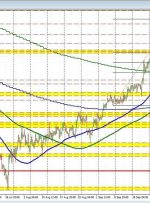

EUR/CAD Shaping up for Long-Term Reversal as Oil, Inflation Rise EUR/CAD sold off into the end of Q3 after the European Central Bank (ECB) hiked rates to 4% which may prove to be the peak. The euro depreciated immediately as markets lowered their expectations of another hike. Fundamentals in Europe also remain weak as the