Japanese Yen Analysis

- Japanese Yen backs away from supposed intervention trigger after renewed strength

- USD/JPY breaks beneath a dynamic level of prior support

- Japanese yen is most heavily shorted since at least 2020, posing risk of a short squeeze

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japanese Yen Backs Away from Supposed Intervention Trigger on Renewed Strength

The yen has struggled to maintain any sustainable period of strength even after the BoJ removed prior barriers to rising bond yields, which typically results in currency appreciation. Adding to the prior lack of impetus, the BoJ Governor Ueda failed to detail when the BoJ may pivot from its ultra-loose policy but has spoken at length about the prospect of withdrawing from negative interest rates should incoming inflation and wage growth data provide a compelling case for it.

It appears the weak dollar is helping mark lower USD/JPY levels but the yen is seen picking up strength across a number of major currency pairs. The net effect is softer USD/JPY as the pair has traded below the 50-day simple moving average (SMA) – which had acted as dynamic support until now. With lower energy prices and a firmer yen, talk about FX intervention is likely to subside.

USD/JPY finds support at 146.50, followed by 145.00 . The 50 SMA now forms a potential dynamic resistance if we are to see a pullback, but the bearish move has not breached oversold conditions on the RSI yet so there may still be more room to run before overheating.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

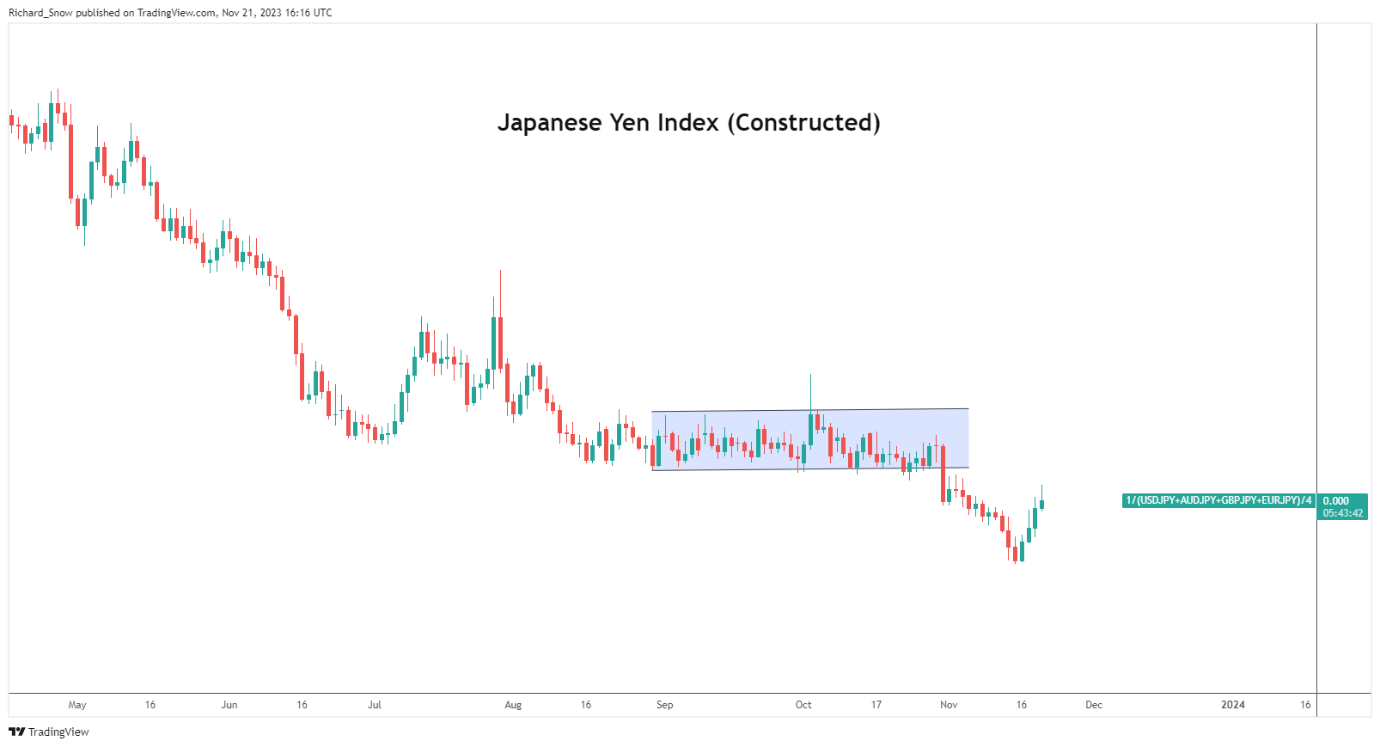

The Japanese Yen Index below is an equal weighted measure of USD/JPY, AUD/JPY, GBP/JPY and EUR/JPY. The index has shown a broad lift in the value of the yen since bottoming out and still has a long way to go to recover lost ground.

Japanese Yen Index

Source: TradingView, prepared by Richard Snow

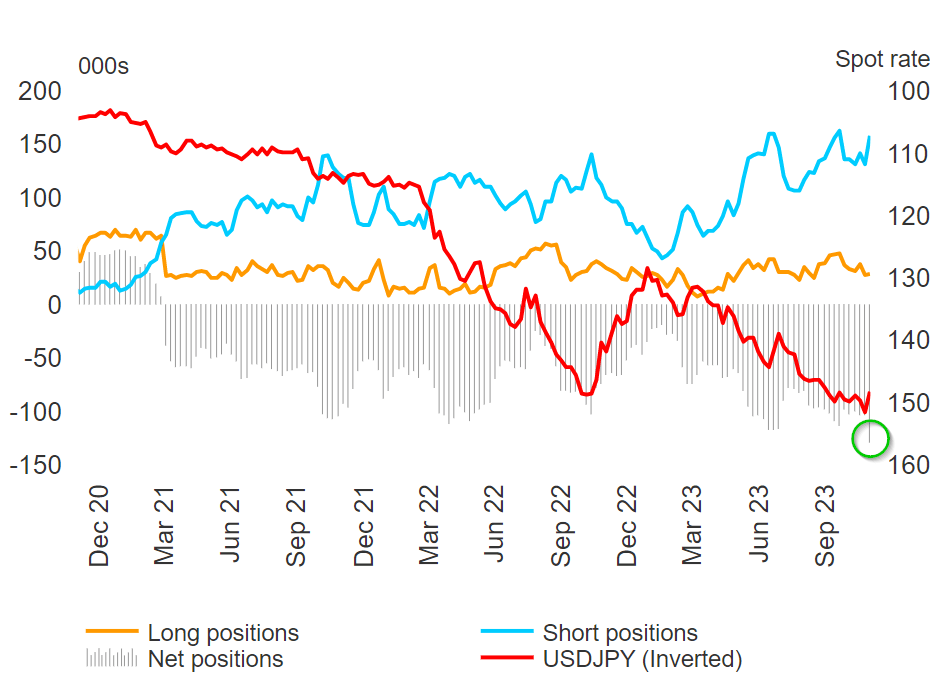

CoT Report Reveals the Yen is Heavily Shorted, Laying the Foundation for a Potential Short Squeeze

The most recent Commitment of Traders (CoT) report from the CFTC reveals that the yen is the most shorted it has been since at least late 2020 (elongated histogram circled in green). Further yen strength may force prior shorts to buy to cover which only adds to the bullish yen momentum.

Japanese Yen Longs and Shorts according to recent Commitment of Traders report

Source: Refinitiv, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by Richard Snow

Traits of Successful Traders

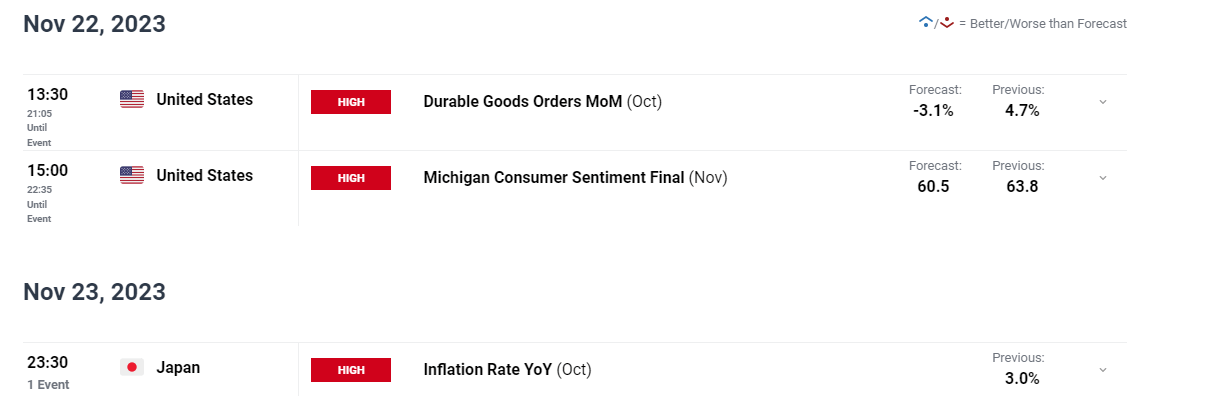

Major event risk includes tonight’s FOMC minutes and Thursday’s Japanese inflation data. A hotter print is likely to boost the yen even further if price pressures trend higher.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0