Harami – price action pattern – Analytics & Forecasts – 17 October 2023

[ad_1] The harami price action pattern is a two candle pattern which represents indecision in the market and is used primarily for breakout trading. It can also be called an ‘inside candle formation’ as one candle forms inside the previous candle’s range, from high to low. Here is an example of what a bearish and bullish harami

[ad_1]

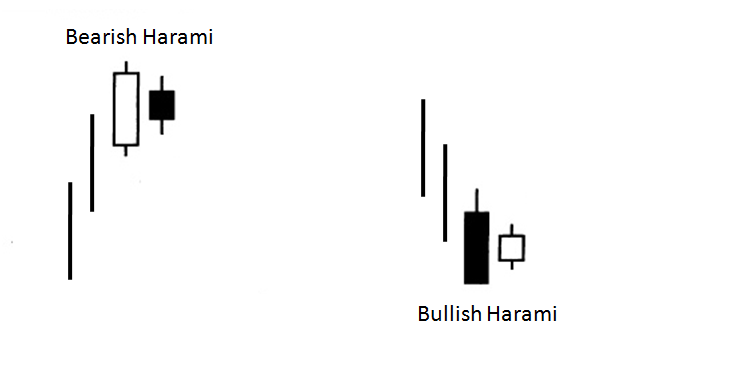

The harami price action pattern is a two candle pattern which represents indecision in the market and is used primarily for breakout trading. It can also be called an ‘inside candle formation’ as one candle forms inside the previous candle’s range, from high to low. Here is an example of what a bearish and bullish harami candle formation looks like:

A bearish harami forms when a seller candle’s high to low range develops within the high and low range of a previous buyer candle. As there has been no continuation to form a new high, the bearish harami represents indecision in the market which could lead to a breakout to the downside.

A bullish harami forms when a buyer candle’s high to low range develops within the high and low range of a previous seller candle. As there has been no continuation to form a new low, the bullish harami represents indecision in the market which could lead to a breakout to the upside.

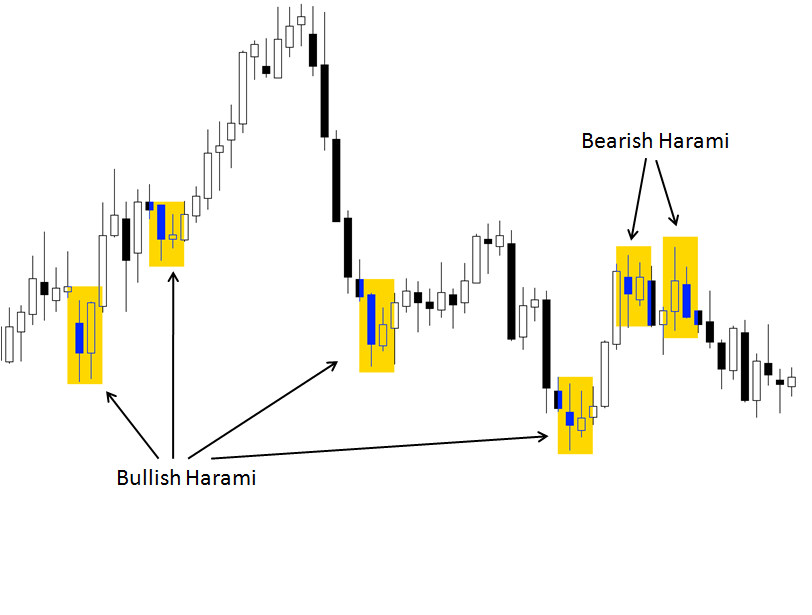

Here are some examples of bullish and bearish harami patterns that form over a period of time:

So how could you trade these patterns as a price action trading strategy? There are many ways and no one perfect way. However, many traders use this as a standalone breakout pattern. Here are some possible rules to build upon:

Trading The Bullish Harami Pattern:

1. Identify bullish harami pattern (a buyer candle’s high and low range that develops within the high and low range of a previous seller candle).

2. Enter one pip above the high of the last candle.

3. Place a stop loss one pip below the low of the previous candle (to give the trade some room to breathe).

4. Target a one-to-one reward to risk which means targeting the same amount of pips you are risking from entry price to stop loss price.

5. If the trade has not triggered by the open of a new candle, cancel the order. If the trade has triggered leave it in the market until stop loss or target levels have been reached.

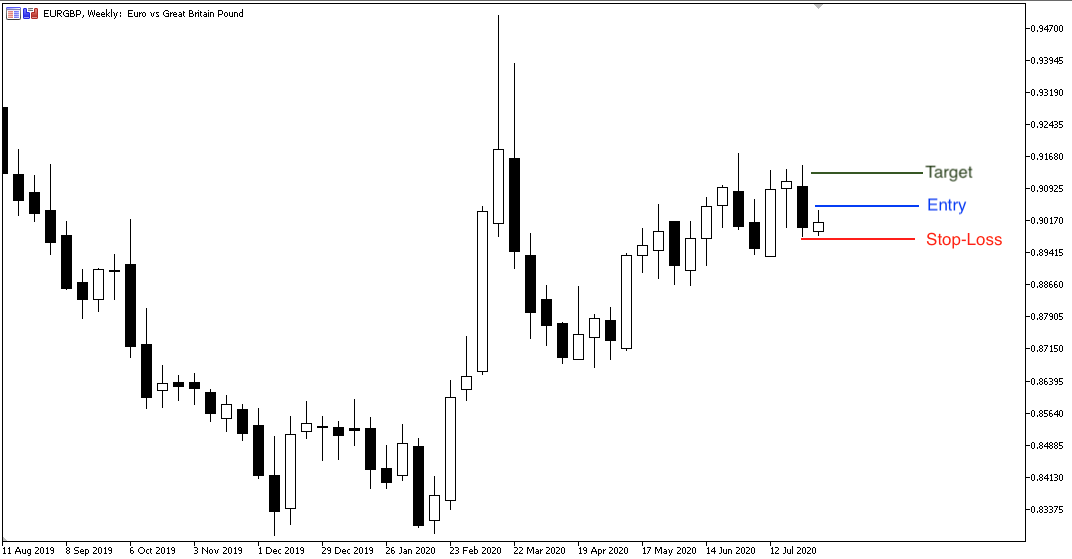

Based on these rules above, here is an example of what it would look like on a chart:

In the above chart of EUR/GBP, a bullish harami has formed. Using the rule above, one could have an entry price above the high of the last candle, with a stop loss at the low of the previous candle. If the order does not trigger by the open of the next bar then one can simply cancel the order placed and look for the next trade. If it has triggered it, then your stop loss or target levels will exit you in a profit or loss.

Trading The Bearish Harami Price Action Pattern:

1. Identify bearish harami pattern (a seller candle’s high and low range that develops within the high and low range of a previous buyer candle).

2. Enter one pip below the low of the last candle.

3. Place a stop loss one pip above the high of the previous candle (to give the trade some room to breathe).

4. Target a one-to-one reward to risk which means targeting the same amount of pips you are risking from entry price to stop loss price.

5. If the trade has not triggered by the open of a new candle, cancel the order. If the trade has triggered leave it in the market until stop loss or target levels have been reached.

Learn more about price action trading and other trading related topics by subscribing to our channel.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0