EUR/USD and EUR/JPY Forecast – Prices, Charts, and Analysis

- Euro Area q/q growth is nominal at best.

- EUR/USD eyes 1.0700 as the greenback remains better bid.

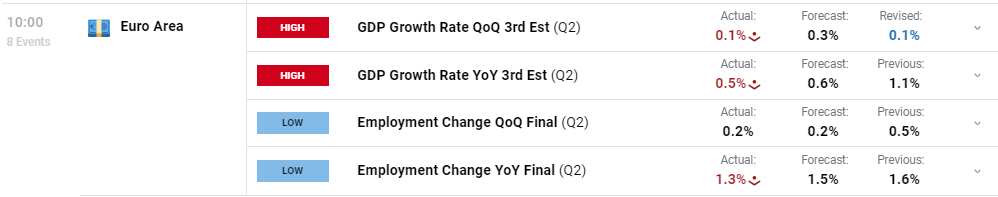

The final Q2 Euro Area GDP release shows that the block of 19 countries has barely expanded over the last quarters. Data from Eurostat, the statistics office of the European Union, showed Q2 growth of just 0.1%, down from a prior forecast of 0.3%, while Q1 GDP was revised up to 0.1% from 0.0%. The last three quarterly Euro Area GDP prints are -0.1%, +0.1% and +0.1%. While the Euro Area has stayed out of a technical recession, the near-complete lack of growth over the last nine months will heighten concerns within the ECB that their current monetary policy may be too restrictive.

DailyFX Calendar

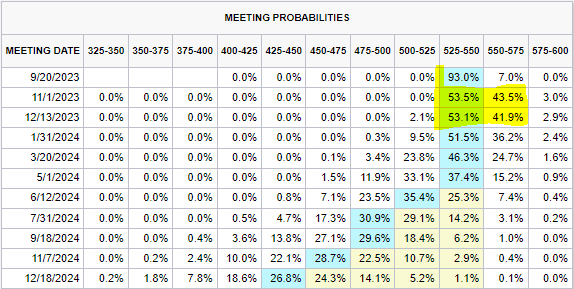

The US dollar index remains on the front foot, aided by robust US Treasury yields and Euro weakness. The latest CME Fed Fund probabilities now point to the June 2024 FOMC for the first official rate cut. Of note also is that the probabilities of a 25 basis point hike in either November or December this year have grown recently, helped by stronger-than-expected US economic data.

Later in today’s session, we have the weekly initial jobless claims data followed by speeches from four Federal Reserve members.

Recommended by Nick Cawley

Trading Forex News: The Strategy

The daily EUR/USD chart shows the pair breaking below the 200-day simple moving average with conviction last Friday, leaving EUR/USD under pressure from all three smas. The next levels of support can be seen at 1.0635 and 1.0615, levels that were last traded in late-May and mid-March respectively. Initial resistance is at 1.0787 before the 200-dsma at 1.0821. The CCI indicator shows the pair in oversold territory, so this may delay or slow any further sell-off.

EUR/USD Daily Price Chart – September 7, 2023

Chart via TradingView

Download the Latest EUR/USD Sentiment Guide for Free

| Change in | Longs | Shorts | OI |

| Daily | 2% | -6% | -1% |

| Weekly | 12% | -8% | 4% |

EUR/JPY remains a couple of points away from highs last seen back in 2008. The double-top made just under 160 in late August may come under pressure, but recent talk from Japanese officials that they may intervene if the Yen weakens too much further may make an attempt on this level more unlikely. While warnings by Japanese officials are nothing new, the Japanese Yen is closing in on levels where action is becoming increasingly likely. Any concerted action by the Bank of Japan or the Ministry of Finance could see EUR/JPY fall sharply with the 151.50 area as the likely first target.

Bank of Japan – Foreign Exchange Market Intervention

EUR/JPY Daily Price Chart – September 7, 2023

Recommended by Nick Cawley

Building Confidence in Trading

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0