Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GOLD PRICE FORECAST

Gold advanced on Monday on the back of a weaker U.S. dollar, but gains were limited as traders avoided taking large directional positions ahead of Wednesday’s U.S. inflation data, which may have a significant impact on financial markets and set the tone for precious metals.

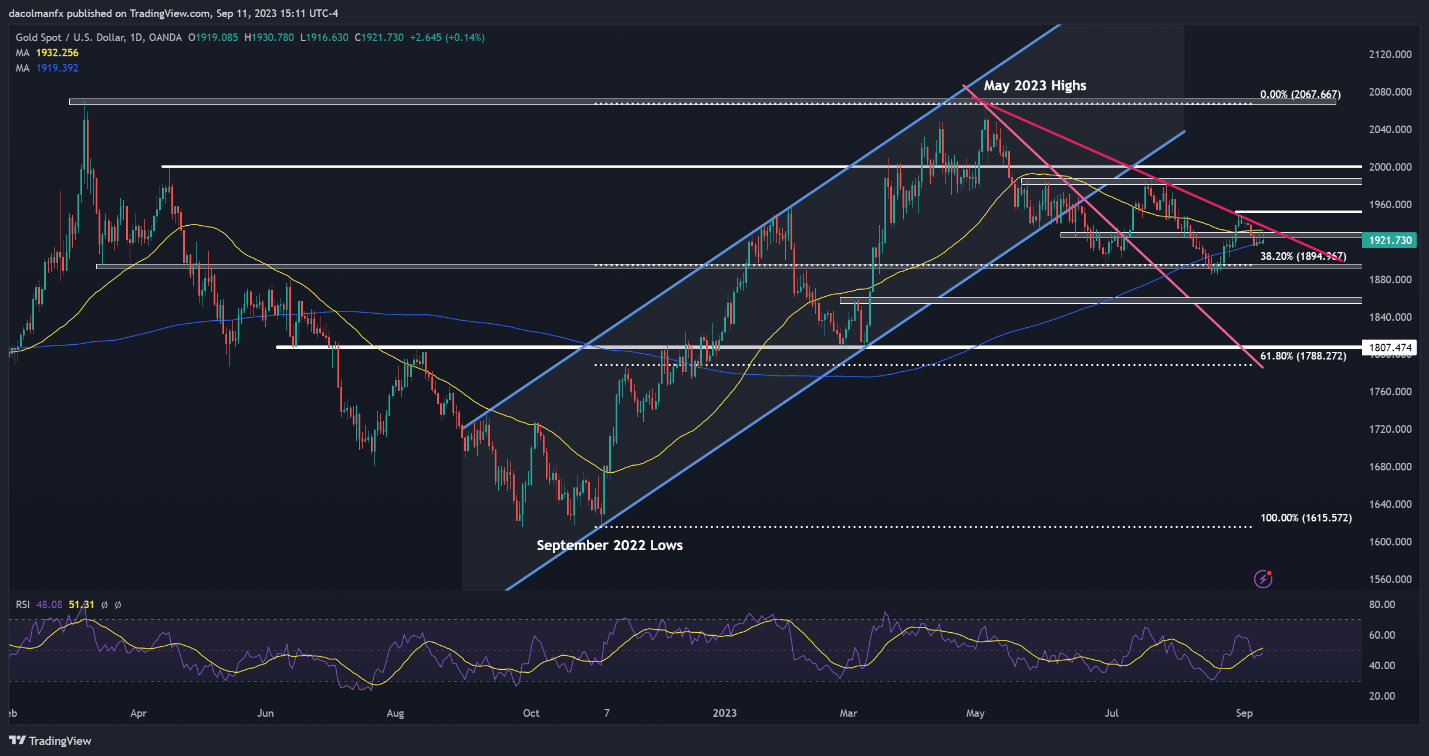

A closer look at XAU/USD’s daily chart reveals a lack of conviction in recent days, with volatility subdued and prices wavering around technical resistance at $1,925/$1,935, where the 50-day simple moving average converges with a short-term descending trendline extended off the May highs.

For short-term guidance, traders should closely monitor how bullion behaves in the coming sessions, considering two possible scenarios: upside clearance of the $1,925/$1,935 region or a bearish rejection from these levels.

Uncover strategies behind consistent trading. Download your “How to Trade Gold” guide for crucial insights and tips!

Recommended by Diego Colman

Get Your Free Gold Forecast

In the event of a bullish breakout, upward momentum could gather pace, opening the door for a move towards $1,955, followed by $1,985. On further strength, buyers may gain the conviction to aim for the psychological $2,000 threshold.

On the flip side, if gold gets repelled by resistance and dips below the 200-day simple moving average in the process, support looms at $1,895, the 38.2% Fibonacci retracement of the September 2022/May 2023 rally. Moving further down, the next key floor is positioned around $1,855.

GOLD PRICE OUTLOOK – TECHNICAL CHART

Gold Price Chart Prepared Using TradingView

Gain a trading advantage by exploring market positioning. Download the sentiment guide to decode gold price behavior. It is totally free!

| Change in | Longs | Shorts | OI |

| Daily | -2% | 16% | 3% |

| Weekly | 0% | -10% | -3% |

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰