Bullish Momentum Slows Ahead of Major Releases

[ad_1] FTSE, DAX Analysis Recommended by Richard Snow See what our analysts foresee in indices in Q3 FTSE Edges Tentatively Higher Ahead of Massive Central Bank Meetings, Earnings The FTSE Index appears on track to print a sixth consecutive daily gain, putting in a near 6.5% recovery form the low earlier this month. The bullish

[ad_1]

FTSE, DAX Analysis

Recommended by Richard Snow

See what our analysts foresee in indices in Q3

FTSE Edges Tentatively Higher Ahead of Massive Central Bank Meetings, Earnings

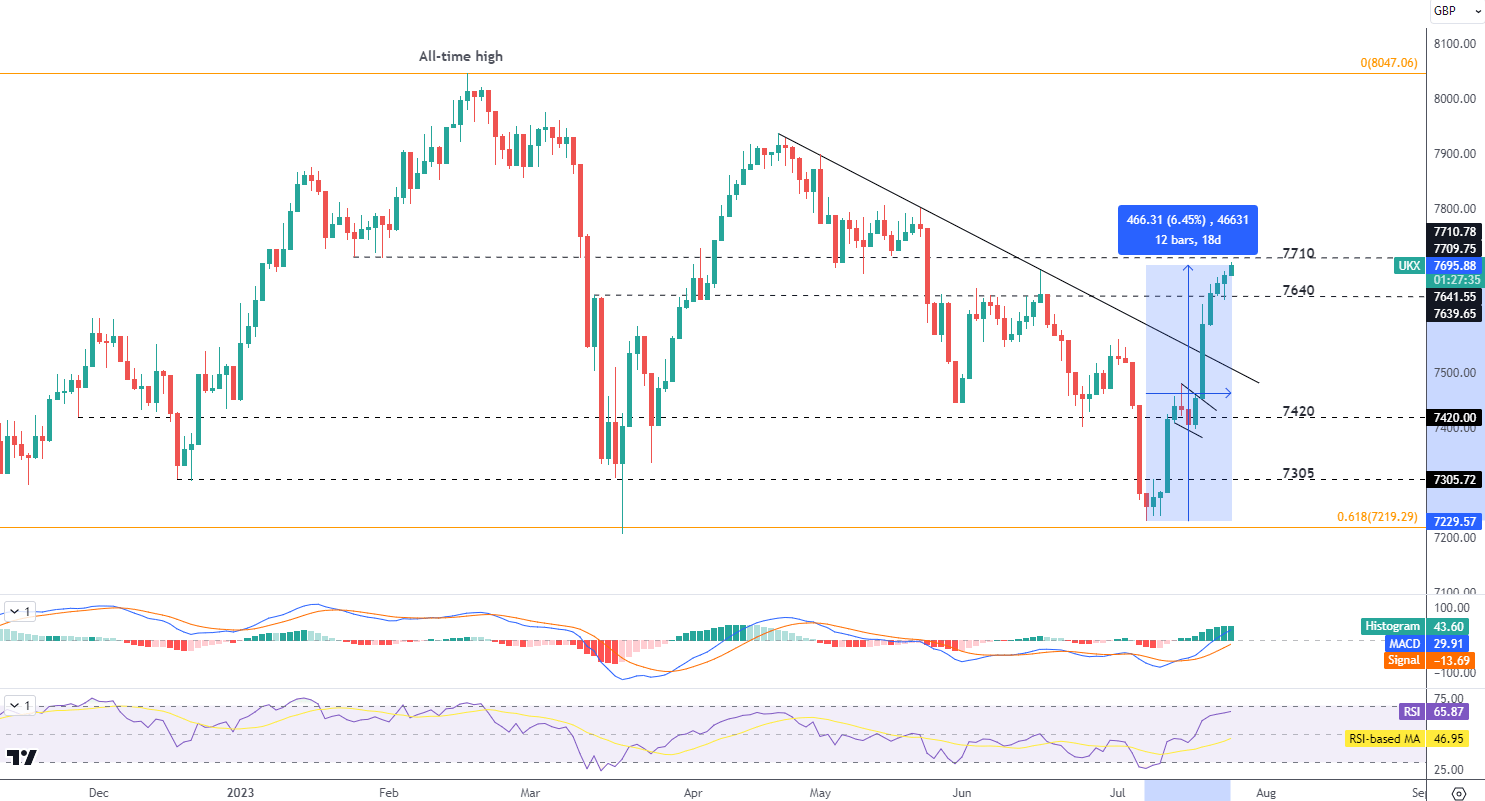

The FTSE Index appears on track to print a sixth consecutive daily gain, putting in a near 6.5% recovery form the low earlier this month. The bullish advance has been nothing short of impressive, breaking the prior long-term downtrend with relative ease.

The remainder of this week is likely to witness a pick up in volatility as influential US and UK earnings pick up. Alphabet, Meta and Microsoft are due this week while Vodafone, Rio Tinto, Lloyds, Boeing, GlaxoSmithKline and Anglo American to name a few. Be sure to bookmark the DailyFX earnings calendar for timely updates and earnings schedules.

In addition, the index has been buoyed by a weaker pound sterling which sold off sharply after encouraging core inflation data for June which saw it beat estimates on the downside – providing some relief for UK households.

7710 is the next and most immediate level of resistance before the cluster of highs around 7800 last seen in May comes into focus on the upside. 7640 presents an early indication of potential bullish fatigue, where a further drop could bring the 50 day simple moving average into focus (blue line).

FTSE 100 Index Daily Chart

Source: TradingView, prepared by Richard Snow

DAX Consolidates Near Significant Level of Resistance

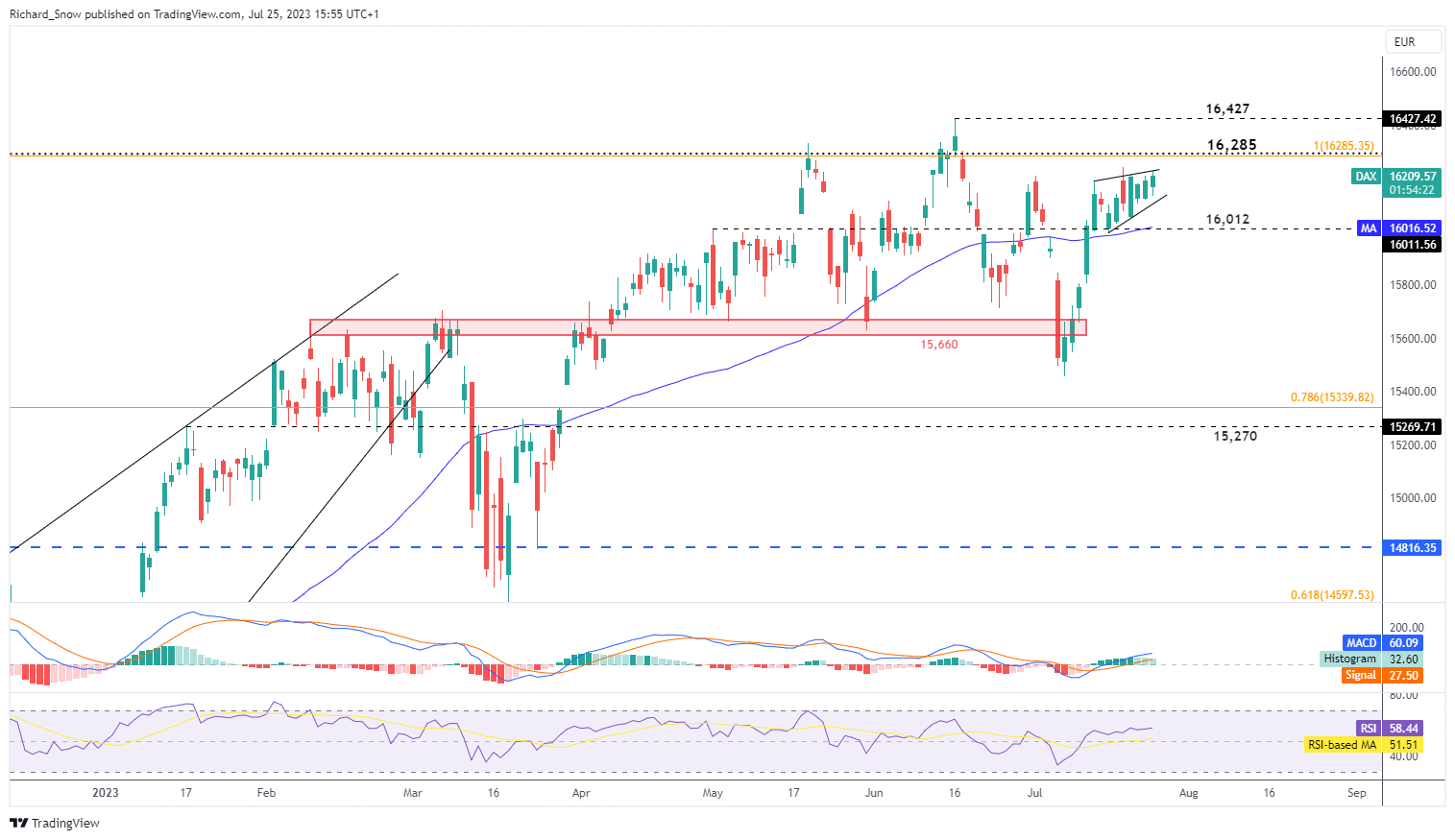

The DAX, has recovered all of the early to mid-July losses but now consolidates at the prior swing high of 16,209. The index has witnessed a notable decline in bullish momentum as recent price action has shown a tendency for sideways trading. That being said, the index is still testing the highs of the recent period of congestion, with the crucial 16,285 level of resistance on the horizon.

16,285 corresponds with the Dec 2021 and Jan 2022 highs before the massive drop throughout the rest of 2022. In the event the index continues higher from there, the June swing high of 16,427 is next in line.

The MACD favours a bullish continuation but we remain at relatively extreme levels. A drop towards 16,012 and the 50 SMA (blue line) could present an opportunity to spot potential re-entries in line with the prior uptrend or a point to observe the possibility of a deeper pullback and possibly longer-term reversal.

DAX Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

See where the opportunities lie in Q3

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰