Forex and Cryptocurrencies Forecast for May 08 – 12, 2023 – Analytics & Forecasts – 6 May 2023

[ad_1] EUR/USD: The Market Is at a Crossroads ● Everything happened as it was supposed to. The Federal Open Market Committee (FOMC) of the US Federal Reserve raised the federal funds rate by 25 basis points (bps) to 5.25% during its meeting on May 2 and 3. Similarly, the European Central Bank did the same

[ad_1]

EUR/USD: The Market Is at a Crossroads

● Everything happened as it was supposed to. The Federal Open Market Committee (FOMC) of the US Federal Reserve raised the federal funds rate by 25 basis points (bps) to 5.25% during its meeting on May 2 and 3. Similarly, the European Central Bank did the same on May 4, increasing the euro interest rate by the same 25 bps to 3.75%. This increase had long been factored into market quotations. Of much greater interest were the statements and press conferences of the leaders of both central banks.

● Attention to Federal Reserve Chairman Jerome Powell’s speech was heightened by the fact that the banking crisis had escalated earlier in the week. Shares of First Republic Bank plummeted following poor financial reports, dragging down the shares of many other banks. The US banking sector had dropped by more than 10% since the beginning of the week. This situation provided grounds for expecting that the Fed would finally shift from a tightening policy (QT) to a more accommodative one (QE), as high interest rates had been the cause of the banking crisis.

The statements made by the Fed Chairman were characteristically vague. While acknowledging some issues, Jerome Powell did not insist on maintaining peak interest rates until the end of 2023. He also indicated that although a decision to pause in the current monetary tightening cycle had not been made, it was not ruled out that the rate was already approaching its peak levels.

As a result, the derivatives market decided that the rate would be 90 basis points lower by the end of the year than it is now. Based on these forecasts, the DXY Dollar Index and Treasury yields went down, while EUR/USD moved upward. However, its growth was relatively moderate, at about 100 points. It failed to surpass the 1.1100 level, and after the ECB meeting on May 5, it even rolled back.

● Statistics published on Tuesday, May 2 showed that retail sales in Germany fell from -7.1% to -.6% (forecast -6.1%), and inflation (CPI) in the Eurozone as a whole increased from 6.9% to 7.0%, according to preliminary data. Against this backdrop, the European Central Bank, like the Fed, indicated its concern about the delayed effect of tightening monetary policy, which could cause new problems in the economy. Consequently, the pace of monetary tightening should be reduced.

Although the ECB announced that, starting from July, asset sales from the balance sheet would be increased from €15 billion to €25 billion per month, investors remained unimpressed. The short-term market reacted to the possibility of winding down QT in the Eurozone by lowering the deposit rate forecast from 3.9% to 3.6% by the end of the year. This time, the euro and German bond yields fell together.

As a result, EUR/USD returned to the centre of the sideways channel of 1.0940-1.1090, in which it had been moving for two consecutive weeks. (In fact, if you exclude spikes, the channel appears even narrower: 1.0965-1.1065.)

● Data from the US labour market arrived on the first Friday of the month, May 5, and provided the dollar with brief support. The number of new jobs created outside the US agricultural sector (NFP) amounted to 253K, significantly exceeding both the previous value (165K) and the forecast (180K). The unemployment situation also improved, with the rate falling from 3.5% to 3.4%, instead of the expected increase to 3.6%.

As a result, EUR/USD ended the five-day period at the 1.1018 level. At the time of writing this review, on the evening of May 5, analysts’ opinions are divided as follows: 60% of them expect the dollar to weaken and the pair to rise, 30% anticipate its strengthening, and the remaining 10% have taken a neutral stance. Regarding technical analysis, among oscillators on the D1 chart, 60% are green (with 10% signalling being overbought), while the remaining 40% are neutral grey; among trend indicators, 90% are green, and only 10% are red. The nearest support for the pair is located around 1.0985-1.1000, followed by 1.0925-1.0955, 1.0865-1.0885, 1.0740-1.0760, 1.0675-1.0710, 1.0620, and 1.0490-1.0530. Bulls would encounter resistance around 1.1050-1.1070, then 1.1109-1.1110, 1.1230, 1.1280, and 1.1355-1.1390.

● As for the events of the upcoming week, Wednesday, May 10, is likely to be the most important day. Inflation data (CPI) for Germany and the US will be released then. The preliminary Michigan Consumer Sentiment Index, to be published on Friday, May 12, will complement the economic picture.

GBP/USD: Pound Forecast Mostly Positive

● When forecasting the past five-day period, the majority of experts (75%) had sided with the US currency. Indeed, at the beginning of the week, the dollar recouped 130 points from the pound. However, then the UK’s Chartered Institute of Procurement and Supply (CIPS) began publishing PMI figures, which indicated an increase in business activity in the country. With a previous value of 52.2 and a forecast of 53.9, the Composite PMI actually grew to 54.9 points. The UK’s services sector PMI showed an even more convincing increase: from 52.9 to 55.9 (forecast 54.9).

The pound received additional support from across the Atlantic Ocean. The banking crisis in the US and the vague statements from the Federal Reserve’s chair allowed GBP/USD to rise to the 1.2652 mark. It had not soared that high since the beginning of June 2022. As for the final note of the past week, it sounded slightly lower, at the 1.2631 level.

● There will be a bank holiday in the United Kingdom on Monday, May 8. However, a whole avalanche of events related to the country’s economy awaits us afterwards. Preliminary data on manufacturing output and the UK’s overall GDP will be revealed on Thursday. In addition, a meeting of the Bank of England (BoE) will be held on the same day. Most experts believe the pound’s interest rate hike cycle has not yet come to an end and will be raised from 4.25% to 4.50%. After the BoE meeting, a press conference will follow, led by its governor, Andrew Bailey. As for the end of the workweek, we will learn the revised data on manufacturing output and the country’s GDP on Friday, May 12.

● At the moment, many experts anticipate further strengthening of the British currency and growth of GBP/USD. Here are just a few quotes.

“It seems that the belief that European banks, including British ones, are better regulated than banks in the US provides some protection for European currencies,” economists from Internationale Nederlanden Groep (ING) write. “This also helps support expectations (with which we disagree) that the Bank of England may raise rates two or three more times this year. According to our latest estimates, the Bank of England may not counteract these expectations next week, leading to sterling retaining its recent achievements.” ING economists believe that the GBP/USD pair could rise to 1.2650-1.2750.

Scotiabank specialists believe that upward pressure will continue to develop towards 1.2700-1.2800, although they do not rule out that this growth could be very slow. In their opinion, support is in the 1.2475-1.2525 zone.

Credit Suisse also sees the “potential for a final upward surge towards the main target at 1.2668-1.2758 – the May 2022 high and the 61.8% correction of the 2021/2022 decline.” “Here, we will expect an important top to form,” the specialists say. Credit Suisse also warns that if the pound weakens, the 1.2344 support should hold. However, if it is broken, a deeper pullback towards the 55-DMA and 1.2190-1.2255 support is threatened.

Strategists at HSBC, one of the largest financial conglomerates in the world, join the positive sentiment of their colleagues. “At present, the pound sterling benefits from both an improvement in investor risk appetite and a cyclical upswing,” states HSBC. “We believe that the positive cyclical momentum will continue to support the British pound in the coming months. […] Nevertheless, amid weakening lending dynamics and the waning positive impact of disinflation, GBP/USD rate may not be able to move far beyond the 1.3000 level.”

● As for the median forecast, currently 50% of experts are siding with the pound, 10% side with the dollar, and 40% remain neutral. Among trend indicators on D1, 100% are in favour of the green (bullish), and oscillators show a similar picture, although a third of them are in the overbought zone. Support levels and zones for the pair are 1.2575-1.2610, 1.2510, 1.2450-1.2480, 1.2390-1.2400, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, and 1.1800-1.1840. If the pair moves north, it will face resistance at levels 1.2650, 1.2695-1.2700, 1.2820, and 1.2940.

USD/JPY: Yen Finds Support from the US

● At its latest meeting, the Bank of Japan (BoJ) maintained its negative interest rate at -0.1% (The last time it changed was on January 29, 2016, when it was lowered by 20 basis points). Recall that during the press conference following this meeting on April 28, the new head of the Central Bank, Kazuo Ueda, stated that “we will continue to ease monetary policy without hesitation if necessary.” It seems like there’s not much room left for easing, but perhaps the current -0.1% is not the limit.

The result of BoJ’s head’s words can be seen on the chart: within just a few hours, USD/JPY soared from 133.30 to 136.55, weakening the yen by 325 points. The growth continued during the past week: the pair recorded a local high at 137.77 on Tuesday, May 2. After that, the yen, acting as a safe haven, was supported by the banking crisis in the US. Jerome Powell’s statements finished the “job” of strengthening the yen, ultimately causing the pair to drop by 428 points to 133.49.

On Friday, May 5, strong US labour market data allowed the US currency to recover some of its losses, and USD/JPY ended the workweek at 134.83.

● The next BoJ meeting will take place only on June 16. Until then, the USD/JPY rate will most likely depend mainly on the dollar. Regarding the short-term prospects of the pair, analysts’ opinions are distributed as follows. At the moment, only 25% of experts vote for its further growth, the same number point in the opposite direction. The majority (50%) simply shrugg, confirming that investors are currently at a crossroads and are waiting for signals that could move the market in one direction or another.

Indicators on D1 are also in doubt. Among oscillators, 50% point north, 25% have taken a neutral position, and the remaining 25% indicate south (with a third of them in the oversold zone). The ratio of forces for trend indicators is 60% to 40% in favour of the greens. The nearest support level is located in the 134.35 area, followed by levels and zones at 133.60, 132.80-133.00, 132.00, 131.25, 130.50-130.60, 129.65, 128.00-128.15, and 127.20. Resistance levels and zones are at 135.15, 135.95-136.25, 137.50-137.75, and 139.05, 140.60.

● Tthe report of the April meeting of the Bank of Japan’s Monetary Policy Committee will be published on Monday, May 8. No other important economic information related to the Japanese economy is expected during the upcoming week.

CRYPTOCURRENCIES: When Will Bitcoin Wake Up?

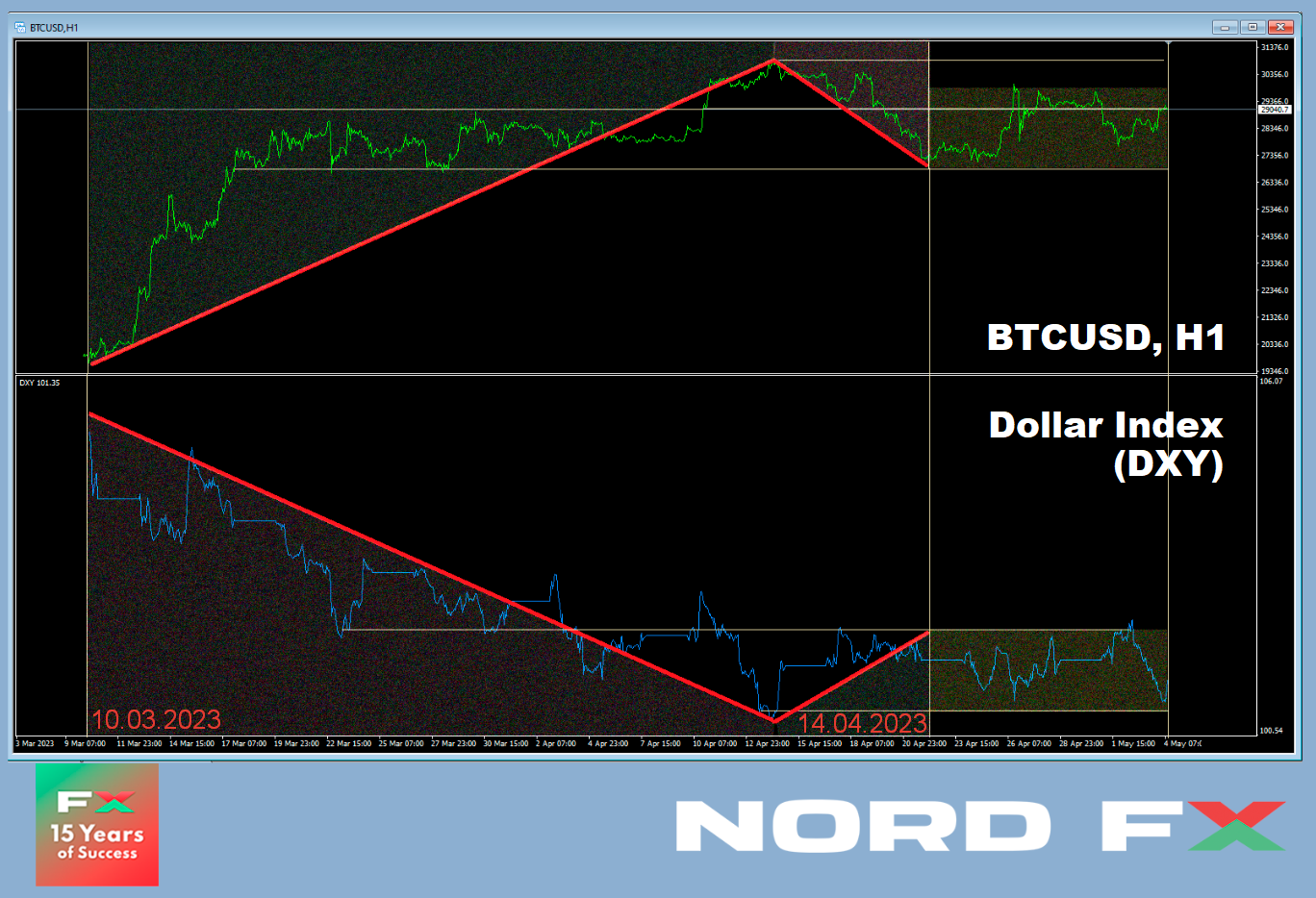

● Of course, the price of bitcoin is influenced by many specific factors. These include industry-related regulatory actions, bankruptcy of crypto exchanges and banks, and statements made by influencers shaping the crypto community’s opinion. All of these factors play a role. However, one of the most important factors affecting BTC/USD is the latter half: the US dollar. The better the world’s main currency performs, the worse it is for the leading cryptocurrency, and vice versa. This inverse correlation is clearly visible when comparing bitcoin charts and the US Dollar Index (DXY).

In March, anticipation of the Federal Reserve’s interest rate decision locked DXY and BTC/USD in a sideways channel. The 25 basis point increase fully coincided with the forecast and was already factored into the market quotes, so the DXY’s calm reaction to this move was quite logical. Bitcoin also reacted calmly to this step, remaining in the $26,500-30,000 range.

● The current background remains neutral. The “bulls” are conserving their energy. In addition to the predictable Fed decision on the key interest rate, their reluctance to buy is influenced by investors’ general lack of appetite for risky assets. Weak macroeconomic data from China plays a significant role here.

Another factor putting pressure on bitcoin is the profit-taking by some holders, which followed the impressive growth of the coin in Q1 of this year. Most of these were short-term speculators, who accounted for over 60% of the total realized profit.

As for the “whales,” having liquidated part of their holdings, they have either gone into hibernation or returned to insignificant accumulation, prompted by the banking crisis. Recall that BTC/USD dropped to $26,933 on April 24. Market participants were already prepared to see bitcoin even lower, at the $26,500 support level, breaking which would open the way to $25,000. However, the coin unexpectedly soared to $30,020 on April 26. The reason for the surge was the fourth bankruptcy of an American bank, this time being the First Republic Bank.

● According to experts at the British bank Standard Chartered, bitcoin took advantage of its status as a “brand-safe haven” for savings at the beginning of 2023, and the current situation indicates the end of the “crypto-winter.” Geoff Kendrick, the head of currency research at the bank, believes that bitcoin could grow by $20,000 if the US defaults on its debts. In an interview with Business Insider, he stated that this could happen in July 2023 if Congress does not agree to raise the debt limit to a new level. However, the specialist called such a default an “unlikely” event, albeit with “massive consequences.”

Kendrick believes that bitcoin will not grow linearly. Most likely, after the default, its price will fall by $5,000 in the first days or week, and then sharply increase by $25,000. As for ethereum, which, according to the analyst, trades like stocks, it is more likely to fall in the event of a default. Kendrick considers the optimal trading strategy to be opening a long position in bitcoin and a short position in ethereum. Recall that earlier, Standard Chartered stated that the first cryptocurrency could grow to $100,000 by the end of 2024. The main reasons cited were the banking crisis, halving, and the easing of the US Federal Reserve’s monetary policy.

● Investor Ray Dalio agrees that the first cryptocurrency is a good hedge against inflation. He admitted that he owns bitcoins, but still prefers gold. According to the billionaire, bitcoin cannot be a full-fledged alternative to the precious metal. “I don’t understand why people are more inclined towards bitcoin than gold,” he wrote. “Gold is the third-largest reserve asset for central banks internationally. First dollars, then euros, gold, and Japanese yen.” In Dalio’s opinion, the precious metal is “timeless and universal.” Bitcoin, on the other hand, requires close attention from investors due to its volatility. “You have to be prepared for its significant drop, about 80% or so,” warned the billionaire.

● Jenny Johnson, the CEO of investment company Franklin Templeton, criticized bitcoin as the biggest distraction from real innovation, blockchain technology. She believes that bitcoin will never become a global currency because the US government will not allow it. Johnson warned that the crypto industry should prepare for tougher regulatory rules.

Senator Cynthia Lummis suggests that President Joe Biden will sign a law establishing basic guidelines for the crypto industry within the next 12 months. Meanwhile, the White House Council of Economic Advisers has proposed a 30% tax on miners to prevent them from damaging the environment, which is expected to be another way for authorities to pressure the industry seen as a threat by many officials.

● Upcoming regulatory changes, along with wars and catastrophes, are just some of the many factors that Artificial Intelligence is currently unable to take into account. Therefore, relying on ChatGPT’s predictions when developing trading strategies would be, to put it mildly, reckless. However, they are still of interest. According to the statement of Coinbase’s Business Director, Conor Grogan, “ChatGPT clearly sympathizes with BTC, while being much more skeptical towards altcoins.” Thus, according to the AI’s forecast, there is a 15% chance that BTC will lose 99.9% of its value by 2035 and become obsolete. In the case of ethereum, the chances of such a scenario are 20%, with LTC – 35%, and with DOGE – 45%.

Earlier, ChatGPT stated that the price of Bitcoin could reach the mark of $150,000 already in 2024, after which it will grow on average by $25,000 per year and reach the mark of $300,000 by 2030.

● Unlike ChatGPT, the trader known as Bluntz possesses human, not artificial intelligence. It was this intelligence that allowed him to correctly predict the bottom of the bearish BTC market in 2018. Now, however, he believes that the leading cryptocurrency is unlikely to sustainably establish itself above $30,000 in the foreseeable future. This opinion is based on the fact that BTC has already passed a five-wave bullish trend on the daily chart. According to Bluntz’s calculations, bitcoin is currently in the middle of a corrective ABC formation, which could lead to a drop to around $25,000. After that, the trader believes the coin will rise to $32,000, and this will happen in the second half of 2023.

● As of the writing of this review, on the evening of Friday, May 5, BTC/USD is trading at $29,450. The total market capitalization of the crypto market is $1.219 trillion ($1.204 trillion a week ago). The Crypto Fear & Greed Index decreased from 64 to 61 points over the past seven days, and it remains in the Greed zone.

The Bitcoin Dominance Index (the share of the first cryptocurrency in the total market capitalization of the crypto market) is currently at 46.9%. According to the legendary trader, analyst, and CEO of Factor LLC, Peter Brandt, this indicator is preparing for a breakthrough after a two-year consolidation in the form of a large rectangle. While the trend is within a “limiting range,” the exit from it will be crucial for the asset, explained the expert. Over the past five years, the BTC share has fallen to 32.4% in 2018 and risen to 71.9% in 2021. The indicator is likely to surpass the 50% mark to begin a bullish movement. “I believe that bitcoin will bury all the imposters. In the end, there will be only one king of the hill,” Peter Brandt wrote.

NordFX Analytical Group

https://nordfx.com/

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

#eurusd #gbpusd #usdjpy #Forex #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Analytics ، Cryptocurrencies ، Forecast ، Forecasts ، Forex

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0