GOLD OUTLOOK & ANALYSIS

- Higher US Treasury yields add to gold pains.

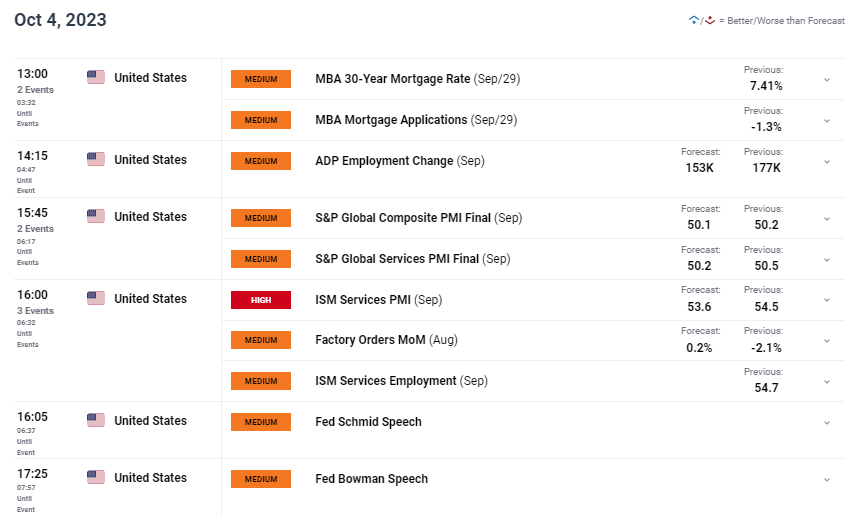

- ADP employment change, ISM services PMI and Fed speakers under the spotlight today.

- Oversold RSI a sign of gold upside to come?

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Gold prices are trading lower for the 8th consecutive trading day as the US dollar remains bid due to some hawkish Fed commentary as well as an upside surprise on yesterday’s US JOLTs job openings statistic. Once again US labor market strength has been reiterated through jobs reports and will surely add pressure from a hawkish perspective. Throughout the week including today (see economic calendar below), markets will be looking to jobs reports beginning with ADP employment change, jobless claims and most importantly Friday’s Non-Farm Payroll (NFP) print. If the JOLTs job openings trend continues, gold prices may breakdown further.

The Fed’s Mester has subsequently stated “I am likely to favor a hike at next meeting if current economic situation holds.” Fed officials will be speaking today as well and with the Fed’s Bowman favoring the hawkish narrative of recent, gold may be vulnerable.

Real yields (refer to graphic below) have now jumped to levels last seen in November 2008 and is weighing negatively on the non-interest bearing metal as it becomes less attractive to investors.

US REAL YIELDS (10-YEAR)

Source: Refinitiv

The highlight for today will come from the US ISM services PMI release due to the US being a primarily services driven economy. Expectations are for a marginal drop off which could give gold bulls some reprieve if actual data follows suit.

GOLD ECONOMIC CALENDAR

Source: DailyFX

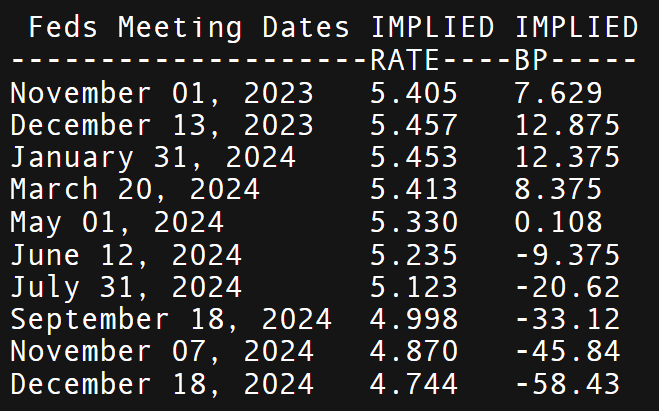

Money market pricing has been gradually showing more preference towards another interest rate hike this year alongside a declining cumulative rate cut figure that has now come down to 58bps (see table below). Upcoming services and jobs data could cement this hike forecast should they reflect an unwavering economy.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

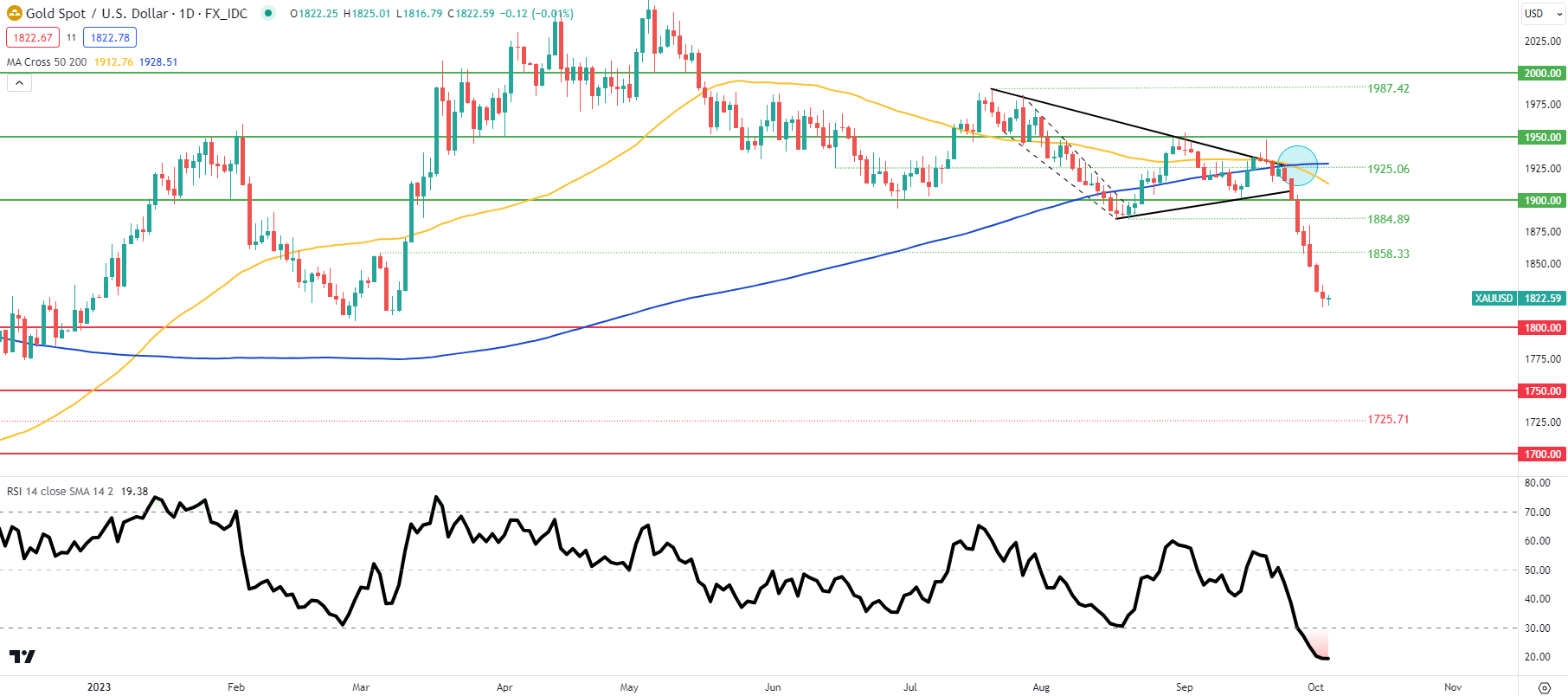

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action above keeps the yellow metal within extreme oversold territory as measured by the Relative Strength Index (RSI). That being said, this does not imply an impending reversal as oversold markets can remain oversold for some time. Subsequently, the moving averages exhibit a death cross formation (blue), exposing the 1800.00 psychological support handle for the first time since December 2022.

The weekly chart does show something interesting in that currently price levels fall in line with the 200-week moving average so the weekly candle close will be of vital importance. Anything below could really be hurtful for gold while a defense of this support zone could result in a long lower wick that could suggest some reprieve for bullion.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 85% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GOLD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰