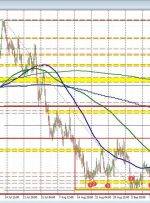

EURO TALKING POINTS & ANALYSIS EUR/USD held steady in data-light sessions for Asia and Europe Its downtrend from July remains very much in place Hawkish comments from US officials will continue to weigh Recommended by David Cottle Get Your Free EUR Forecast The Euro steadied against a broadly stronger United States Dollar in Tuesday’s Asian