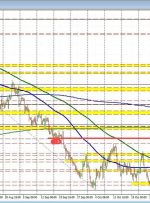

EUR/USD, PRICE FORECAST: MOST READ: Oil Latest – US Crude Trying to Nudge Higher After Another Week of Heavy Losses The Euro continues to hold the high ground against the Greenback following Tuesday’s explosive move to the upside. EURUSD is currently trading between two key levels with support provided around the 1.0840 handle and resistance