Gold, Retail Trader Positioning, Technical Analysis – IGCS Update

- Gold prices continue aiming lower in recent weeks

- Retail traders are becoming increasingly bullish

- This continues to offer a bearish contrarian signal

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

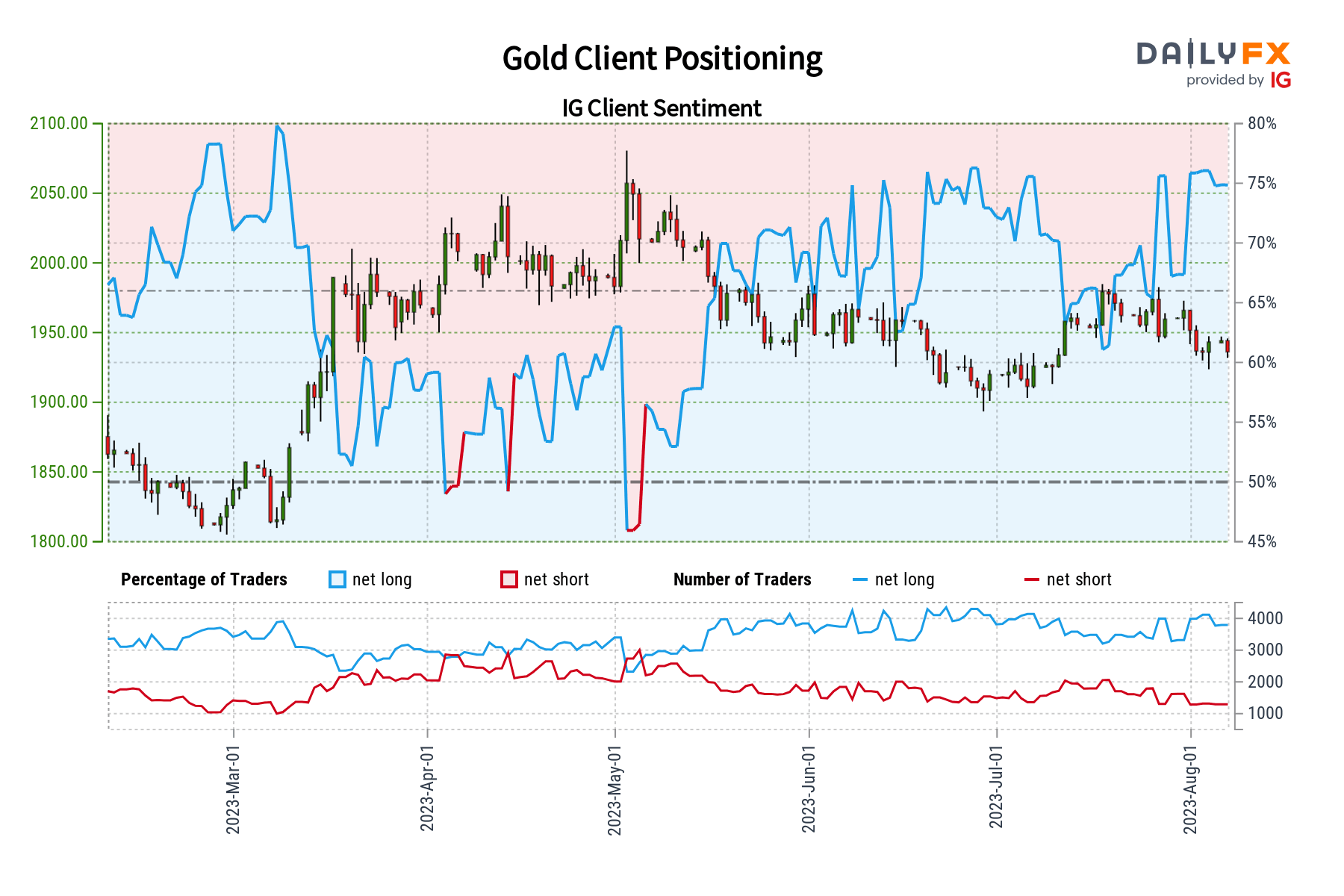

Gold prices have been continuing to aim cautiously lower in recent weeks. In response, retail traders have been slowly boosting their upside exposure. This can be seen by taking a look at IG Client Sentiment (IGCS). The latter often functions as a contrarian indicator. With that in mind, if retail traders continue to become increasingly bullish, will this bode ill for the yellow metal?

Gold Sentiment Outlook – Bearish

The IGCS gauge shows that about 76% of retail traders are net-long gold. Since the vast majority are biased to the upside, this continues to suggest that prices may keep falling down the road. This is as upside exposure increased by 8.75% and 27.83% compared to yesterday and last week, respectively. With that in mind, the combination of overall positioning and recent changes offers a stronger bearish contrarian trading bias for XAU/USD.

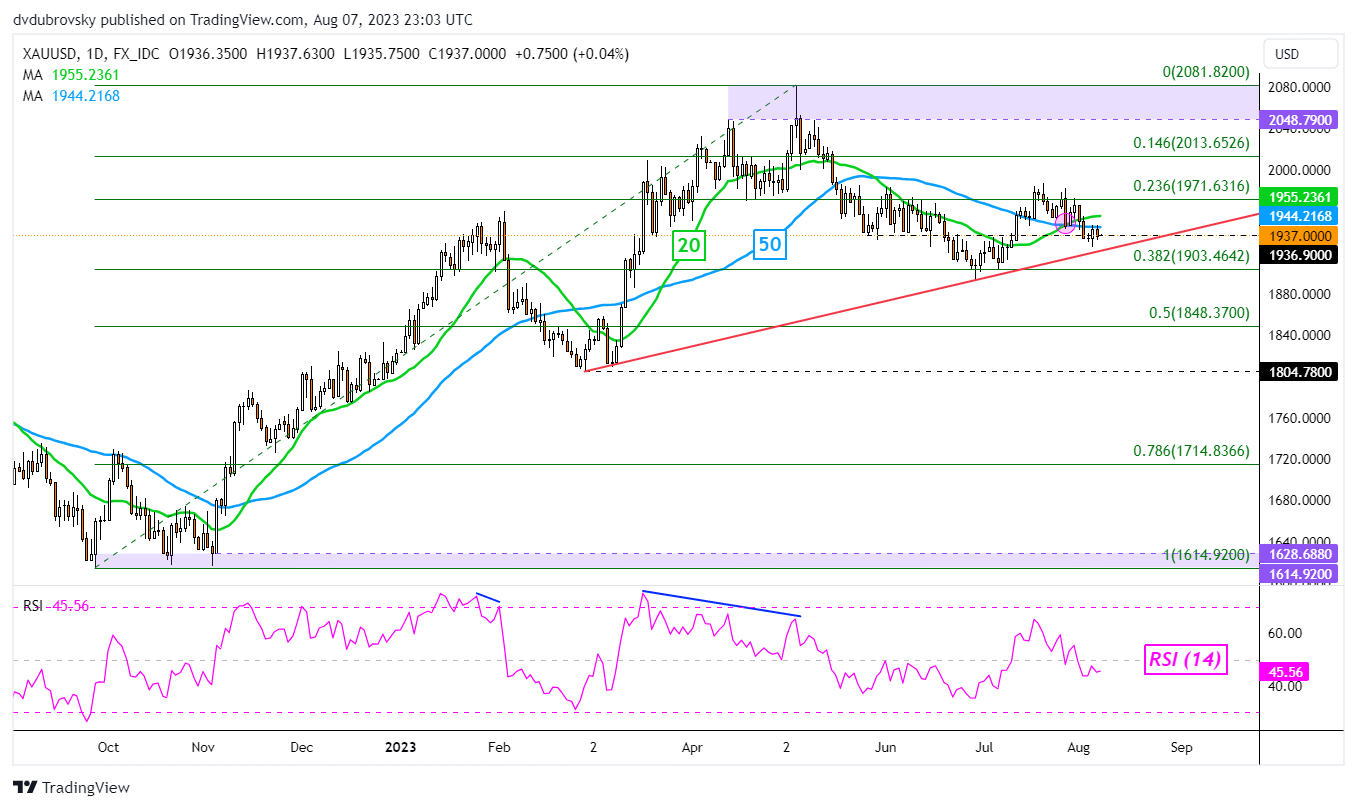

XAU/USD Daily Chart

On the daily chart, a bullish Golden Cross formed between the 20- and 50-day Moving Averages (MA) in late July. Since then, however, upside progress has been lacking and this has been undermining the crossover. From here, immediate support appears to be the rising trendline from February as well as the 1936 inflection point.

Clearing lower would increasingly offer a bearish technical bias that would converge with the IGCS signal. Otherwise, the trendline is maintaining the broader bullish bias. Further downside progress exposes the 38.2% Fibonacci retracement level of 1903. The latter is also closely aligned with lows from June. Confirming a breakout under here may open a revisit of the March low.

Otherwise, a turn higher from here places the focus on the 23.6% Fibonacci retracement level of 1971.63. Clearing higher offers an increasingly bullish technical view, opening the door to a revisit of highs from earlier this year.

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0