What You Need to Know

Forex traders must keep up with endless news that affects currency markets. The forex market operates 24/5. This means staying informed is key. Economic data releases can cause big price swings, over 100 pips in minutes. Many traders find it hard to understand and use this news well. This can lead to missing chances or

Forex traders must keep up with endless news that affects currency markets. The forex market operates 24/5. This means staying informed is key. Economic data releases can cause big price swings, over 100 pips in minutes.

Many traders find it hard to understand and use this news well. This can lead to missing chances or making big mistakes. But, knowing about forex news events can help you succeed in trading.

Key Takeaways

- Forex markets operate 24 hours a day, 5 days a week

- Economic data releases can cause significant market volatility

- Major news events can lead to price movements of 100+ pips

- Government speeches can impact currency values by 50-100 pips

- Understanding news events is key for good forex trading

- Spreads can widen by up to 50% during major news releases

- Over 60% of traders wait 15+ minutes after news releases to trade

Introduction to Forex News Trading

Forex news trading is key in the currency market. It helps traders catch big price changes from global events. The market is open 24/5, giving traders many chances to make money from the news.

What Makes News Trading Important

News trading lets traders use market ups and downs. For example, the Non-Farm Payroll report can change USD pair prices a lot. This shows how news can lead to good trading chances.

The 24/5 Nature of Forex Markets

The forex market is open all day, every day. It starts on Sunday at 5 p.m. ET and ends on Friday at 4 p.m. ET. This means traders can act fast on news from around the world.

Impact of Global Economic Data

Global economic data has a big effect on forex trading. Things like inflation, unemployment, and GDP change how strong currencies are. For instance, if inflation is higher than expected, it might mean higher interest rates. This can make a currency stronger.

Events like the Brexit referendum show how big news can change currency values. Global news can greatly affect the market.

| Economic Indicator | Potential Impact |

|---|---|

| Inflation | Currency strengthening if above forecast |

| Unemployment | Currency weakening if above expectations |

| GDP | Currency appreciation if higher than predicted |

Major Currency Pairs and Their Significance

The forex market centers on major currency pairs. These pairs are key in global trade. They are made of the world’s most traded currencies.

Eight Major Global Currencies

The forex market has eight major global currencies. These include the U.S. Dollar (USD), Euro (EUR), British Pound (GBP), and Japanese Yen (JPY). Also, the Swiss Franc (CHF), Canadian Dollar (CAD), Australian Dollar (AUD), and New Zealand Dollar (NZD).

Most Traded Currency Pairs

The four major currency pairs lead in forex trading. EUR/USD is the top, making up over 20% of all trades. USD/JPY is the second most traded pair.

GBP/USD and USD/CHF are also important but have smaller shares. Interestingly, commodity pairs like USD/CAD, AUD/USD, and NZD/USD can trade more than USD/CHF.

Understanding Currency Correlations

Currency correlations show how pairs move together. This helps traders make smart choices. For example, the U.S. dollar is in over 80% of all forex trades.

This affects many currency relationships. Major pairs have high liquidity. This means tighter spreads and less risk of slippage.

| Currency Pair | Market Share | Characteristics |

|---|---|---|

| EUR/USD | Over 20% | Highest liquidity, tightest spreads |

| USD/JPY | Second highest | High liquidity, popular for carry trades |

| GBP/USD | Lower than top two | Significant liquidity, sensitive to UK economic data |

| USD/CHF | Lower than top three | Known as a safe-haven currency |

Understanding Forex News Events

Forex news events are key in shaping currency markets. They include types of forex news like economic indicators, geopolitical news, and central bank statements. Knowing their impact is vital for traders in the complex foreign exchange world.

Economic indicators are major market movers. They include GDP reports, inflation data, and job numbers. For example, the non-farm payrolls report can make markets very volatile, with an 80% spike in activity.

Such economic indicators can cause big price swings. They can move prices by 50 to 100 pips in big currency pairs like EUR/USD.

Geopolitical events also have a big impact. About 40% of traders consider news on trade deals or conflicts when looking at currency effects. Central bank decisions, like interest rate changes, can quickly change currency values.

The U.S. dollar is very sensitive to news, being in 88% of all currency trades. About 60% of traders say U.S. economic news greatly affects their trading. This shows how important it is to keep up with global economic news and its effects on currency markets.

Key Economic Indicators That Move Markets

Economic indicators are very important in the forex market. They show how well a country’s economy is doing. This affects how much money different currencies are worth and what traders decide to do.

Interest Rate Decisions

When central banks change interest rates, it can change how much a currency is worth. Higher rates make a currency more attractive to investors. This can make the currency go up in value.

The Federal Reserve’s decisions are a big deal. They can cause big changes in the market.

Inflation Reports

Reports on inflation, like the Consumer Price Index (CPI), are very important. Most countries want their inflation to be between 1-3%. If it’s not, they might change their money policies. This can affect how much money a currency is worth.

Employment Data

Jobs reports, like the Non-Farm Payroll (NFP) in the US, are very important. They come out every month. They show things like unemployment rates and how much people are earning on average.

When jobs are strong, it can make a currency go up in value.

GDP Reports

Gross Domestic Product (GDP) reports are very important too. They come out every quarter. If a country has two-quarters of negative GDP, it might be in a recession. This can make a currency weaker.

| Indicator | Frequency | Impact |

|---|---|---|

| Interest Rates | 8 times/year | High |

| Inflation (CPI) | Monthly | High |

| NFP | Monthly | High |

| GDP | Quarterly | High |

Knowing about these economic indicators is key for forex traders. They help traders understand market trends and how currencies might move. This helps traders make smart choices in the fast-paced forex market.

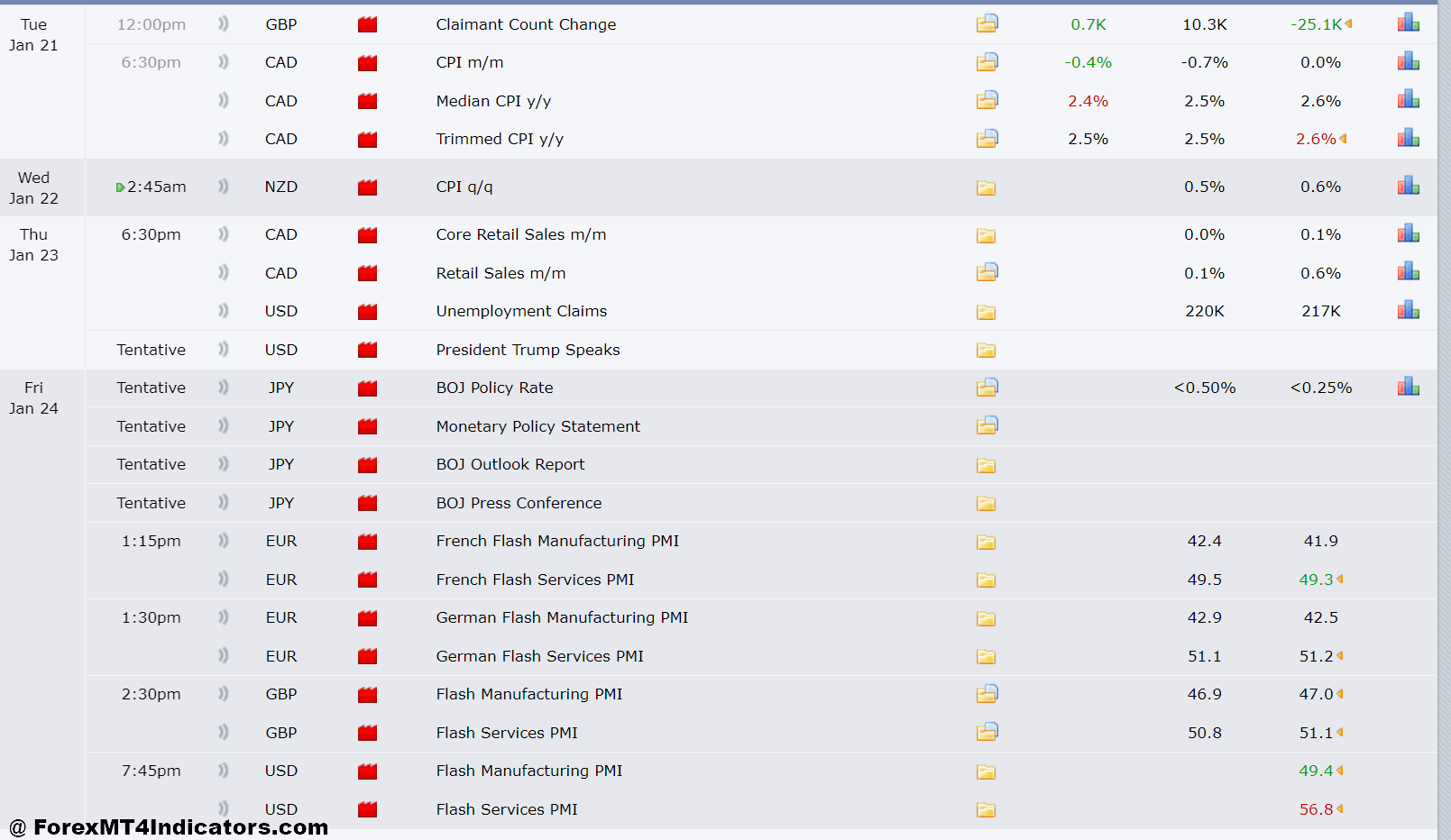

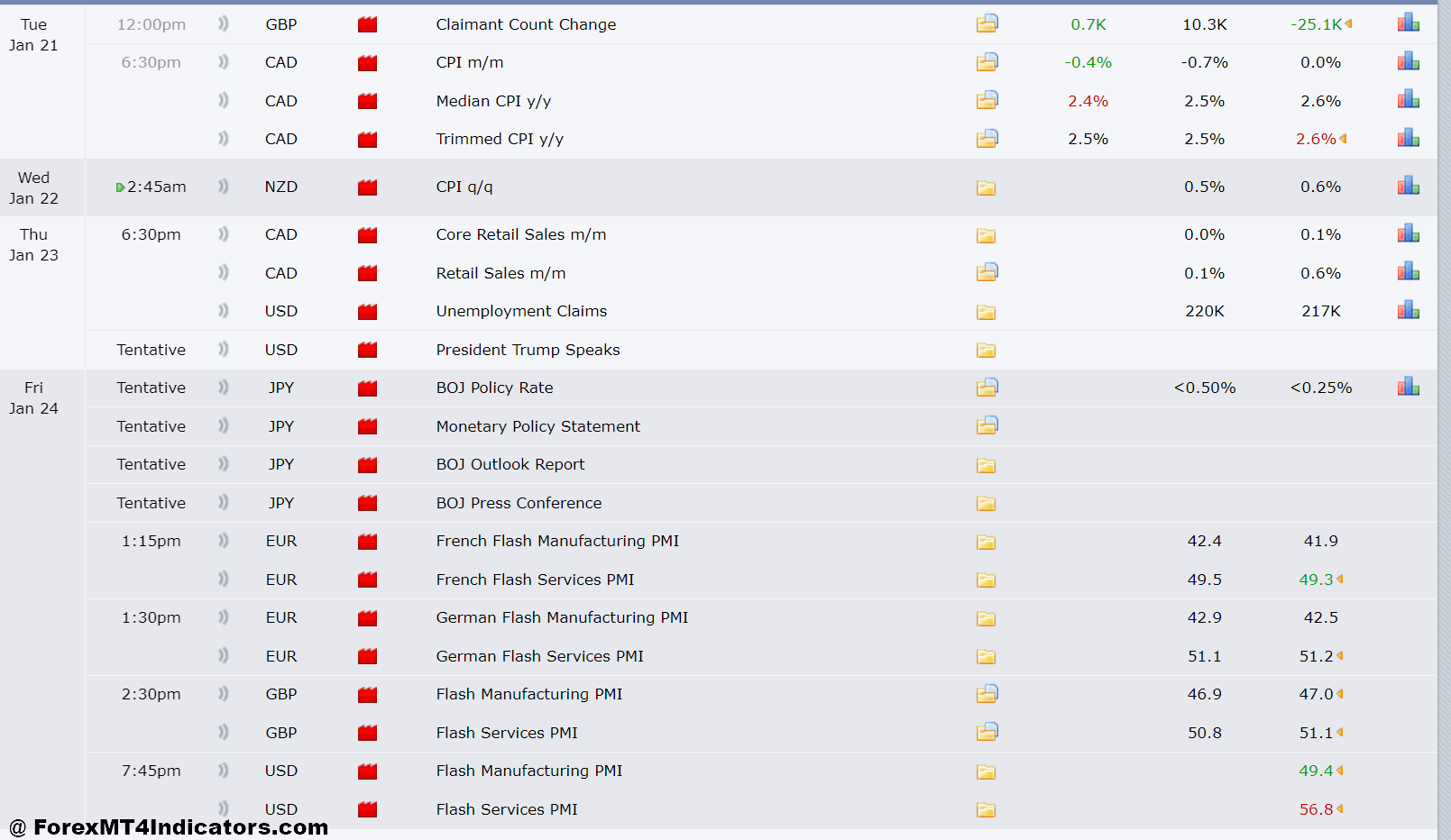

Global Market Hours and News Release Schedules

The forex market is open 24/7, five days a week. It spans four major trading centers. This lets traders respond to global events anytime. Knowing the market hours and economic calendar is key to trading success.

Major Economic Calendar Times

Big economic news can change currency values a lot. This includes interest rates, CPI data, GDP reports, and unemployment rates. The U.S. dollar, used in 88% of forex trades, is very sensitive to this news.

Regional Market Hours

The forex week starts at 5 PM EST on Sunday and ends at 5 PM EST on Friday. Each region has its hours:

- New York: 8 AM to 5 PM EST

- London: 3 AM to noon EST

- Tokyo: 7 PM to 4 AM EST

- Sydney: 5 PM to 2 AM EST

High-Impact News Timing

The U.S./London overlap (8 AM to noon EST) is the busiest time. It makes up nearly 58% of all trades. This is when big news comes out, causing big price changes.

| Session | EST Time | Notable Characteristics |

|---|---|---|

| Sydney-Tokyo Overlap | 7 PM – 2 AM | Opportunities for AUD, NZD, JPY pairs |

| London-Tokyo Overlap | 3 AM – 4 AM | Lower volatility, fewer participants |

| London-New York Overlap | 8 AM – 12 PM | Most active period, significant price movements |

Traders should watch these overlap times closely. They should also use an economic calendar for news. This helps plan trades and manage risks in the fast-moving forex market.

Market Impact Duration of News Events

News events can shake up the forex market. Their effects can last from minutes to days. It’s key for traders to know about news event duration and market reaction time.

Studies show that market reactions to news can last hours or days. The first impact usually happens in the first two days. But, effects can last up to four days later. This shows why traders need to stay alert long after the news comes out.

- GDP reports often cause immediate spikes but can influence trends for weeks

- Interest rate decisions may lead to quick currency shifts and long-term sentiment changes

- Unexpected political events can spark prolonged periods of volatility

Experienced traders often use a strategy called “fading” news events. They bet against extreme price movements after the initial shock. This requires a good understanding of news event duration and market reactions.

While some news impacts fade fast, others can change market dynamics for a long time. Being informed and adaptable is key for successful forex trading in this fast-paced world.

Trading Strategies for News Releases

News trading strategies are exciting in forex markets. Traders who learn these methods can make money from market swings during big economic news. Let’s look at some good ways to trade news.

Breakout Trading Approaches

Breakout trading is a favorite for news events. Traders wait for prices to settle before big news. Then, they try to make money from the big move. This breakout trading can bring quick wins if done right.

Consolidation Pattern Recognition

Spotting consolidation patterns is key for trading news. These patterns show up when markets wait for big data. Traders who see these can get ready for big moves when news comes out.

Risk Management During News Events

Managing risk well is important when trading news. Here are some tips:

- Use wider stop losses to handle more volatility

- Take smaller positions to risk less

- Set achievable profit goals based on the market

| Economic Indicator | Expected Impact | Actual Result | Market Reaction |

|---|---|---|---|

| U.S. Unemployment Rate | 9.0% | 8.0% | Dollar rally |

| U.S. Unemployment Rate | 9.0% | 10.0% | Dollar drop |

By knowing these news trading strategies and managing risk well, traders can handle the ups and downs of forex news better.

Common Pitfalls in News Trading

News trading in forex has its challenges. Knowing these obstacles helps traders deal with the ups and downs of currency markets during big economic events.

Spread Widening Issues

When big news comes out, forex brokers often raise spreads. This makes trading more expensive. It can cut into profits or turn wins into losses. For instance, a spread might go from 1 pip to 10 pips or more, affecting trade results a lot.

Slippage Challenges

Slippage is a big risk in news trading. It happens when orders are filled at unexpected prices. In very volatile markets, slippage can be big. A trader might want to buy at a certain price but gets a fill far away, changing the trade’s risk and reward.

Volatility Risks

Forex volatility goes up during news events, causing fast and unpredictable price changes. These changes can trigger stop losses too early or lead to bigger losses than expected. To handle this, many traders only risk 1-2% of their account per trade.

- Wait for market volatility to stabilize before entering trades

- Use wider stop losses during news events

- Consider using a demo account to practice news trading strategies

- Stay informed about upcoming economic events and their possible impact

By knowing these common pitfalls and using good risk management, traders can handle the challenges of news trading in the forex market better.

Advanced News Trading Techniques

Forex traders looking to improve can explore advanced news trading techniques. These methods are more complex than basic analysis. They help understand how markets react to economic news.

News sentiment analysis is a key tool in advanced forex strategies. It measures market expectations and reactions to the news. This way, traders can guess market moves better.

Economic surprise indices give more insight. They compare actual data to market expectations. This shows how new info might change currency values. Traders use this to improve their strategies.

Seasoned traders use a tactic called straddling. They place orders on both sides of key levels. This way, they can profit from price changes in any direction.

Knowing market positioning is vital in news trading. Data like the Commitment of Traders report shows market imbalances. This helps traders predict how the news will affect currency pairs.

Using these advanced techniques, traders can create more detailed and profitable strategies. However, these methods need a lot of study and practice to be used well.

Using Trading Tools for News Events

Forex trading tools and news alert systems are key for success in news trading. They keep traders informed and help them make quick decisions in the fast forex market.

Economic Calendars

Economic calendars are important forex tools. They list upcoming economic releases, including forecasts and past data. This info helps traders predict market moves and plan their strategies.

News Alert Systems

News alert systems update traders on breaking news affecting currency pairs. They send alerts on key economic indicators, global events, and central bank actions. Quick alerts let traders act fast on market news.

Technical Analysis Tools

Technical analysis tools add to news trading strategies. They show support and resistance levels for setting trade points around the news. Chart patterns and indicators offer insights when used with fundamental analysis.

| Tool Type | Function | Example |

|---|---|---|

| Economic Calendar | Lists upcoming economic events | ForexFactory Calendar |

| News Alert System | Provides real-time news updates | Bloomberg Terminal |

| Technical Analysis Tool | Offers chart analysis features | TradingView |

Using these forex tools together helps traders make strong news trading plans. Economic calendars plan and news alerts provide timely info, and technical tools help execute. This mix improves decision-making and trading results.

Risk Management During News Releases

Forex risk management is very important during news releases. News events can cause sudden market changes. This makes keeping your trades safe a big priority. Let’s look at ways to protect your money during news-driven trades.

Position Sizing Strategies

Smart position sizing is key to managing risk. During news events, reduce your trade sizes. This helps protect you from big losses if the market goes against you.

A good rule is to risk no more than 1-2% of your account on any trade.

Stop Loss Placement

Setting stop losses during news events needs careful thought. Make sure your stops are wide enough to avoid early triggers. But not so wide that you risk big losses.

About 70% of traders think markets will price in news before announcements. So, be ready for unexpected moves.

Managing Leverage During News

High leverage can be risky during news events. Think about reducing your leverage or avoiding it when trading news. This careful approach helps keep your trades safe by limiting losses.

Stick to your trading plan and avoid making quick decisions based on market feelings.

By using these risk management strategies, you’ll be ready to handle news trading challenges. And you’ll keep your capital safe.

Conclusion

Forex news trading is a fast-paced way to get into the currency market. It’s shaped by economic signs, central bank moves, and world events. Knowing these factors is key for traders in the currency exchange world.

Big economic news, like Non-Farm Payrolls, can cause quick price changes. Traders face issues like price slippage and wider spreads during news-times. They can choose from different strategies, each with its risks and rewards.

Forex news trading can lead to big wins, but it’s also very risky. A huge 79% of retail investors lose money trading CFDs with some providers. Winners use strong risk management, and technical tools, and keep their emotions in check.

In short, forex news trading needs constant learning, being flexible, and knowing global economics. By staying updated and having a good plan, traders can make the most of market news. They can also reduce risks in this quick financial world.

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :

ناموجود- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰