Brent Crude, WTI Take a Breather as USD Surges

[ad_1] Oil (Brent Crude, WTI) Analysis Strong yields, USD and Fed speak send oil prices lower Support eyed ahead of storage data as bulls weigh up possible continuation plays Risk events: OPEC, API and EIA storage data due The analysis in this article makes use of chart patterns and key support and resistance levels. For

[ad_1]

Oil (Brent Crude, WTI) Analysis

- Strong yields, USD and Fed speak send oil prices lower

- Support eyed ahead of storage data as bulls weigh up possible continuation plays

- Risk events: OPEC, API and EIA storage data due

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

Strong Yields, Dollar and Fed Speak Send Oil Prices Lower

A widely watched benchmark of USD performance is the US Dollar Basket (DXY) and this morning it touched the 107 mark. Towards the end of last week, the dollar eased off as fears around another US Government shutdown went down to the wire, eventually ending on Saturday where Congress voted to avoid such an outcome. On Monday when the dust had settled, yields and the dollar regained lost ground and even surged higher. In a hawkish comment, the Fed’s Michelle Bowman admitted it ‘will likely be appropriate’ to raise rates further and hold them at a restrictive level for some time.

A stronger dollar makes foreign purchases of oil more expensive and can have an effect in lowering the price of the commodity. However, the fundamental landscape of the oil market suggests we could see a return to recent high. OPEC is largely expected to maintain its current output cuts of 2 million barrels per day (bpd) with Saudi Arabia and Russia further reducing supply by 1 mbpd and 300,000 bpd respectively.

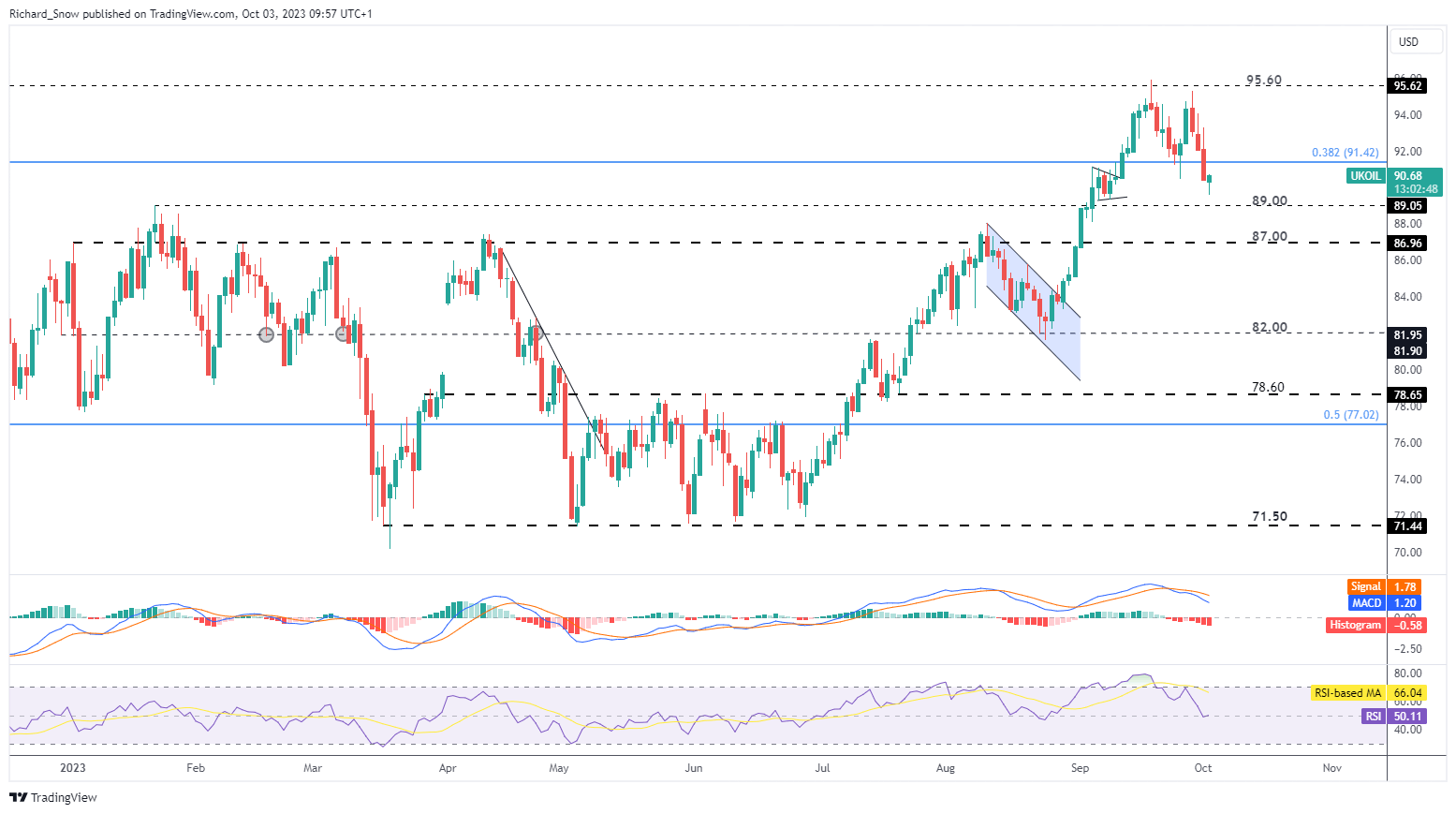

Brent Crude Oil Attempts to Halt Recent Decline

Brent crude oil has pulled back roughly 6% since the September high where it is attempting to find support. Prices closed marginally below the 26 September swing low, opening the door to further selling. However, in early trading on Tuesday it appears bulls could be spotting some value around the $90 level – lifting prices.

The RSI is in no man’s land at the 50 mark while the MACD still suggests momentum is to the downside. As far as support goes, the $89 is a stronger level of support should prices continue lower, with $87 not far thereafter. Resistance appears at the 38.2% Fibonacci retracement of the major 2020-2022 move at $91.42 and a retest of the high around $95.60.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

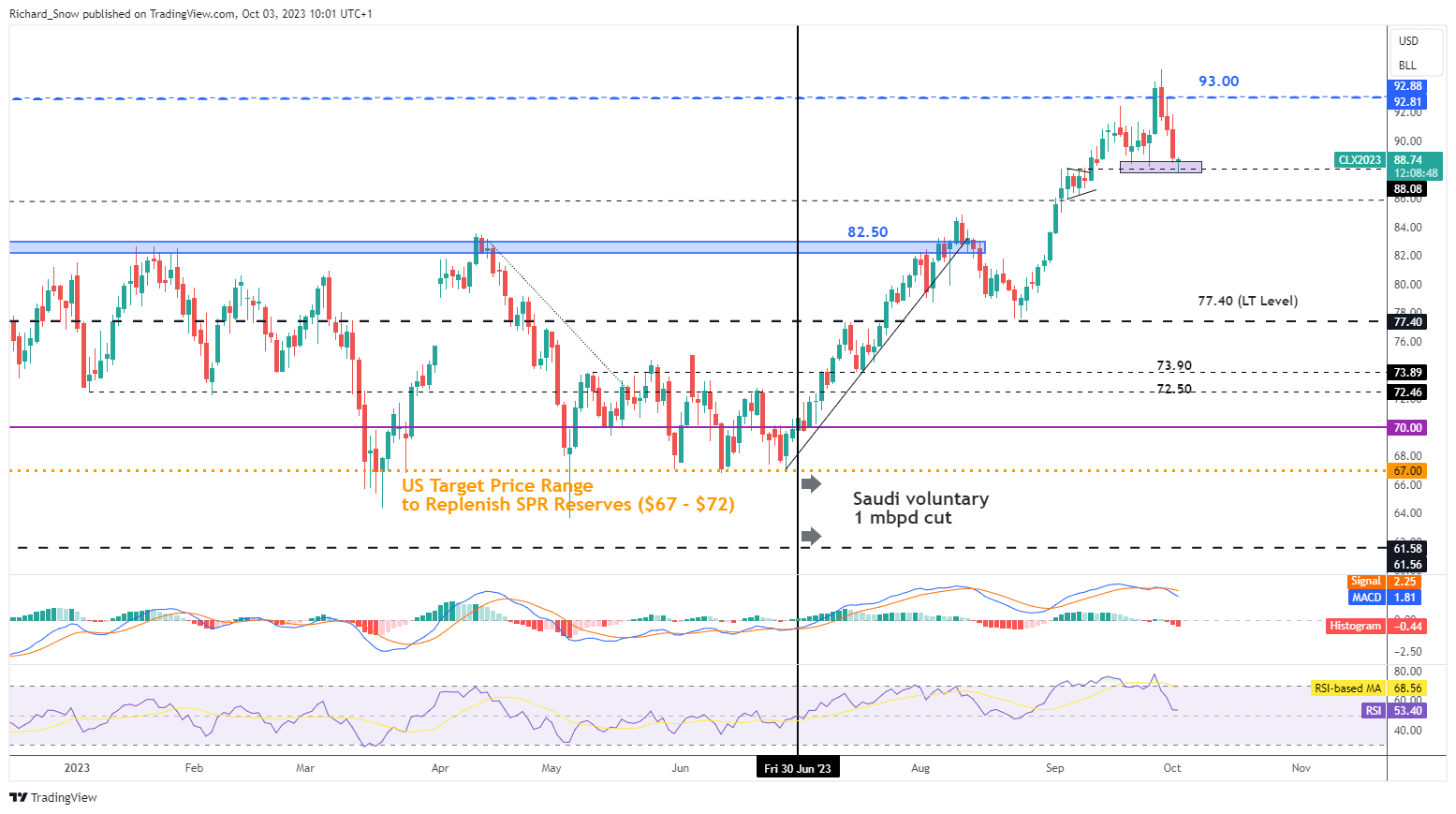

WTI provides a much more appealing setup for bulls where price action appears to be reversing around an area previously approached and respected as support. The highest point of the prior bullish pennant marks a level of support around $88.90, with prices testing the zone around it twice previously.

With the Brent/WTI spread narrowing, it appears that WTI could lead a move higher in oil prices should we see further bullish momentum from here.

US Crude Oil (WTI) Daily Chart

Source: TradingView, prepared by Richard Snow

Crude Stocks Remain Under Strain in a Tight Oil Market

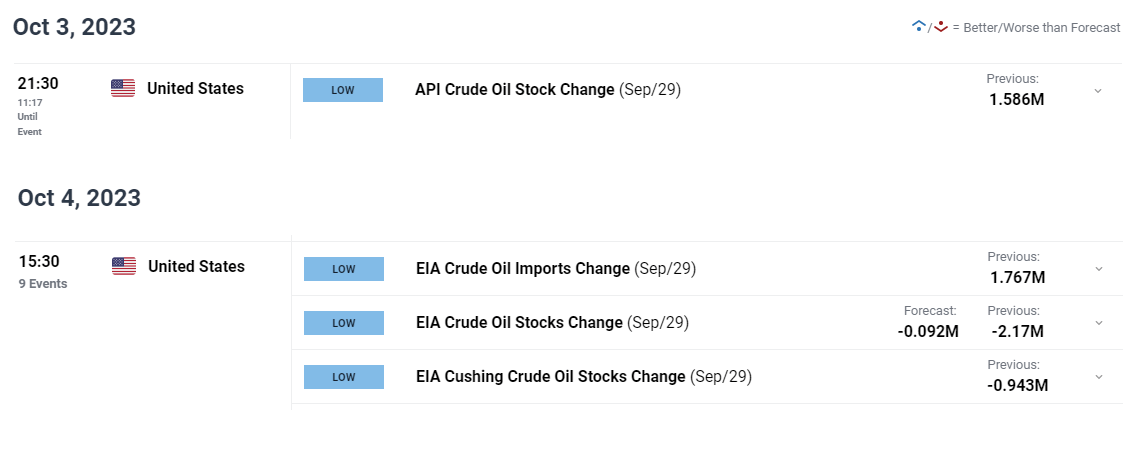

In the US, crude oil stocks have been on the decline since mid-August with the rate of decline admittedly easing up. Global oil demand has remained resilient despite widespread growth concerns linked to restrictive financial conditions.

However, the US economy continues to grow despite the recent downward revision in Q2 GDP, spurring oil demand. Later today, API crude oil stock levels are due for release followed by tomorrow’s EIA storage data and the OPEC meeting.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0