Euro, EUR/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- Euro sets the stage for a potential win this week

- And, retail traders began turning more bearish

- What technical obstacles does EUR/USD face?

Recommended by Daniel Dubrovsky

Get Your Free EUR Forecast

While the week is still fresh, the Euro is seemingly on course for its first 5-day gain since July, potentially ending an 8-week losing streak. In response, retail traders have been becoming more bearish. This can be seen by taking a look at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, could EUR/USD aim higher from here?

EUR/USD Sentiment Outlook – Bullish

The IGCS gauge shows that about 63% of retail traders are net-long EUR/USD. Since most of them are still biased to the upside, this hints that prices may continue falling down the road. This is as downside exposure increased by 24.53% and 12.26% compared to yesterday and last week, respectively. With that in mind, recent changes in exposure warn that the current price trend may reverse higher.

| Change in | Longs | Shorts | OI |

| Daily | -3% | 23% | 5% |

| Weekly | -5% | 10% | 0% |

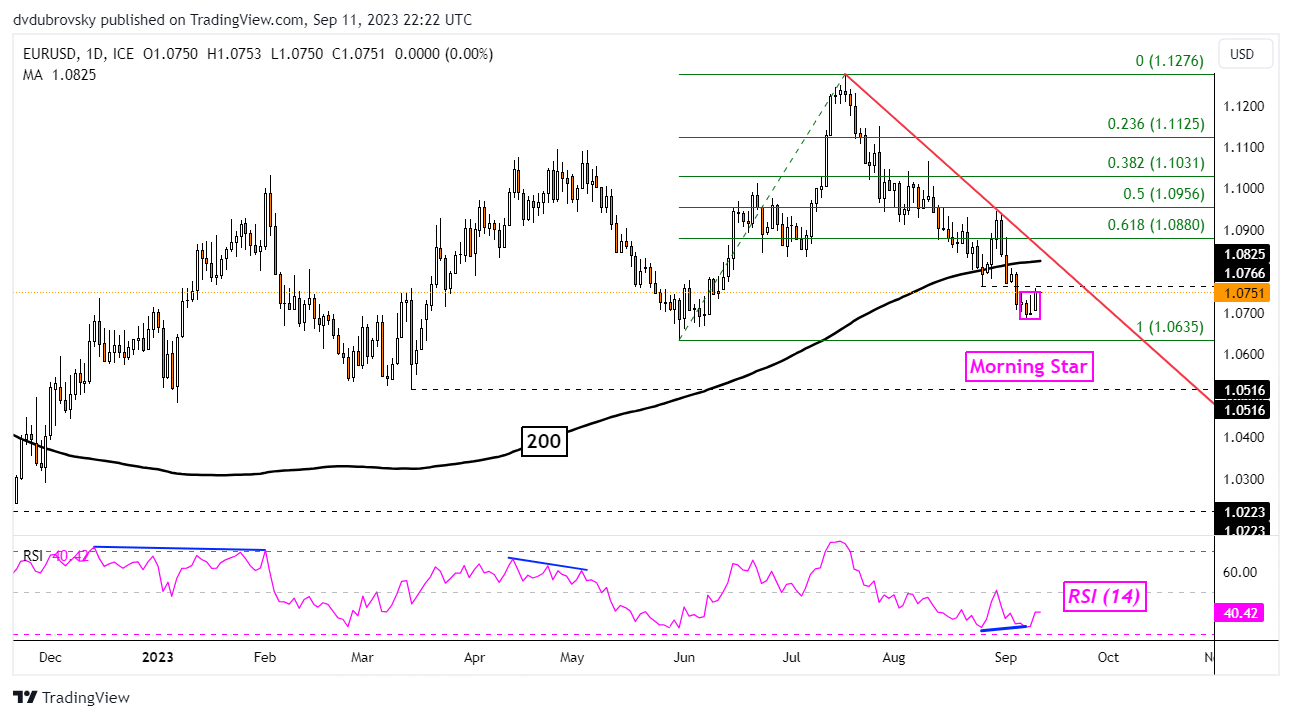

Euro Daily Chart

On the daily chart, EUR/USD has formed a bullish Morning Star candlestick pattern. This is after positive RSI divergence has been showing fading downside momentum, which can at times precede a turn higher. At this stage, confirmation of the candlestick pattern is lacking. Upside progress from here could open the door to extending upward.

Still, prices remain below the 200-day Moving Average and the falling trendline from July. These could prove to be formidable obstacles, maintaining the dominant downside bias. As such, while a near-term reversal is possible, the broader horizon remains bearish.

Recommended by Daniel Dubrovsky

How to Trade EUR/USD

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰