Weekly Market Recap (10-14 July)

[ad_1] Monday: China CPI missed expectations coming at 0.0% vs. 0.2% expected for the Y/Y reading and -0.2% vs. 0.0% expected for the M/M figure. Moreover, the PPI Y/Y came at -5.0% vs. -4.6% expected. These figures signal that China is sliding into deflation, and we should see stronger easing measures being adopted soon. China

[ad_1]

Monday:

China CPI missed

expectations coming at 0.0% vs. 0.2% expected for the Y/Y reading and -0.2% vs.

0.0% expected for the M/M figure. Moreover, the PPI Y/Y came at -5.0% vs. -4.6%

expected. These figures signal that China is sliding into deflation, and we should

see stronger easing measures being adopted soon.

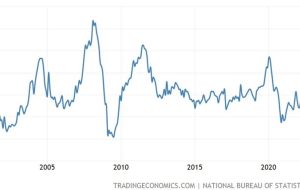

China CPI YoY

Fed’s Barr (hawk –

voter) said that inflation is far too high and that they are attentive to bring

inflation down to target. He acknowledged that they made a lot of progress on

inflation and that they are close (to the end of the hiking cycle) but they

still have a bit of work to do.

The NY Fed 1-year

ahead inflation expectations eased to 3.8% vs. 4.1% previously, which is the

lowest since April 2021. The bad news is that the 3-year ahead expected

inflation remained unchanged at 3% and the 5-year expected inflation jumped to

3% vs. 2.7% previously.

New York Federal Reserve

Fed’ Mester (hawk

– non voter) said that the Fed will need to tighten somewhat further to lower

inflation as its policy is less restrictive compared to history. She continued

saying that raising rates again will reduce the risk of more action in the

future. She acknowledged that the rate hikes have been moderating the economic

activity, but the economy proved stronger than expected. She also said that the

Fed is closed to the end of its tightening campaign. She added that the gains

in core inflation are too high and broad-based, and wages pressures remain too

high to get inflation back to 2% target. She concluded that there’s no decision

yet on the need for a July rate hike as more data is needed.

Fed’s Daly (hawk –

non voter) said that the US economic momentum continues to surprise and

therefore there’s more that they need to do with rate hikes. She added that

they are data dependent but sees the need for two more rate hikes this year to

lower high inflation amidst a robust labour market. She acknowledged that the

precise number of rate hikes may be adjusted based on the economic data and

more or fewer hikes may be needed. She concluded that the Fed should increase

rates more slowly than last year to evaluate the economy’s response but thinks

that the risk of underacting continues to outweigh the risk of overacting

despite these risks being more balanced now.

BoE’s Bailey

(hawk) said that UK inflation is unacceptably high, but it’s expected to

decrease significantly. He acknowledged that both price and wage increases at

current rate are inconsistent with the inflation target. He added that the MPC

is monitoring developments in the labour market, wage growth and services price

inflation.

Fed’s Bostic (dove

– non voter) said that inflation is too high and not sustainable and that a lot

of the strength is due to pandemic support. He added that the trajectory on

inflation right now is in the right direction and the Fed will ensure that it

continues. A recession is not his baseline outlook, but the biggest risk is not

moving inflation back to target. He continued with saying that the policy is

clearly in restrictive territory right now and the Fed can be patient as the

economy is starting to slow down with job growth slowing and inflation coming

down. He concluded that there is no expectation of needing to raise rates any

further from here and that even with a 25 bps move at the next meeting, it will

still require patience.

Tuesday:

The UK payrolls

missed expectations coming at 102K vs. 125K expected and 250K prior. The

unemployment rate has also increased to 4.0% vs. 3.8% expected and the 3.8%

prior. The worst part of the report for the BoE were the wages data that

surprised again to the upside. In fact, the average weekly earnings came at

6.9% vs. 6.8% expected and 6.5% prior (revised to 6.7%). The average weekly

earnings ex-bonus printed at 7.3% vs. 7.1% expected and 7.2% prior (revised to

7.3%). The market started to price in a higher chance of a 50 bps hike from the

BoE after the release.

UK Average Weekly Earnings ex Bonus

ECB’s Villeroy (hawk)

said that they are close to the peak in interest rates and once they hit the

peak, they will need to stay at that level for a while. He acknowledged that

they are starting to see good news on inflation, and it’s expected that it will

continue to decline and be back to 2% by 2025.

The US Redbook Y/Y

got some attention as the index fell -0.4% vs. 0.7% last week and this was the

first negative reading since the start of the pandemic.

US Redbook YoY

Wednesday:

The RBNZ left its

cash rate unchanged at 5.50% as widely expected. Below the key passages from

the statement:

- The

level of interest rates are constraining spending and inflation pressure as

anticipated and required. - The

Committee agreed that the OCR will need to remain at a restrictive level for

the foreseeable future, to ensure that consumer price inflation returns to the

1 to 3% annual target range, while supporting maximum sustainable employment. - Global

economic growth remains weak and inflation pressures are easing. - Global

inflation rates continue to decline, assisted by the normalisation of

international supply chains, and the decline in shipping costs and energy

prices. - The

weaker global growth has led to lower export prices for New Zealand’s goods. - In

New Zealand, inflation is expected to continue to decline from its peak, and

with it measures of inflation expectations. Core inflation is expected to

decline as capacity constraints ease. - While

employment is above its maximum sustainable level, there are signs of labour

market pressures dissipating and vacancies declining. - The

Committee is confident that with interest rates remaining at a restrictive

level for some time, consumer price inflation will return to within its target

range of 1 to 3% per annum, while supporting maximum sustainable employment.

Reserve Bank of New Zealand

RBA’s Governor

Lowe said that it’s possible there will be more rate hikes still to come to

return inflation back to target. He acknowledged that it remains to be

determined whether monetary policy has more work to do as the picture on

inflation is complex and there are significant uncertainties regarding outlook.

He added that he’s very conscious that monetary policy operates with lag and

the full effects are yet to be felt. He concluded that he’s “deadly serious”

about getting inflation back to target and that he’s confident that higher

interest rates are working.

The US CPI missed

expectations across the board with the Y/Y figure coming at 3.0% (2.97%

unrounded) vs. 3.1% expected and 4.0% prior. The M/M reading printed at 0.2%

vs. 0.3% expected and 0.1% prior. The even better news is that Core Inflation

figures have also missed expectations with the Y/Y rate coming at 4.8% vs. 5.0%

expected and 5.3% prior, and the M/M figure printing at 0.2% (0.158% unrounded)

vs. 0.3% expected and 0.4% prior.

US Core CPI MoM

Fed’s Barkin (hawk

– non voter) was the first one to speak after the CPI release and he didn’t

hint to any skip or pause at the July meeting, instead he said that inflation

remains too high and there’s still a question whether inflation can settle

while labour market remains as strong as it is. He concluded that he’s

comfortable doing more with policy if incoming data does not confirm that

inflation will return to target.

Fed’s Kashkari

(hawk – voter) said that if high inflation persists, they may need to raise rates

further. He added that the fight against inflation must succeed but

acknowledged that higher rates could increase pressure on banks and that’s why

bank supervisors should ensure that all banks are prepared to withstand higher

rate environment.

Given the

tightness in the labour market and the lack of hints to a possible skip or

pause from the Fed members, the market still expects the FOMC to hike by 25 bps

at the July meeting. Notably, the “Fed whisperer” Nick Timiraos has also

published an article after the CPI release stating that this report is unlikely

to change the Fed’s course on a 25 bps hike at the upcoming meeting. Nevertheless,

the chances of rate increases after the July meeting plunged.

CME FedWatch Tool

ECB’s Vujcic (hawk

– voter) said that the September ECB meeting is very open. He acknowledged that

China is a risk to GDP outlook and that slowing down the pace of rate hikes is

certainly a possibility. He concluded that even if they pause, they will still

say that they can resume hiking.

ECB’s Lane (dove –

voter) said that the typical length and monetary transmission mean that full

economic impact of the tightening over the last year will only play out over

the next couple of years.

The BoC raised

interest rates by 25 bps to 5.0% as expected. The key lines from the statement

below:

- Robust

demand and tight labour markets are causing persistent inflationary pressures

in services. - Canada’s

economy has been stronger than expected, with more momentum in demand. - While

the Bank expects consumer spending to slow in response to the cumulative

increase in interest rates, recent retail trade and other data suggest more

persistent excess demand in the economy. - The

housing market has seen some pickup. New construction and real estate listings

are lagging demand, which is adding pressure to prices. - In

the labour market, there are signs of more availability of workers, but

conditions remain tight, and wage growth has been around 4-5%. Strong

population growth from immigration is adding both demand and supply to the

economy: newcomers are helping to ease the shortage of workers while also

boosting consumer spending and adding to demand for housing. - As

higher interest rates continue to work their way through the economy, the Bank

expects economic growth to slow. - While

CPI inflation has come down largely as expected so far this year, the downward

momentum has come more from lower energy prices, and less from easing

underlying inflation. With the large price increases of last year out of the

annual data, there will be less near-term downward momentum in CPI inflation. - Moreover,

with three-month rates of core inflation running around 3½-4% since last

September, underlying price pressures appear to be more persistent than

anticipated. This is reinforced by the Bank’s business surveys, which find

businesses are still increasing their prices more frequently than normal. - Governing

Council remains concerned that progress towards the 2% target could stall,

jeopardizing the return to price stability. - Governing

Council will continue to assess the dynamics of core inflation and the outlook

for CPI inflation. In particular, we will be evaluating whether the evolution

of excess demand, inflation expectations, wage growth and corporate pricing

behaviour are consistent with achieving the 2% inflation target.

BoC’s Governor

Macklem said that they are concerned that if they are not careful, the progress

to price stability could stall and if they get some upward surprises, inflation

could even move back higher. He added that there was not a big benefit of

waiting to raise rates, but they did discuss the possibility of keeping rates

unchanged. The monetary policy is working but underlying inflationary pressures

are proving more stubborn while the labour market remains tight, even if there

are some signs of easing. He said that the Bank of Canada is prepared to raise

rates further as if they don’t do enough now, they will likely have to do even

more later.

Bank of Canada

Thursday:

The New Zealand

Manufacturing PMI for June came at 47.5 vs. 48.9 previously. For a weaker

reading one has to go back to August 2021 (39.0) when the Delta strain outbreak

of COVID-19 invoked level-4 lockdowns.

New Zealand Manufacturing PMI

The UK May monthly

GDP came at -0.1% vs. -0.3% expected and 0.2% prior.

ECB’s Visco (dove

– non voter) said that they are not very far from the peak in interest rates

and that he somewhat disagrees with the preference for further tightening.

The ECB released

the accounts of its June monetary policy meeting. Below the key lines:

· Members considered that there were both

upside and downside risks to the inflation outlook.

· It was argued that market participants would

be surprised by the upward revision of inflation.

· This could trigger a repricing of the forward

curve.

· Members broadly concurred that inflation was

still projected to remain too high for too long.

· It was argued that policymakers should not

put too much emphasis on the behaviour of core inflation, as its mandate

related to headline inflation.

· Maintaining a gradual tightening path would

allow the ECB to monitor and assess the impact of past monetary policy

decisions and ensure that financial conditions were adjusting in a way that was

consistent with inflation moving back to the 2% medium-term target.

· Members generally agreed that the

data-dependent approach to monetary policymaking.

·

Policymakers should stress that fiscal policy needed to be tightened in

order to dampen demand and support the disinflation process.

European Central Bank

The US PPI missed

expectations across the board with the Y/Y figure coming at 0.1% vs. 0.4%

expected and 1.1% prior, while the M/M reading printed at 0.1% vs. 0.2%

expected and -0.4% prior (revised from -0.3%). The Core PPI Y/Y figure came at

2.4% vs. 2.6% expected and 2.6% prior (revised from 2.8%), while the M/M

reading printed at 0.1% vs. 0.2% expected and 0.1% prior (revised from 0.2%).

US PPI YoY

The US Initial

Claims beat expectations coming at 237K vs. 250K expected and 249K prior. On

the other hand, Continuing Claims missed expectations coming at 1729K vs. 1723K

expected and 1718K prior.

US Initial Claims

Fed’s Daly (hawk –

non voter) said that the good news on inflation this week is indeed good news.

She acknowledged that saying that they needed 2 more rate hikes was a way to

keep optionality open but it’s too early to say that we can declare victory on inflation.

She continued saying that the lags in monetary policy are generally between 12

and 24 months and that there are still cumulative effects of monetary

tightening that will work its way through the system. She added that they are

going to continue to work on rate hikes until they are sure that inflation is

on the path to come back down toward the 2% target. She acknowledged that if

they wait for inflation to be 2% and have monetary lags, it’s better to head to

a less restrictive policy to adjust for the last. In fact, as inflation starts

coming down, they can start lowering the nominal rate to bring real rates down

to neutral levels. She concluded that they are not there yet and the skip at

the June meeting was because as they reach their destination, they want to slow

the pace of hikes.

Friday:

Fed’s Waller (hawk

– voter) said that he’s in favour of raising interest rates at the July FOMC

meeting as he’s increasingly confident that the banking stress won’t derail the

economy and that the cooler CPI data is welcome, but they need to see if it’s

sustained given that inflation has shown false dawns before. He added that although

the job market has slowed, it remains very strong and that coupled with the

economic strength gives the Fed space to hike further. He still thinks that the

Fed will likely need two more 25 bps hikes this year as the monetary policy

changes are moving through the economy more quickly and the bulk of past rates

hikes have already impacted the economy. He concluded that fighting inflation

remains the Fed’s main goal and that they will succeed.

The Japanese media

reported that the BoJ is likely to raise its FY2023 inflation forecast above

2%. They previously expected inflation falling down from September/October, but

now they are not confident on such a scenario anymore. This might be another

signal that a change in policy like a tweak to the YCC might be coming. Another

possible hint came from the former BoJ director Hayakawa as he said that he

expects the BoJ to tweak YCC at the July meeting (27-28th July)

widening the target band to -/+ 1.00% from the current -/+ 0.50%.

Bank of Japan

Fed’s Goolsbee

(dove – voter) said that there’s a way to curb inflation without a recession

and that weaker inflation data shows that the Fed is making progress.

The University of Michigan Consumer Sentiment for July jumped to 72.6 vs. 65.5 expected and 64.4 prior. The Current Conditions index printed at 77.5 vs. 70.4 expected and 69.0 prior, while the Expectations index came at 69.4 vs. 61.8 expected and 61.5 prior. The 1-year inflation expectations ticked higher to 3.4% vs. 3.3% prior and the 5-year inflation expectations printed at 3.1% vs. 3.0% prior.That’s a really strong release.

University of Michigan Consumer Sentiment

The highlights for

next week include:

- Tuesday: US Retail Sales, Canada CPI.

- Wednesday: NZ CPI, UK CPI.

- Thursday: PBoC LPR, Australia Jobs Report, US Jobless Claims.

- Friday: Japan CPI.

That’s all folks,

have a great weekend!

.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :July ، Market ، Recap ، Weekly ، Weekly Market Recap

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0