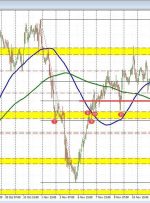

[ad_1] Today, the AUDUSD has moved up from a swing area support between 0.6445 and a 0.6455 (see red numbered circles on the chart below). The subsequent move to the upside took the price back above its 100-day moving average of 0.64874 (blue overlay line on the chart below). That moving average is – and