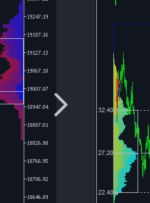

Market Profile MetaTrader indicator — is a classic Market Profile implementation that can show the price density over time, outlining the most important price levels, value area, and control value of a given trading session. This indicator can be attached to any timeframe and supports multiple session lengths, including a free-draw rectangle session to create a