Oil (WTI, Brent) News and Analysis

- Shell forced to halt unit at Europe’s biggest refinery- exacerbating tight supply

- EIA storage data reveals continuing trend of crude drawdowns – adding to tailwinds

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Shell Forced to Halt Unit at Europe’s Biggest Refinery – Exacerbating Tight Supply

In yesterday’s oil market update the possibility of a pullback arose as intra-day prices retreated from the daily high. After yesterday’s red candle, price action continued lower in the lead up to the FOMC meeting later this evening, however, news of Shell being forced to halt a unit at Europe’s biggest refinery is likely to exacerbate an already tight oil market – pushing prices higher.

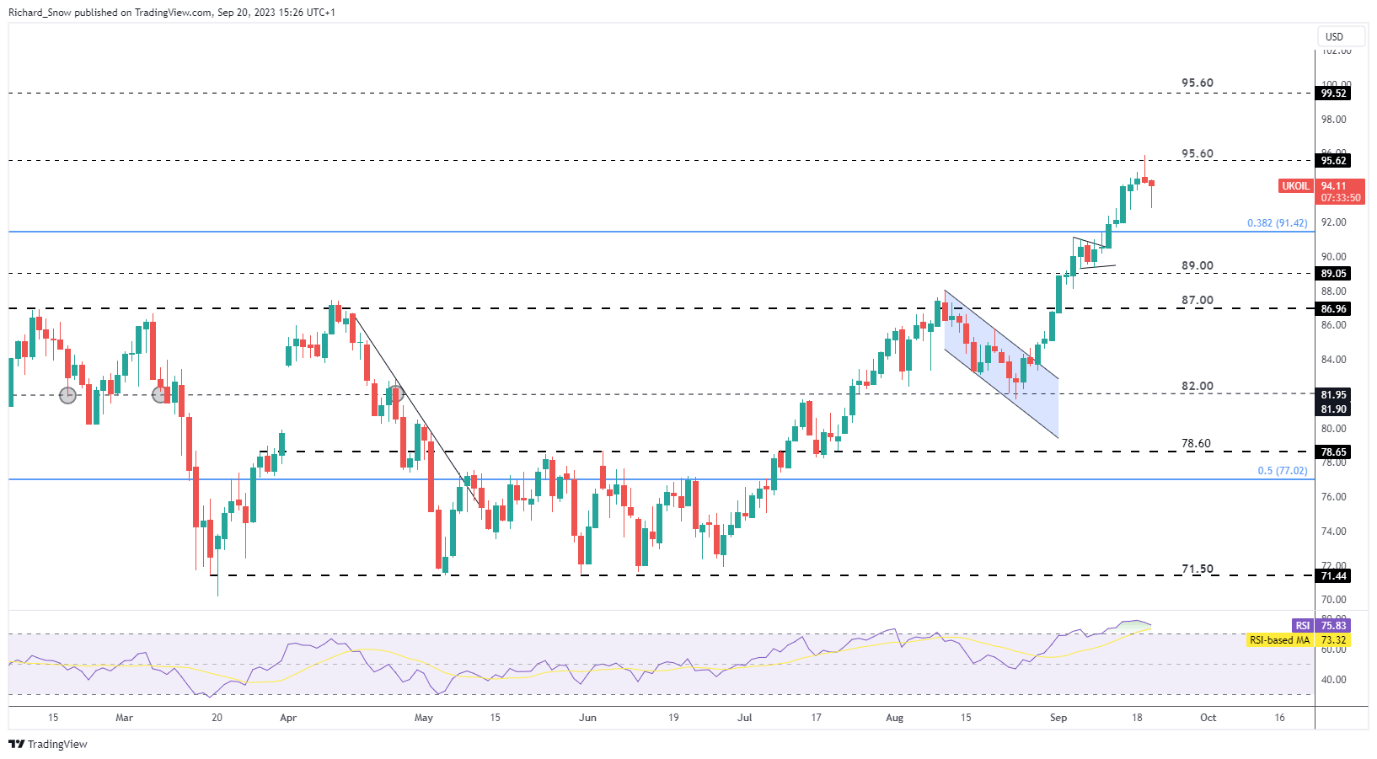

Brent crude oil appeared on track towards $91.42 but posted an intra-day reversal thus far – suggesting the broader oil pullback may be short-lived. The fundamentally tight oil market stands in the way of a deeper decline, despite being heavily overbought. $96.50 reemerges as resistance. Markets will be fixated on the Fed’s projections later this evening with oil markets scrutinizing the GDP estimate. A stronger US economy bodes well for oil prices.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

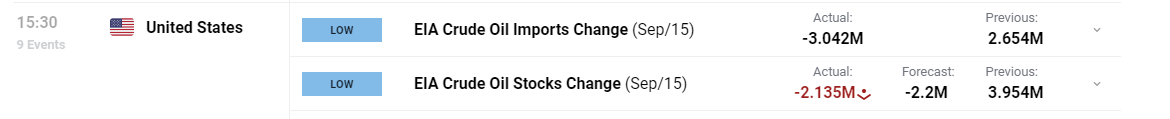

In addition, EIA storage data for the week ending 15 September confirms the recent trend of diminishing US crude oil inventories. Not that the oil market needed it, but the Shell news and storage data adds to the existing tailwind that was set in place after the output cuts came into force in July.

Customize and filter live economic data via our DailyFX economic calendar

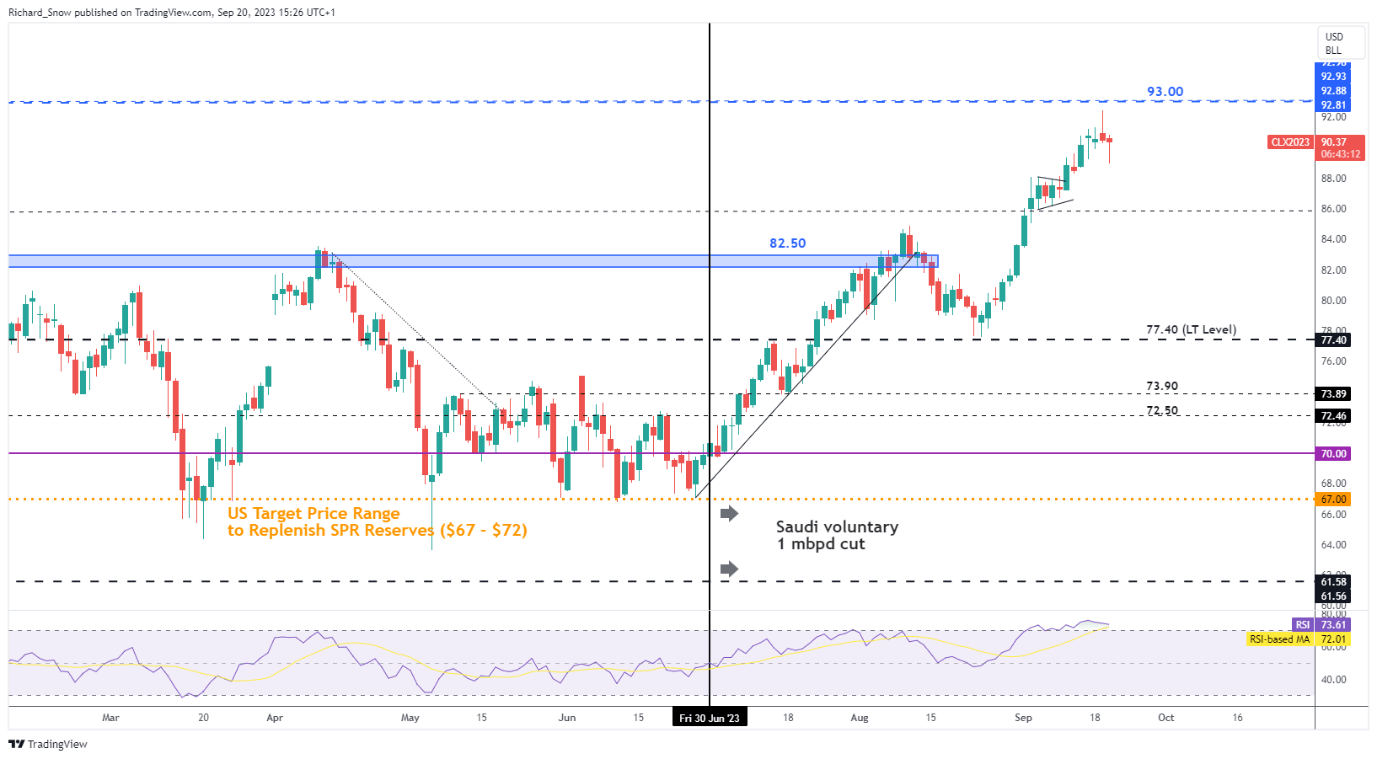

WTI crude oil ran out of steam ahead of $93, but the pullback – like Brent crude oil – appears under threat already. The bullish structure remains in tact and $93 appears as resistance with $88.13 and $86.00 the next levels of support.

WTI Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

The oil market is inextricably linked to demand and supply dynamics. Find out what these are and how they influence oil prices below:

Recommended by Richard Snow

How to Trade Oil

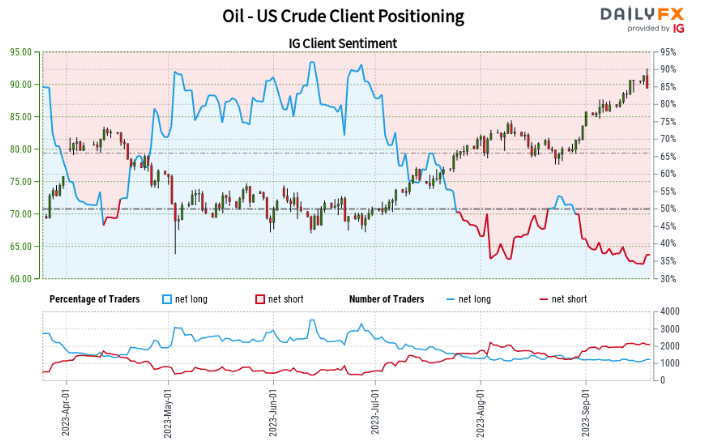

IG Client Sentiment Hints at Deeper Pullback Despite Net Short Positioning

Oil– US Crude:Retail trader data shows 39.43% of traders are net-long with the ratio of traders short to long at 1.54 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggestsOil- US Crude prices may continue to rise. However, recent changes in sentiment warn that prices may soon reverse despite the fact that traders are net short.

Find out how to read IG client sentiment and incorporate it into your trading process:

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -3% |

| Weekly | -1% | 1% | 0% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0