Bears Reload but Energy Market Outlook Stays Positive

[ad_1] CRUDE OIL PRICES OUTLOOK Oil prices extend losses for the second consecutive day, reversing most of Monday’s rally Despite the recent pullback, geopolitical tensions in the Middle East create a constructive backdrop for energy markets. This article looks at the key technical levels for oil to keep an eye on in the coming days.

[ad_1]

CRUDE OIL PRICES OUTLOOK

- Oil prices extend losses for the second consecutive day, reversing most of Monday’s rally

- Despite the recent pullback, geopolitical tensions in the Middle East create a constructive backdrop for energy markets.

- This article looks at the key technical levels for oil to keep an eye on in the coming days.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: EUR/USD Stalls at Channel Resistance, AUD/USD Shifts Gears after Technical Rejection, Fed Minutes a ‘Non-Event’

Crude oil prices, as measured by WTI futures, extended losses on Wednesday, falling for the second consecutive session and erasing most of Monday’s vigorous rally, a brief upswing that came in the wake of last weekend’s events in the Middle East. To give some background, the militant group Hamas launched a deadly incursion into Israel from the Gaza Strip early Saturday, leading to the most substantial loss of civilian lives in the history of the Jewish nation.

As a response, Israeli Prime Minister Benjamin Netanyahu initiated a military offensive against Hamas, ordering extensive aerial attacks in Gaza and imposing a total siege on the coastal enclave to eradicate the operational centers and dismantle the strongholds of the extremist group. As of Wednesday, the number of dead had topped 1000 on each side of the war.

Although Israel is not a major crude producer, the ongoing conflict’s implications for oil could be substantial if major players are drawn into the crisis. For instance, should conclusive evidence emerge implicating Iran in the terrorist incidents in any way, the West could be forced to impose new economic sanctions on the Islamic Republic’s energy sector, a situation that could further tighten markets.

Eager to gain a better understanding of where the oil market is headed? Download our Q4 trading forecast for enlightening insights!

Recommended by Diego Colman

Get Your Free Oil Forecast

To stay ahead of future market trends, traders must maintain a vigilant watch over the evolving geopolitical situation in the Middle East. If tensions intensify and bring Israel and Iran into open confrontation, oil prices could rally violently, especially if the United States intervenes directly in the fray in support of its regional ally. The situation could get uglier if Tehran closes the vital Strait of Hormuz in response to perceived aggression. This would be very bullish for oil prices.

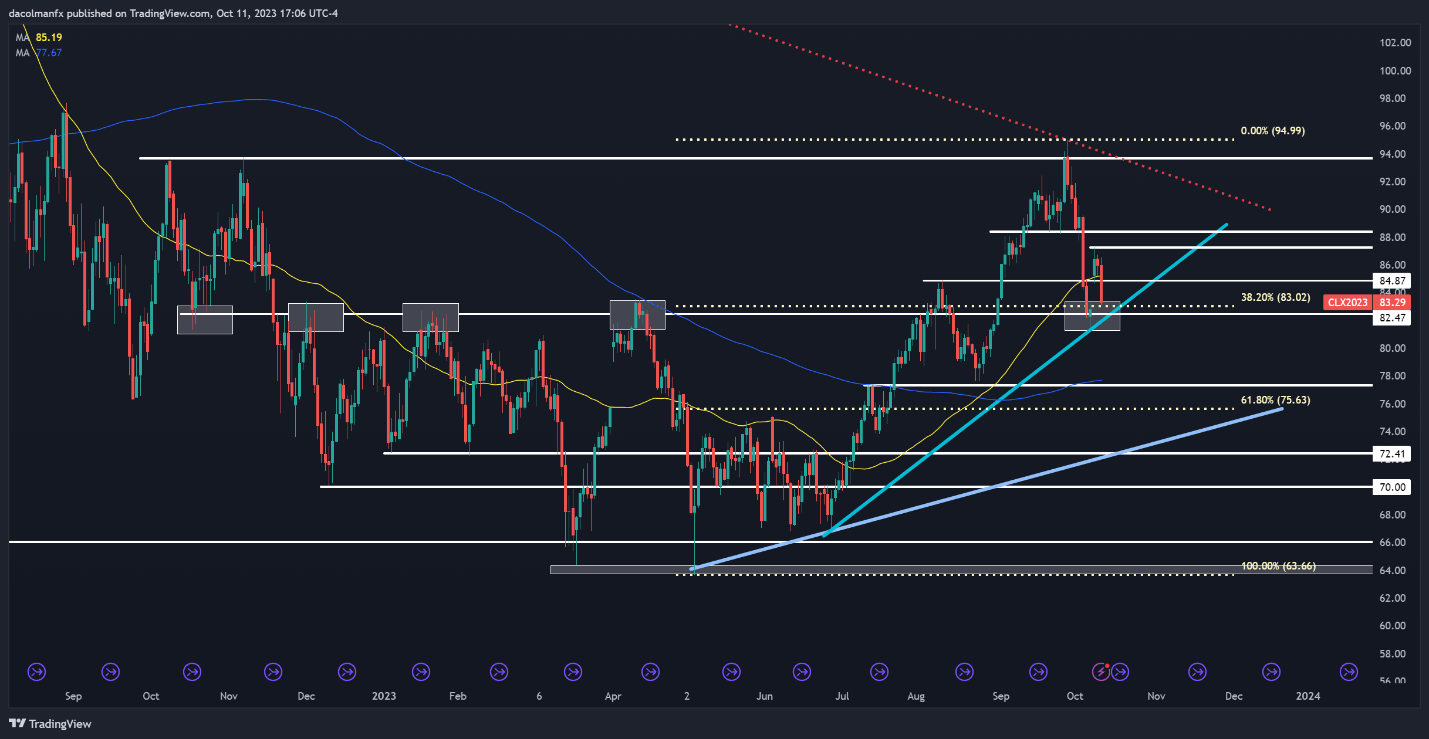

From a technical perspective, oil prices have fallen towards an important support near the $83.00 handle after Wednesday’s pullback – a key level that aligns with the 38.2% Fibonacci retracement of the 2023 rally. If the bears manage to breach this floor and push prices below trendline resistance at $82.00, we could see a drop toward $77.50.

On the other hand, if WTI manages to resume its rebound, initial resistance is situated at $85.00. While surmounting this obstacle may pose a challenge for buyers, a successful breakout has the potential to bolster the bullish momentum, opening the path for a move to $87.25, followed by $88.40. On further strength, a retest of the yearly high becomes more likely.

Start your voyage to becoming a knowledgeable oil trader today. Don’t let the occasion to acquire vital insights and strategies pass you by – obtain your ‘How to Trade Oil’ guide immediately!

Recommended by Diego Colman

How to Trade Oil

CRUDE OIL (WTI FUTURES) TECHNICAL CHART

Light Crude Oil Futures Chart Created Using TradingView

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0