Euro, EUR/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- Euro on course for a 6th consecutive weekly loss

- Retail traders are maintaining their bullish bets

- EUR/USD faces rising support from November

Recommended by Daniel Dubrovsky

Get Your Free EUR Forecast

The Euro is on course for a 6th consecutive weekly loss against the US Dollar. If confirmed, this would be the longest losing streak for EUR/USD since 2018. During this time, retail traders have become increasingly bullish on the Euro. This can be seen by taking a look at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, could further pain be in store for the single currency?

EUR/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 67% of retail traders are net-long the Euro. Since the majority of them remain biased to the upside, this continues to suggest that EUR/USD may fall down the road. This is as upside exposure increased by 22% and 33% compared to yesterday and last week, respectively. With that in mind, the combination of overall exposure and recent changes offers a stronger bearish contrarian trading bias.

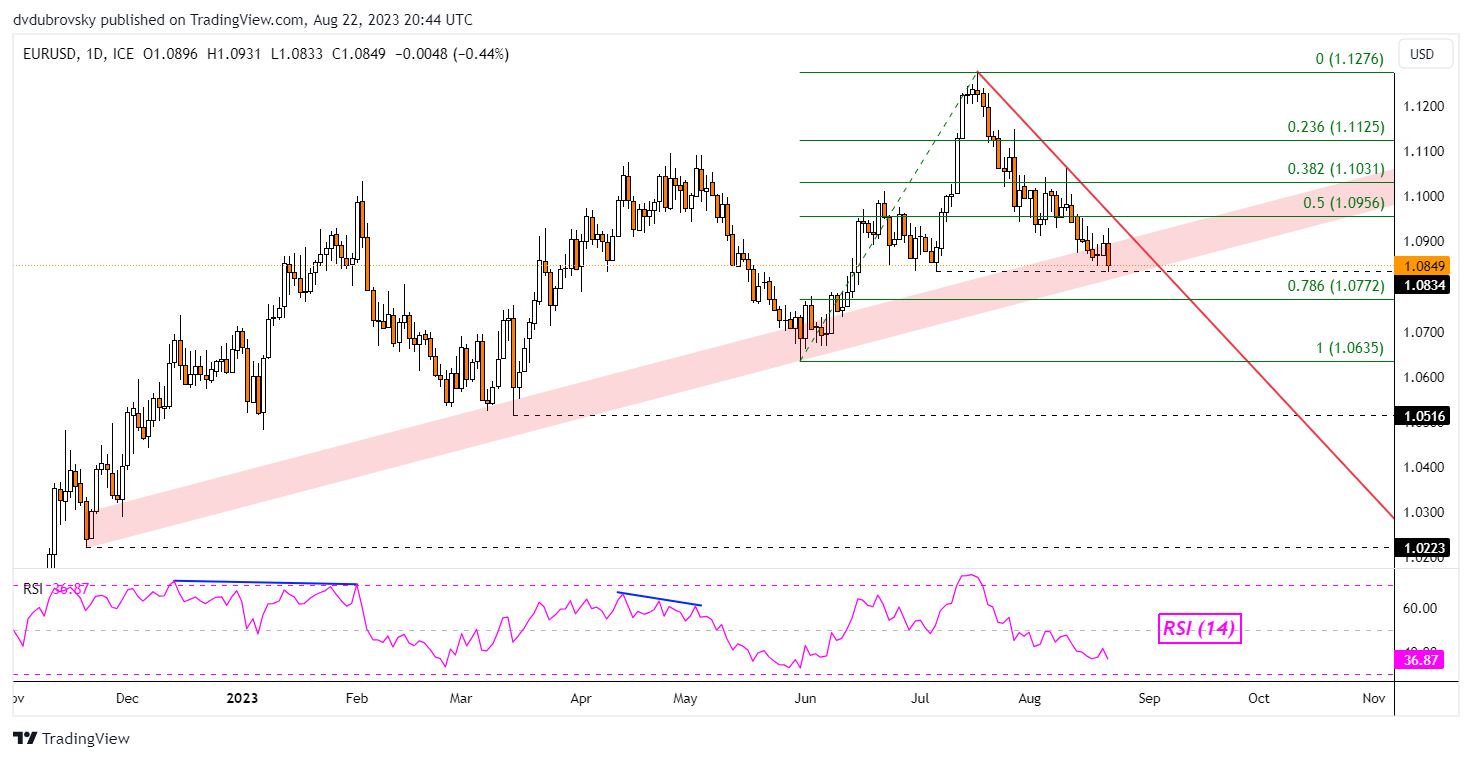

Euro Daily Chart

On the daily chart, EUR/USD has once again dropped to just above the July low of 1.0834. Guiding the single currency lower has been a near-term falling trendline from July – see chart below. Now, the Euro is facing a rising range of support from November. Confirming a breakout lower could open the door to reversing the broader bullish technical bias.

That would expose the 78.6% Fibonacci retracement level of 1.0772 on the way toward the May low of 1.0635. Otherwise, pushing above the near-term falling trendline exposes the midpoint of the Fibonacci retracement at 1.0956 before the 38.2% level comes into focus at 1.1031.

Recommended by Daniel Dubrovsky

How to Trade EUR/USD

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰