Cautious Risk Tone, with Chatters of a Policy Adjustment from the BoJ: USD/JPY, Nikkei 225, EUR/JPY

[ad_1] Market Recap Recommended by Jun Rong Yeap Get Your Free Equities Forecast Initial gains in Wall Street took a turn overnight, as a jump in Treasury yields kept the pressure on risk sentiments. Particularly, the 10-year Treasury yields saw a jump of 13 basis-point (bp) to reclaim its key 4% level, while the US

[ad_1]

Market Recap

Recommended by Jun Rong Yeap

Get Your Free Equities Forecast

Initial gains in Wall Street took a turn overnight, as a jump in Treasury yields kept the pressure on risk sentiments. Particularly, the 10-year Treasury yields saw a jump of 13 basis-point (bp) to reclaim its key 4% level, while the US two-year yields were up by 8 bp, driven by a confluence of stronger-than-expected US economic data and chatters of a policy adjustment from the Bank of Japan (BoJ).

The advance estimate for US 2Q GDP has smashed expectations by a wide margin (2.4% versus 1.8% consensus), notably with surprise strength in consumer spending and business investment, anchoring down on soft landing hopes. But while market rate expectations remain firmly priced for the Fed to keep rates on hold over coming months, the timeline for rate cuts is more unsettled with economic resilience supporting a high-for-longer rate outlook.

Perhaps the greater surprise overnight comes from a news release from Nikkei, which reported that the Bank of Japan (BoJ) will discuss tweaking its yield curve control (YCC) policy at the upcoming policy board meeting. A tweak of its YCC policy back in December 2022 has triggered a jump in global bond yields in its aftermath and kept risk sentiments in check. If confirmed later today, a similar situation may play out.

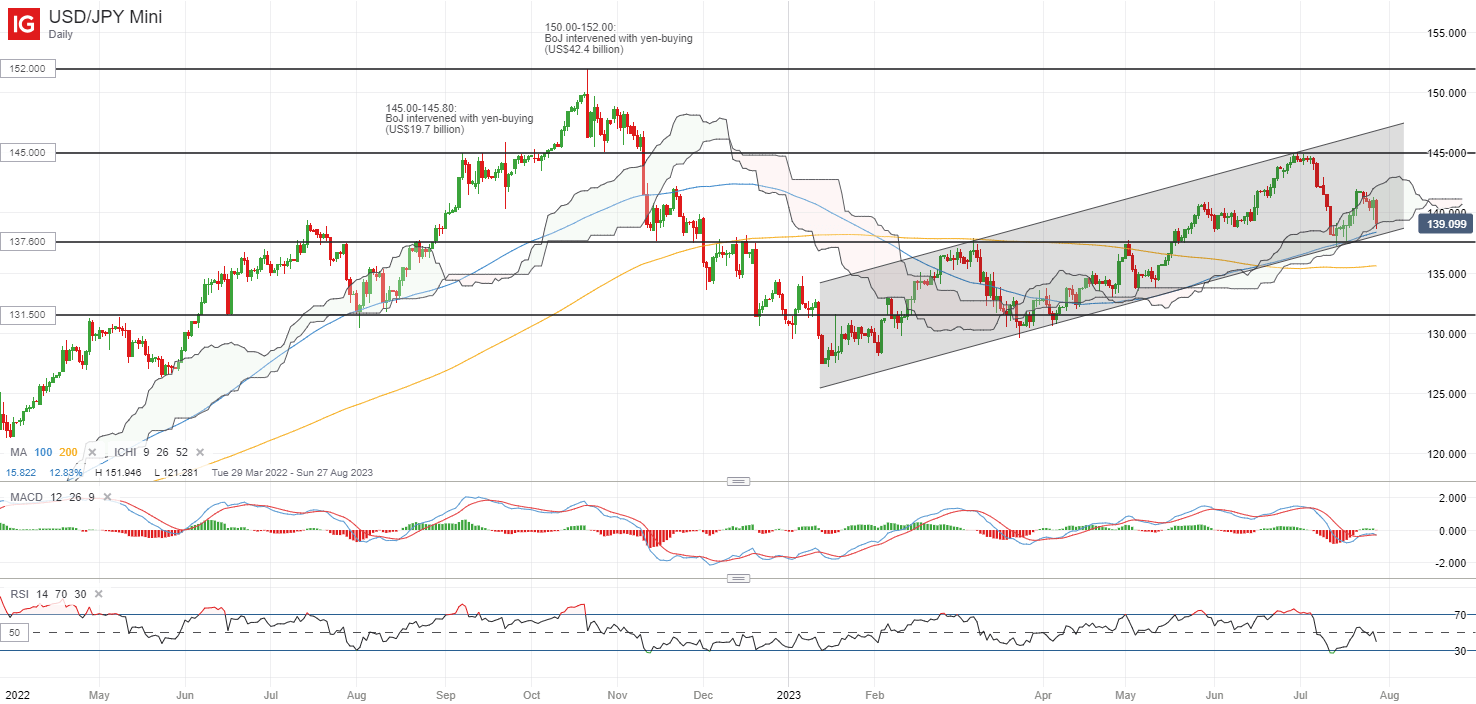

Despite higher Treasury yields, the USD/JPY has plunged by 1.3% overnight on a stronger yen and put the pair in sight of the 137.60 level, where a key confluence support stands (Ichimoku cloud support, 100-day moving average, lower channel trendline). Its relative strength index (RSI) has turned lower from the key 50 level, which puts sellers in control in the near term. Any breakdown of the 137.60 level may potentially pave the way to retest the 134.50 level next.

Source: IG charts

Asia Open

Asian stocks look set for a negative open, with Nikkei -1.44%, ASX -0.86% and KOSPI -0.35% at the time of writing, tracking the downbeat session in Wall Street. No doubt the BoJ meeting will be on the radar today, with chatters that the central bank may consider letting long-term interest rates rise above its 0.5% cap by “a certain degree” overturning previous expectations of more wait-and-see from the central bank.

While it is likely that the BoJ’s accommodative stance could largely remain, market sentiments have been highly sensitive to any tweaks in policy settings as an indication of a quicker policy normalisation since the surprise YCC tweak back in December 2022. Any confirmation at the upcoming meeting will being about upside risks to global bond yields, as Japanese bond returns could be more attractive to its domestic investors.

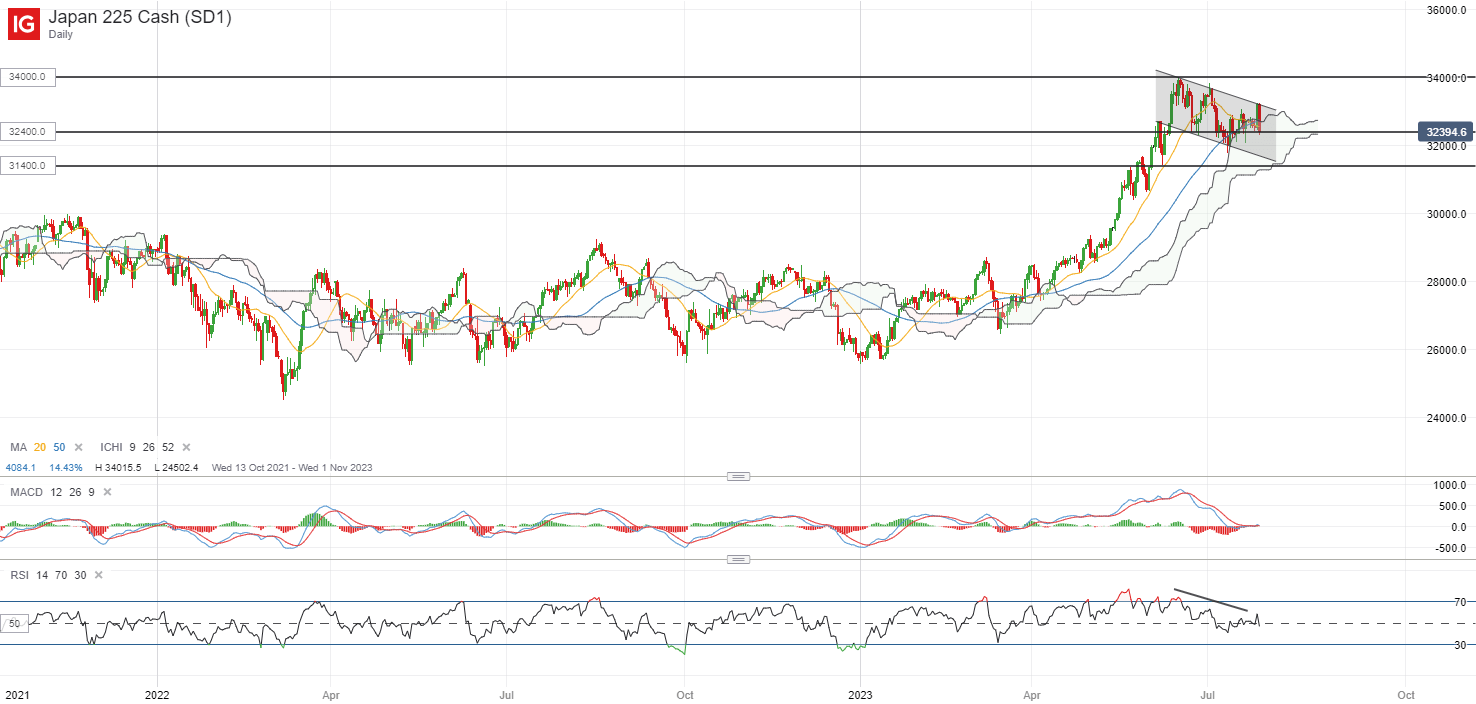

The Nikkei 225 index is put on the radar as well. Previous adjustment to its 10-year bond yield cap in December 2022 has triggered a 3% sell-off in the index in a single day, considering the reduced traction in holding equities on a higher risk-free rate. The index is currently back to retest its 32,400 level of support, finding resistance at a near-term downward-sloping trendline. Any failure to defend the level may potentially pave the way towards the 31,400 level next.

Recommended by Jun Rong Yeap

Get Your Free Top Trading Opportunities Forecast

Source: IG charts

On the watchlist: Breakdown of double-top formation in EUR/JPY

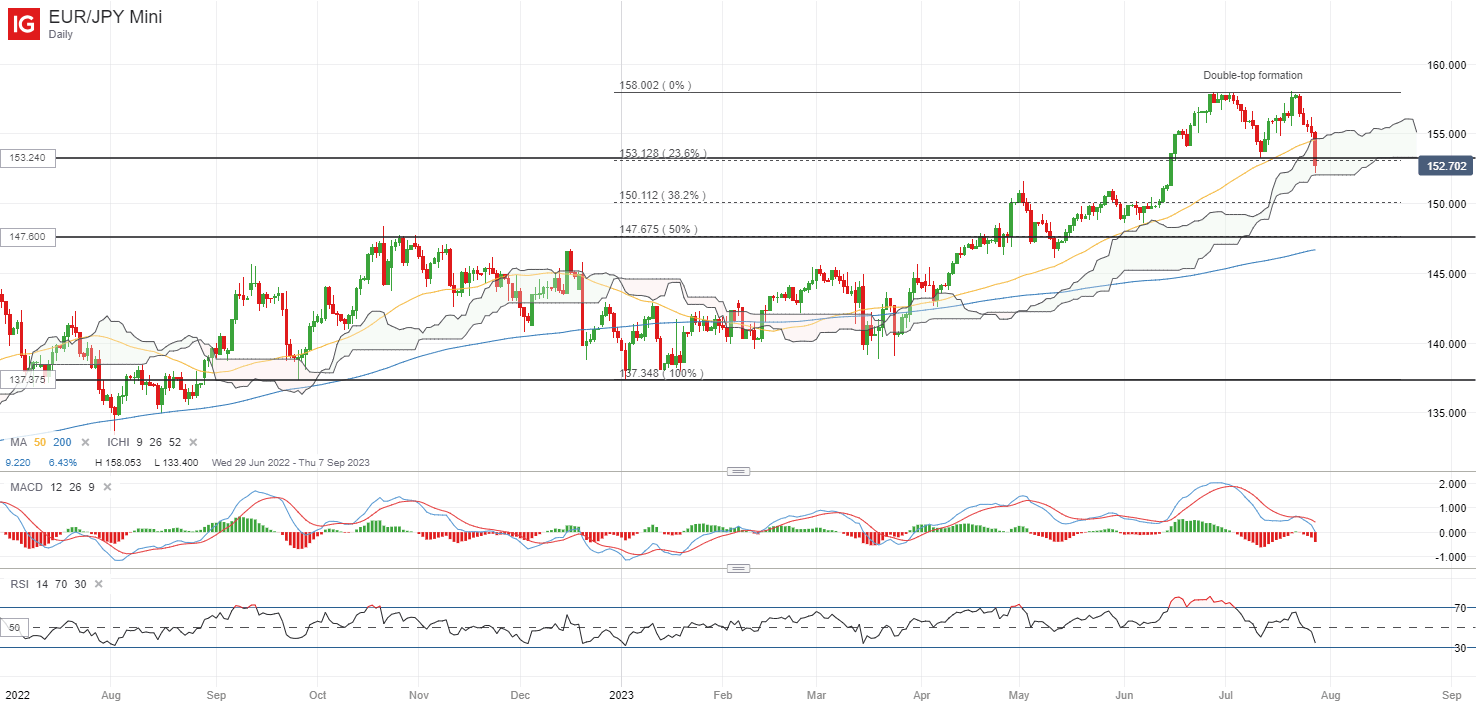

The confluence of a more data-dependent stance from the European Central Bank (ECB) and speculations of a policy adjustment from the Bank of Japan (BoJ) have prompted the EUR/JPY to break below the neckline of a double-top formation overnight.

Despite an initial hawkish policy statement from the ECB, the tone from the press conference seems to carry some reservations. The ECB President Christine Lagarde floated the possibility of a rate pause during the press conference, saying that the central bank is “deliberately data dependent” and “have an open mind” for subsequent rate decisions.

For the EUR/JPY, the 153.24 level has been breached, with the projection of the double-top pattern potentially placing the 147.60 level on watch next. Much will revolve around the upcoming BoJ meeting, with any confirmation of a YCC tweak likely to drive further strength in the Japanese yen and kept the lid on the EUR/JPY.

Recommended by Jun Rong Yeap

Get Your Free JPY Forecast

Source: IG charts

Thursday: DJIA -0.67%; S&P 500 -0.64%; Nasdaq -0.55%, DAX +1.70%, FTSE +0.21%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰