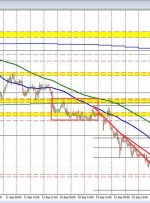

© Reuters. FILE PHOTO: Japanese yen and U.S. dollar banknotes are seen with a currency exchange rate graph in this illustration picture taken June 16, 2022. REUTERS/Florence Lo/Illustration/File Photo By Karen Brettell and Amanda Cooper NEW YORK/LONDON (Reuters) – The dollar was on track to post its biggest quarterly gain in a year on Friday