Short USD/JPY: A Reprieve in the DXY Rally and FX Intervention by the BoJ

The USD/JPY has held the high ground for the majority of Q3 with rallies to the downside proving short lived at this stage. The potential for a downside move however remains in play and with the right fundamental developments could provide an excellent risk/reward potential.

Now I’d like to start off by saying that this is what I would term a high-risk trade as we are going against an extremely bullish uptrend. This coupled with the FED meeting this week and the narrative of higher for longer may seem like a wildcard trade opportunity.

Elevate your trading skills with an extensive analysis of the Japanese Yens prospects, incorporating insights from both fundamental and technical viewpoints. Download your free Q4 guide now!!

Recommended by Zain Vawda

Get Your Free JPY Forecast

The Bank of Japan (BoJ) at their most recent Central Bank meeting kept rates steady and signaled no rush to tighten policy. This was largely expected and something I expect to persist in Q4 but the threat of FX intervention remains very much on the table. So far Japanese officials have used comments to help support the Yen but former BoJ members have earmarked the 150.00 level as the level for actual FX intervention.

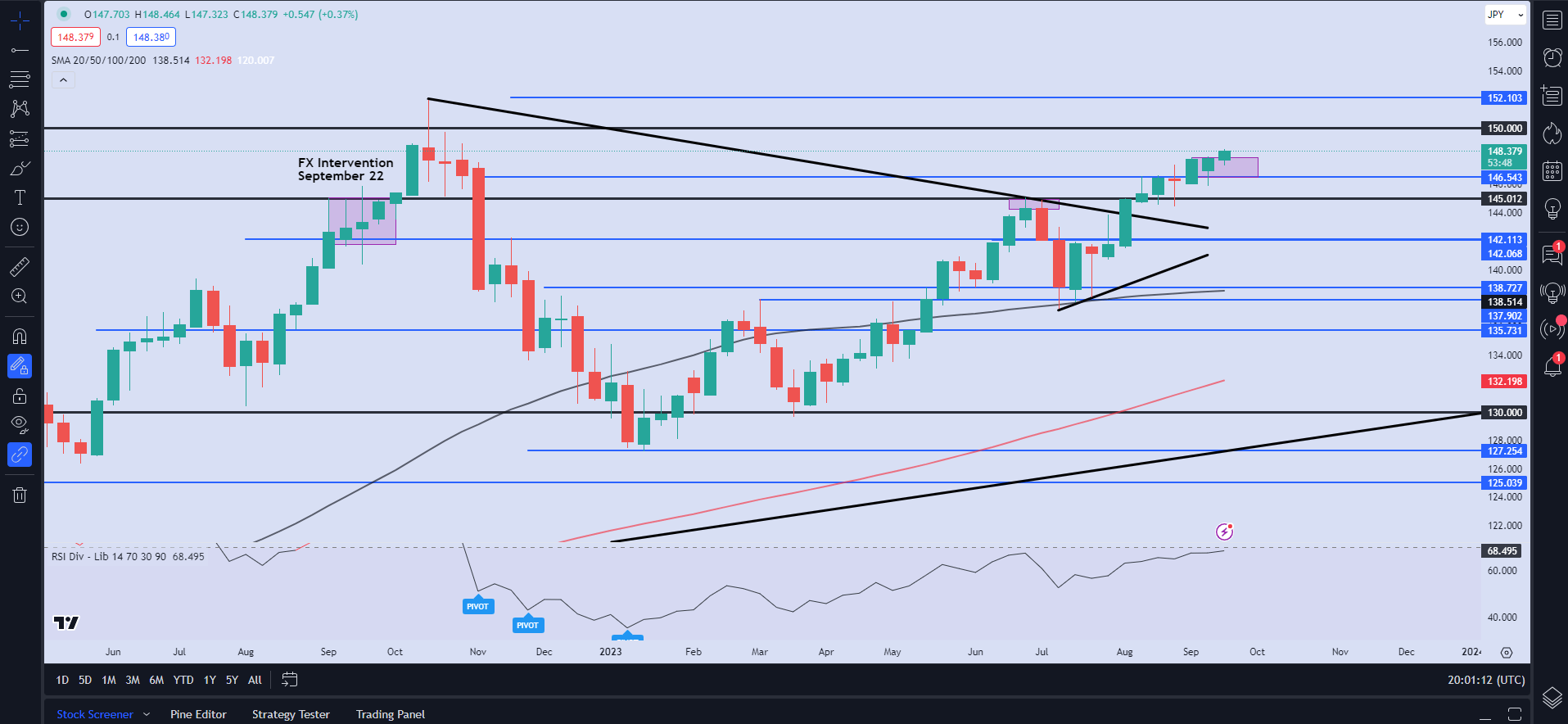

Now last year the BoJ started FX intervention on September 22, 2022, and in the aftermath, we saw a spike higher in USDJPY (as you can see on the chart below). However, what followed was a steep drop-off in USDJPY from a high of around the 152.00 handle all the way down to the 128.00 mark by early January. I expect FX intervention to have a similar impact this time around should it materialize.

FX INTERVENTION LAST YEAR

Source: TradingView, Chart Prepared by Zain Vawda

It is important to note that the BoJ do not really issue a warning to markets before intervention and as seen from last year it can take a few days before Intervention is actually felt in the market.

Looking for the best trade ideas for Q4? Look no further and download your complimentary guide courtesy of the DailyFX team of Analysts and Strategists.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

TECHNICAL ANALYSIS

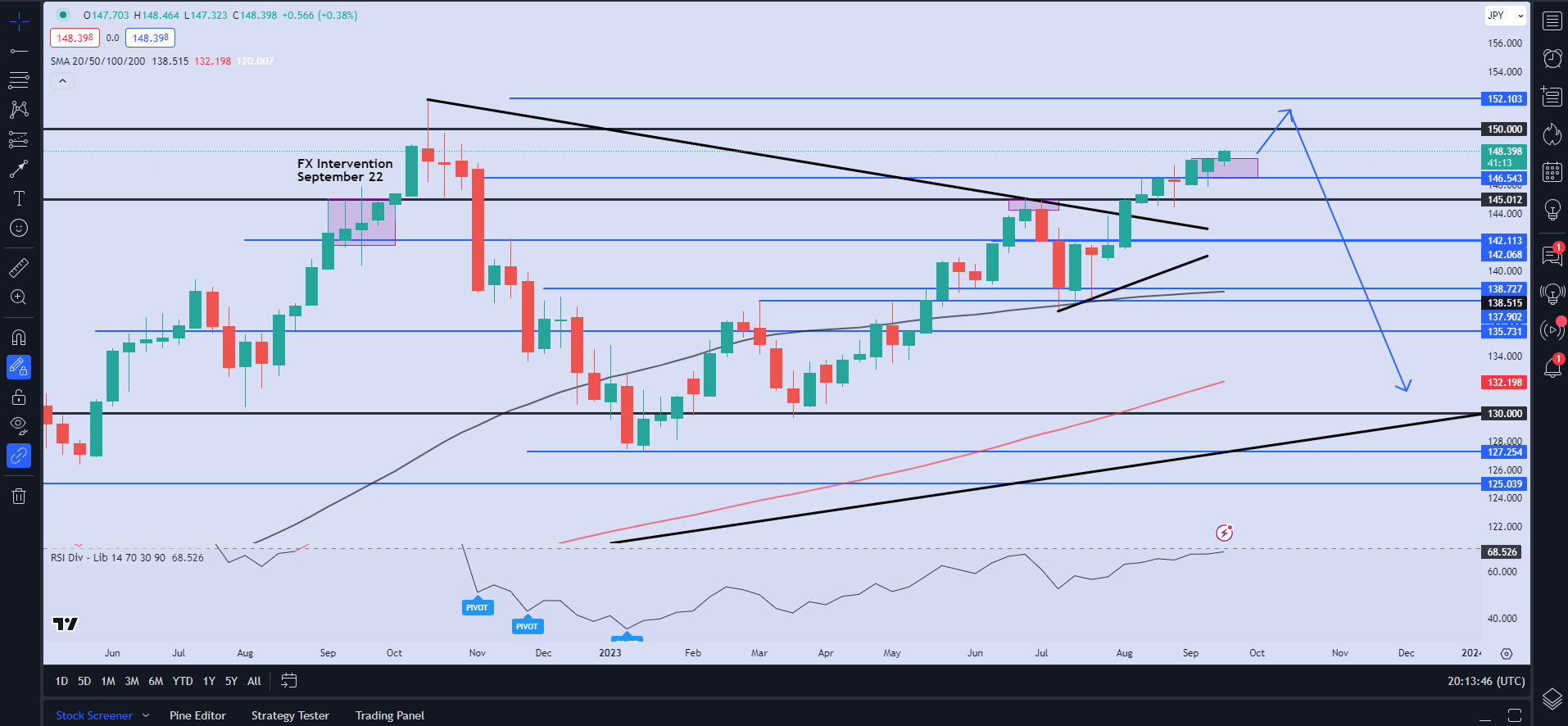

Looking at the technical picture, it is clear that we are in a strong uptrend with the 14-day RSI approaching overbought territory. I however would prefer a retest of the 150.00-152.00 mark before looking for a potential short opportunity. Waiting for an announcement around FX Intervention may also pay dividend as we have mentioned above that last year saw a spike higher following intervention before the selloff in USDJPY began a few days later.

USD/JPY WEEKLY CHART

Chart prepared by Zain Vawda, TradingView

Now should the opportunity present itself as I mentioned the downside move and potential remains huge. I would suggest keeping a close watch on developments around the BoJ as USDJPY approaches the 150.00 psychological mark and then it comes to using your own discretion for potential entry opportunities.

Key Levels to Keep an Eye On:

Support Levels:

- 147.50

- 145.00 (psychological level)

- 142.10

- 140.00 (psychological level)

Resistance Levels:

- 150.00 (psychological level)

- 152.00 (2022 high)

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

| Change in | Longs | Shorts | OI |

| Daily | 7% | -1% | 1% |

| Weekly | -5% | -3% | -3% |

Contact and follow Zain on Twitter @zvawda

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰