greater than that would be perceived to be quite hawkish, triggering a reassessment of the dovish market pricing next year, pushing up USD globally. On the other hand, if 2024 median policy rate projections are unchanged, USD’s rally could take a breather. However, any retreat could be temporary while the US economy outperforms the rest of the world.

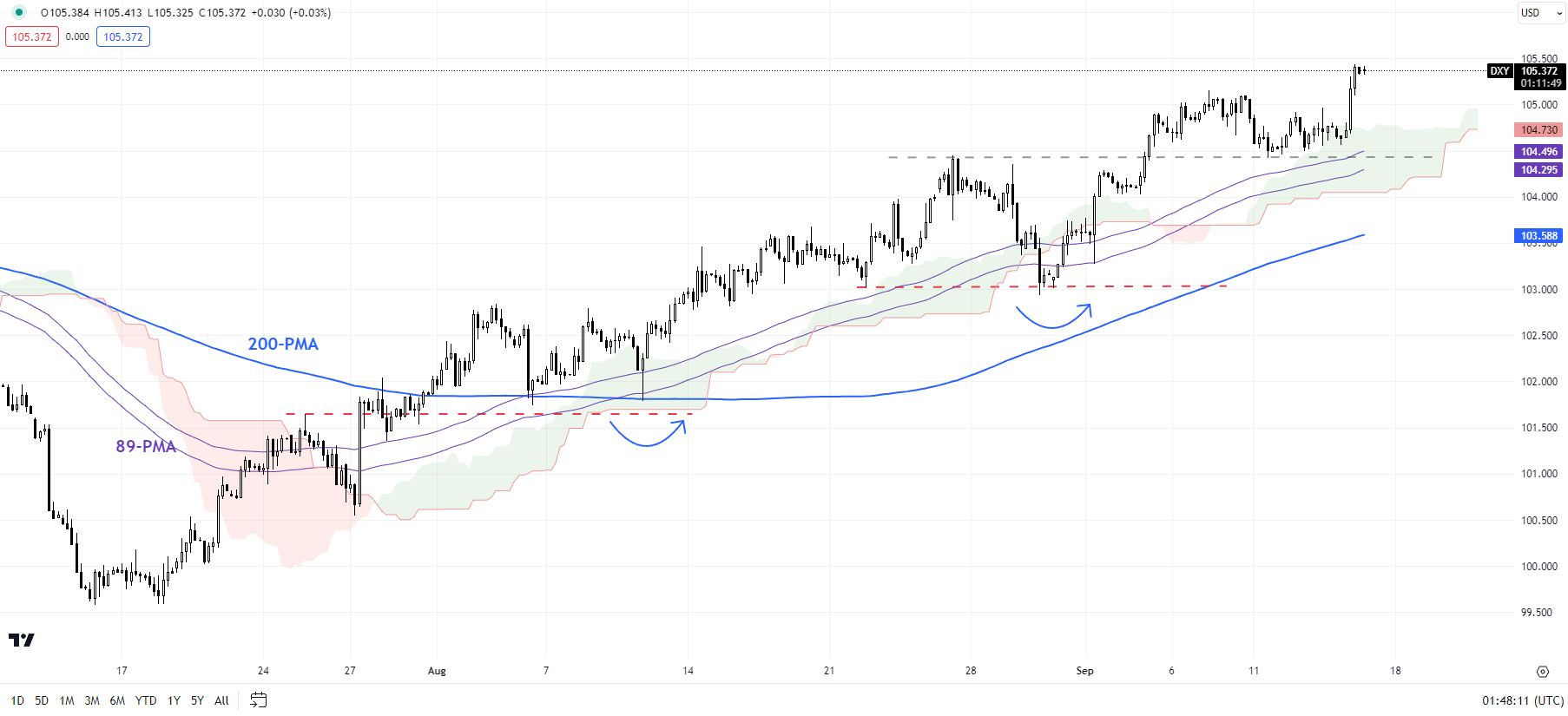

DXY Index (USD) 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

On technical charts, as highlighted in the previous update, the short-term bullish pressure remains intact after the DXY Index (USD index). See “US Dollar Struggles at Resistance Amid Softening Data; EUR/USD, GBP/USD, USD/CAD,” published September 5. The higher-highs-higher-lows sequence from July, associated with breaks above two vital resistance levels on the daily chart reinforces the short-term uptrend.

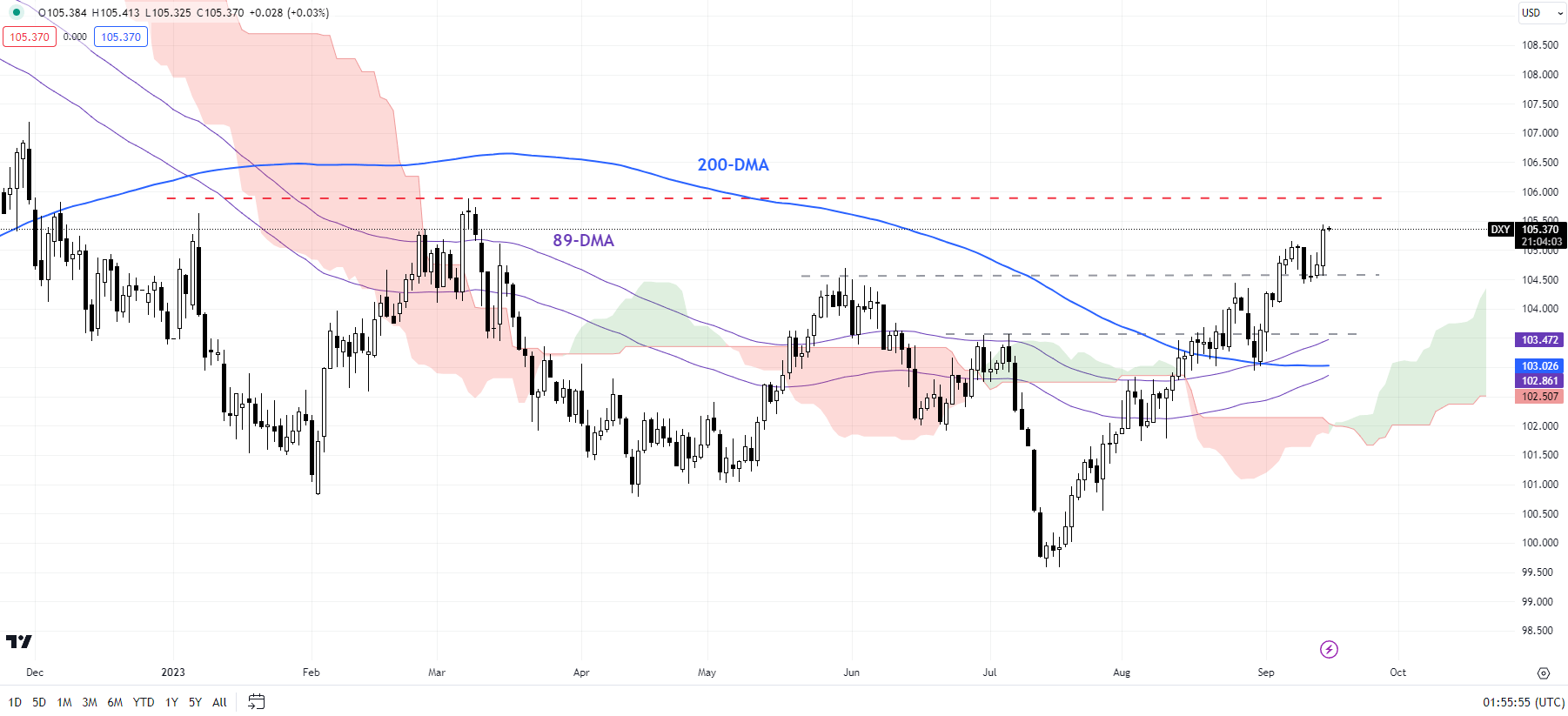

DXY Index (USD) Daily Chart

Chart Created by Manish Jaradi Using TradingView

The index is now testing stiff resistance at the March high of around 106.00. While momentum on the daily charts has flattened even as the index has marched higher, suggesting fatigue in the rally, a decisive break above 106.00 would be significantly bullish for the US dollar. On the downside, only a break below the 102.50-103.00 would raise the odds that the DXY Index had peaked.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰