Euro, EUR/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- Euro is on course for an 11th consecutive weekly loss

- Retail traders maintaining increasingly bearish bets

- EUR/USD on course to set new lows for this year?

Recommended by Daniel Dubrovsky

How to Trade EUR/USD

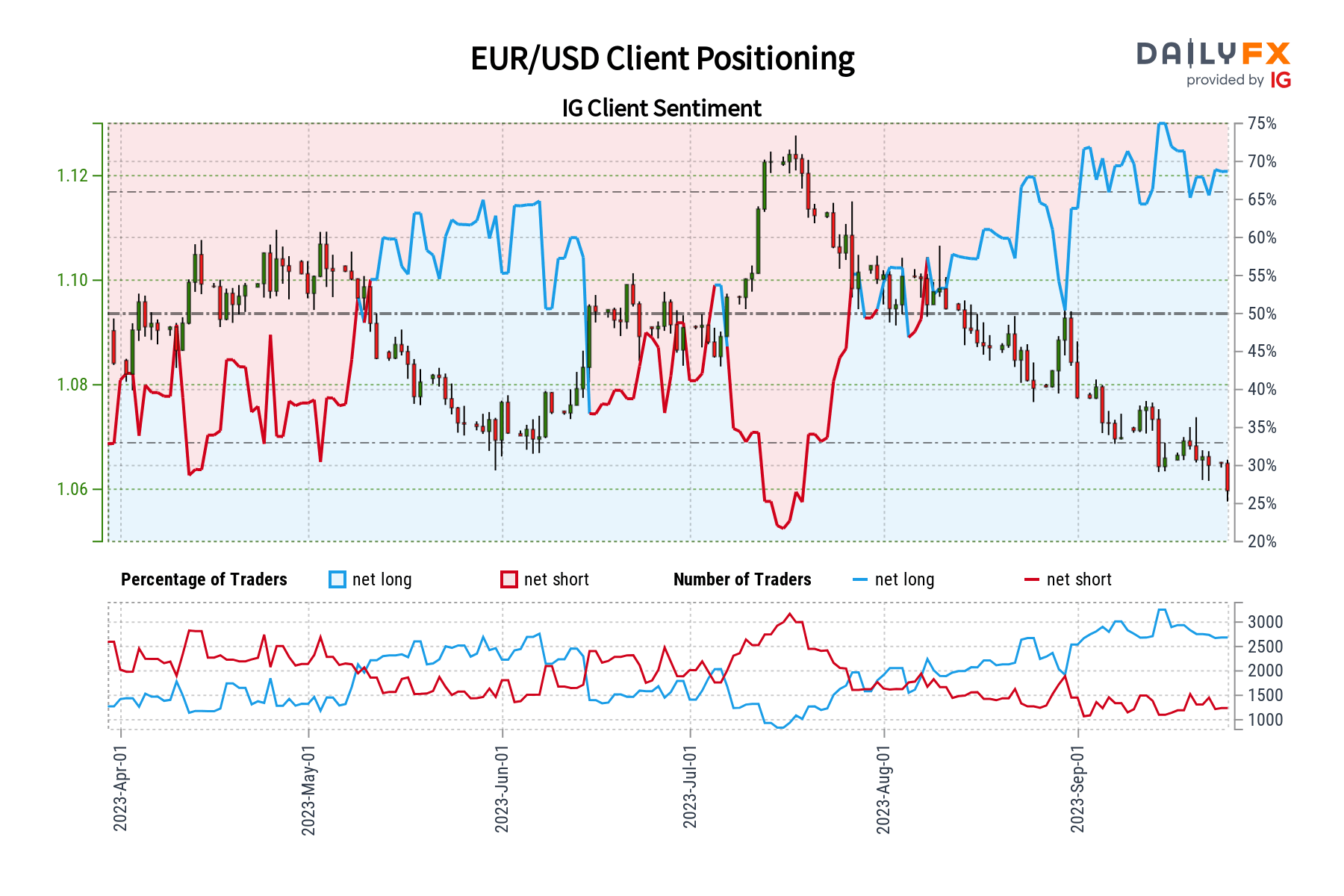

The Euro fell about -0.5 percent against the US Dollar on Monday. Now, EUR/USD is on course for an 11th consecutive weekly loss, matching the longest losing streak on record back in 1997. In response, retail traders have increased upside exposure. This can be seen by taking a look at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, will the Euro extend its losing streak?

EUR/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 72% of retail traders are net-long EUR/USD. Since the majority of them are biased to the upside, this continues to hint that prices may fall down the road. This is as upside exposure increased by 12.82% and 6.9% compared to yesterday and last week, respectively. With that in mind, the combination of overall positioning and recent changes produces a stronger bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 12% | 0% | 8% |

| Weekly | 7% | -19% | -2% |

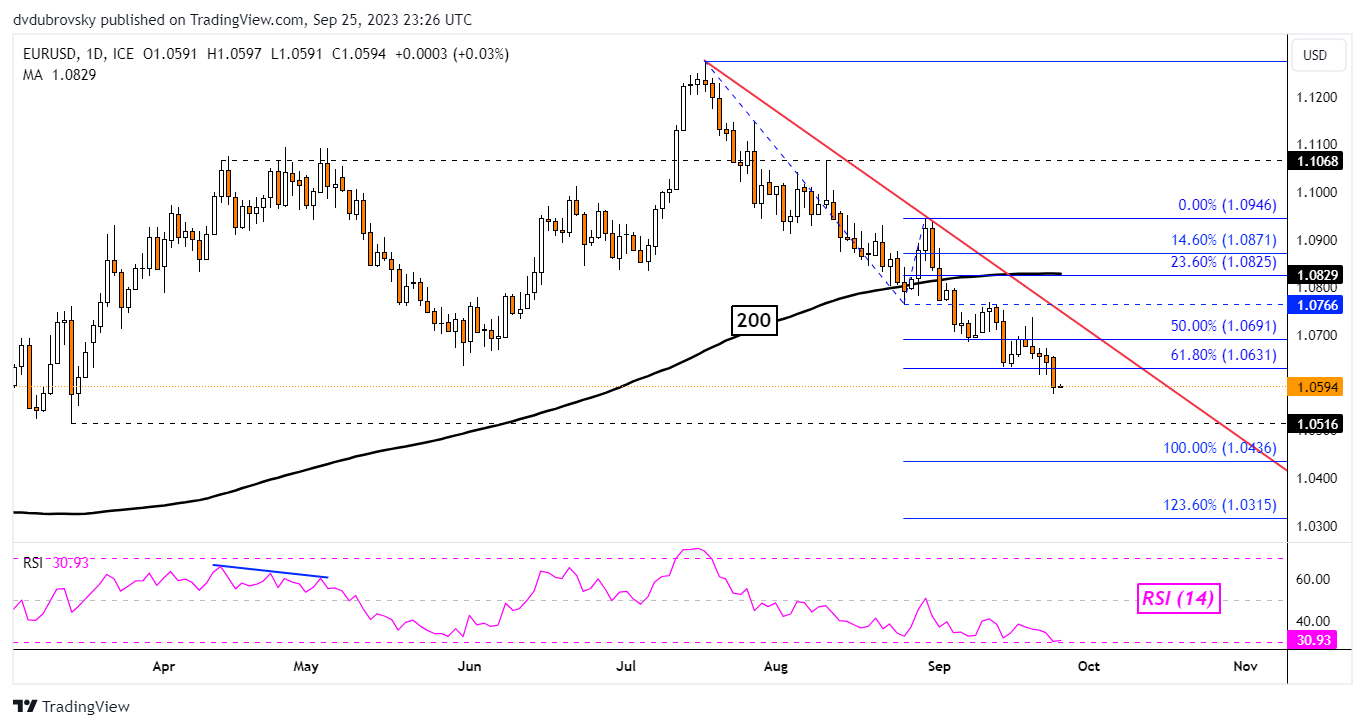

Euro Daily Chart

On the daily chart below, EUR/USD broke under the 61.8% Fibonacci extension level at 1.0631. That has exposed the March low of 1.0516 as immediate support. Meanwhile, the falling trendline from July continues to guide the exchange rate lower.

As such, in the event of a turn higher, the trendline may hold as key resistance, maintaining a broadly bearish technical bias. Meanwhile, confirming a breakout under the March low. Establishing new lows for this year exposes the 100% level at 1.0436.

Recommended by Daniel Dubrovsky

The Fundamentals of Breakout Trading

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0