Euro Stumbles Against a Resurgent US Dollar and Japanese Yen – EUR/USD and EUR/JPY Latest

EUR/USD and EUR/JPY Forecast – Prices, Charts, and Analysis Strong economic data gives the greenback a boost – next up Core PCE. BoJ announces Yield Curve Control flexibility. Recommended by Nick Cawley Download our Brand New Q3 Euro Guide Three of the most important global central banks announced their latest monetary policy decisions this week

EUR/USD and EUR/JPY Forecast – Prices, Charts, and Analysis

- Strong economic data gives the greenback a boost – next up Core PCE.

- BoJ announces Yield Curve Control flexibility.

Recommended by Nick Cawley

Download our Brand New Q3 Euro Guide

Three of the most important global central banks announced their latest monetary policy decisions this week and foreign exchange traders looking for volatility were not disappointed. Two fx-pairs in particular, EUR/USD and EUR/JPY experienced sharp moves in the latter half of the week.

Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths

On Wednesday the Federal Reserve hiked rates by 25 basis points to a range of 5.25%-5.50%, a move fully expected and priced in by the market. The press conference that followed gave little away although it seems that the Fed is happy to be guided by data releases in the coming months.

US Second-Quarter GDP Growth Shatters Estimates, Boosting Yields and the Dollar

This week’s US data was dollar positive with advanced Q2 GDP seen at a robust growth rate o f2.4%, a strong durable goods reading of 4.7%, while jobs data also underscored the strength in the US labor market.

Later today – 13:30 UK – the latest look at US Core PCE will give an update on US inflation and any deviation from a forecast of 4.2% y/y will steer the US dollar going into the weekend.

DailyFX Calendar

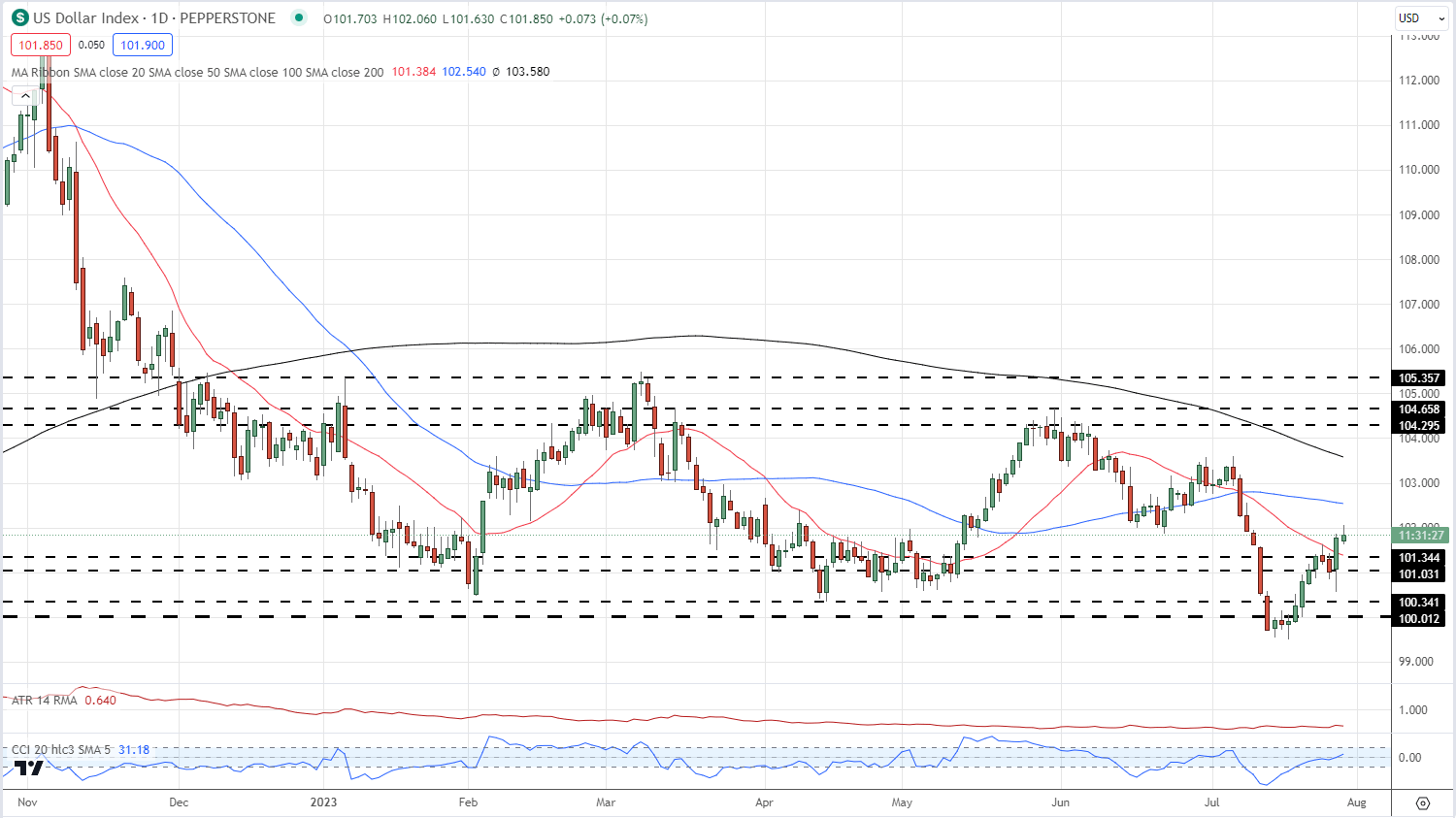

The US dollar index has rallied on the back of the strong US data and the weak Euro and is now back at levels last seen nearly three weeks ago.

US Dollar Index Daily Chart – July 28, 2023

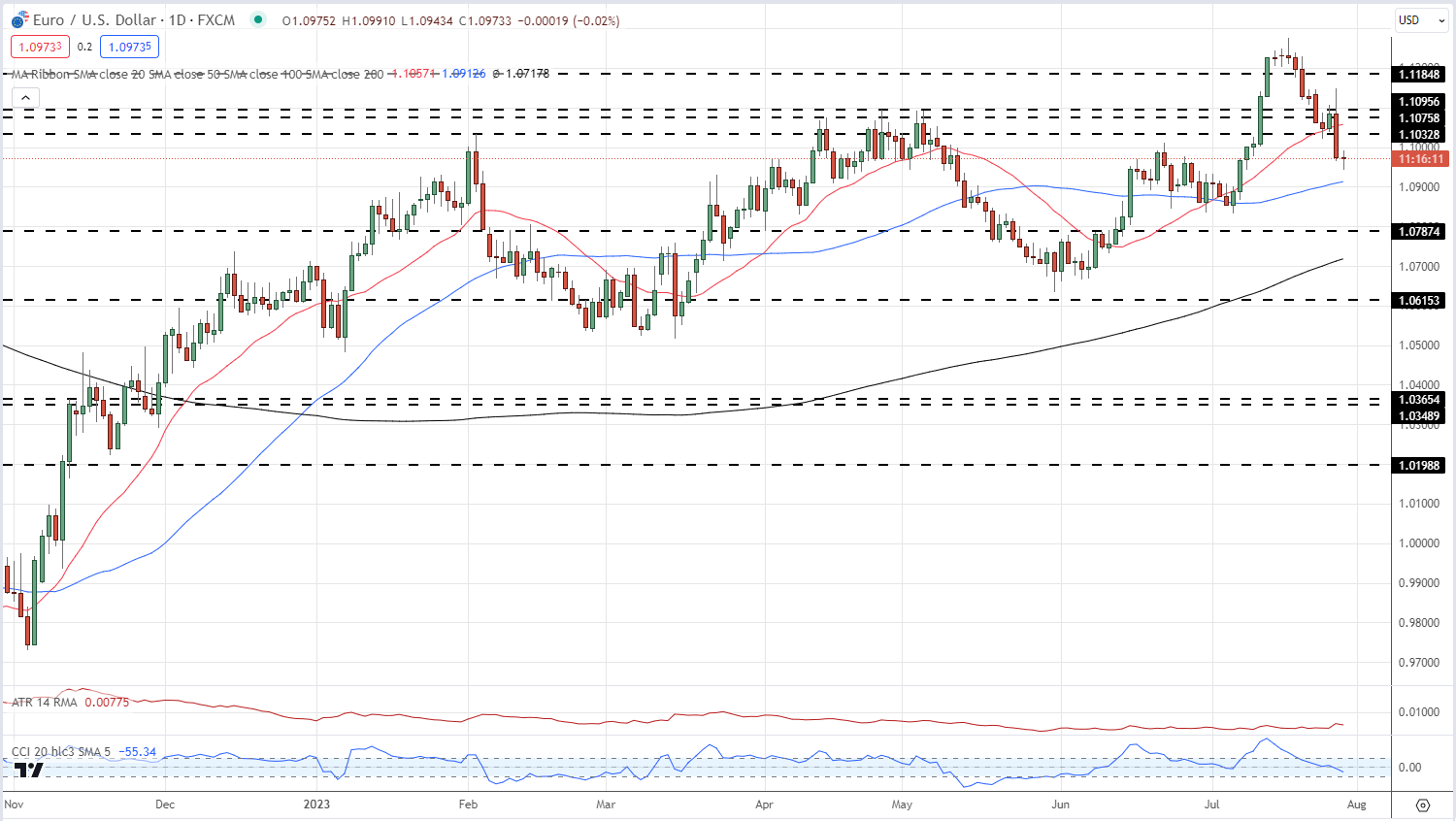

This week’s ECB meeting saw the central bank lift rates by 25 basis points, again i-line with market forecasts, but at the press conference President Lagarde said that at the next meeting (September 14) that they could lift raise rates again or pause. The suggestion that rates may stay unchanged in September sent the single currency spinning lower against a range of peers. EUR/USD is now back below 1.1000 after Thursday’s 2-point sell-off and will struggle to push higher. A cluster of recent lows on either side of 1.0850 will provide the next test for EUR/USD bears.

ECB Hikes by 25bps Keeping Options Open, EUR/USD, EUR/GBP Slide

EUR/USD Daily Price Chart – July 28, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 22% | -23% | -3% |

| Weekly | 63% | -39% | -6% |

EUR/USD Retail Traders Ramp up Net-Long Weekly Positions

Retail trader data shows 54.61% of traders are net-long with the ratio of traders long to short at 1.20 to 1.The number of traders net-long is 9.88% higher than yesterday and 51.84% higher than last week, while the number of traders net-short is 22.36% lower than yesterday and 36.83% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

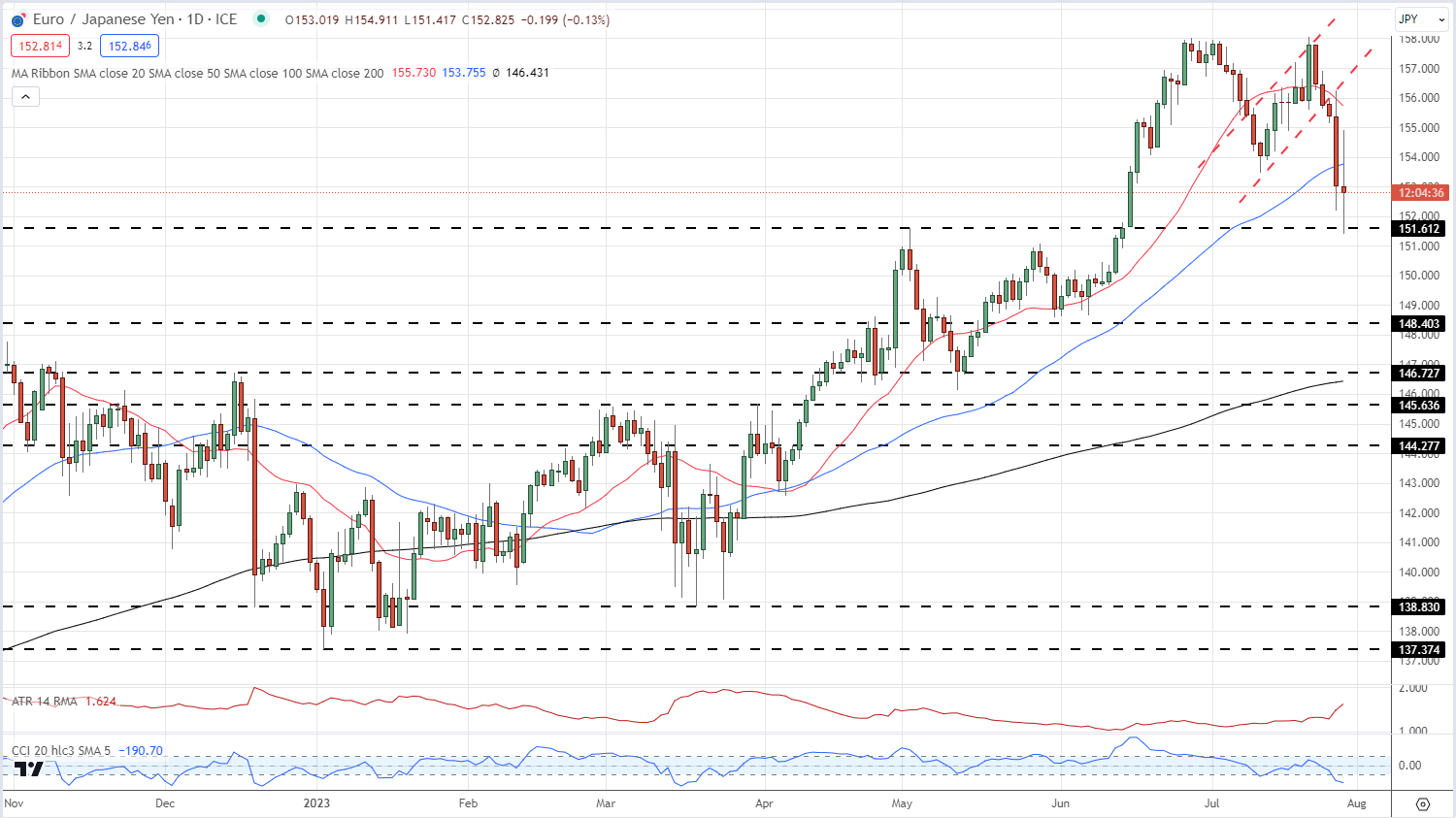

Today’s Bank of Japan meeting saw the central bank leave rates untouched but changed their wording on their Yield Curve Control (YCC) program. The BoJ said of their ongoing policy of keeping JGB 10-year yields within a fixed band of -0.5% to +0.5%, that this was now a ‘reference’ rather than a ‘rigid limit’. This sent JGB yields, and the Japanese Yen, higher. A combination of a weaker Euro and a stronger Yen sent EUR/JPY spinning lower. The pair broke out of a short-term ascending channel this week and yesterday rejected the support line again. The pair traded as low as 151.42 today and this looks likely to be tested again in the coming days.

EUR/JPY Daily Price Chart – July 28, 2023

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰