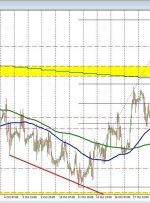

BITCOIN, CRYPTO KEY POINTS: READ MORE: Oil Weekly Forecast: Technicals Hint at Further Upside but Geopolitics Holds the Key Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter! Recommended by Zain Vawda Get Your Free Top Trading Opportunities Forecast Bitcoin Rally Gathers Pace as ETF