VWAP Bands and Forex Reversal Forex Trading Strategy

[ad_1] The fast changes in currency values can make it hard to know what to do. The VWAP indicator helps by mixing price and volume data. This gives you a solid guide for trading. By using VWAP bands in your trading plan, you can spot when things might change. This can make your trading choices

[ad_1]

The fast changes in currency values can make it hard to know what to do. The VWAP indicator helps by mixing price and volume data. This gives you a solid guide for trading.

By using VWAP bands in your trading plan, you can spot when things might change. This can make your trading choices better. Let’s see how this method can change your trading game.

Key Takeaways

- VWAP combines price and volume data for a complete market view.

- Trading above or below VWAP shows where the trend might go.

- VWAP bands show when prices are too high or too low.

- When VWAP and price cross over, it might mean a trend shift.

- There are many VWAP strategies, like using it for support or breakouts.

Understanding VWAP Indicator Fundamentals

The Volume Weighted Average Price (VWAP) indicator is key in forex trading. It mixes price and volume to give a full view of market moves.

What is Volume Weighted Average Price

VWAP is a benchmark for trading. It shows the average price of a security all day, based on volume and price. The formula is: VWAP = ∑(Price * Volume) / Total Volume Traded. This formula combines price and volume for a better market view.

Components of VWAP Calculation

The main parts of VWAP calculation are:

- Price data

- Volume data

- Period

VWAP is mostly used in intraday trading, where each day, it is reset. A “Session” timeframe for quick scalping is 1 to 5 minutes. For longer strategies, 5 to 15 minutes is used.

Importance of Volume in VWAP Analysis

Volume is very important in VWAP analysis. Unlike moving averages, VWAP looks at both price and volume. This makes it a better tool for understanding market behavior.

In a bullish trend, big volume after a price jump above VWAP can increase prices.

| Aspect | VWAP | Simple Moving Average |

|---|---|---|

| Data Used | Price and Volume | Price Only |

| Sensitivity to Large Trades | High | Low |

| Intraday Reset | Yes | No |

| Benchmark for Trade Execution | Yes | No |

VWAP Bands and Forex Reversal Forex Trading Strategy

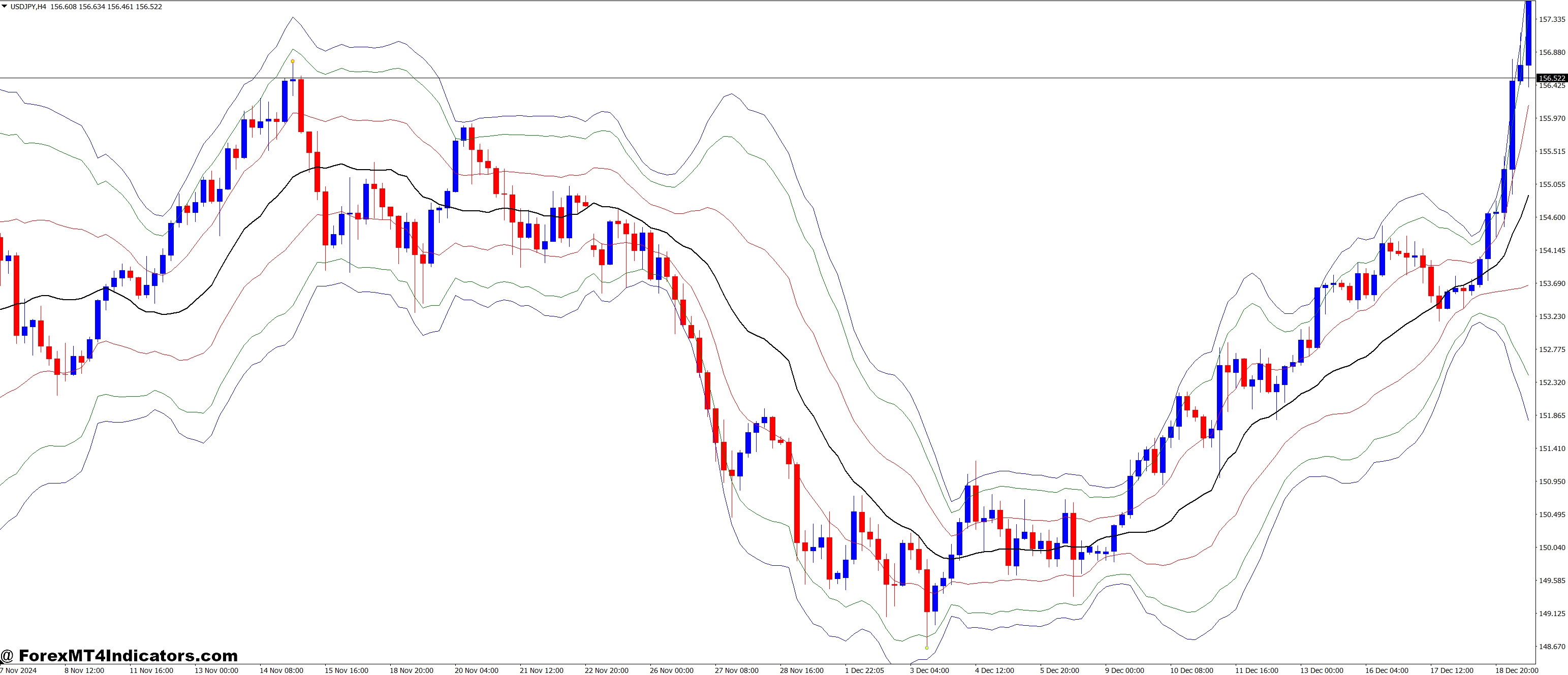

VWAP bands bring a new level to forex trading. They form a channel around the standard VWAP line. This helps traders spot market reversals more easily.

Using VWAP bands, traders can find overbought and oversold conditions with better accuracy. The forex reversal strategy is simple. When the price goes above the upper band, it might be overbought. Going below the lower band could mean it’s oversold.

VWAP bands also show market volatility. Wider bands mean more volatility, while narrower bands show a calmer market. This helps traders adjust their plans, making better decisions.

To use this strategy, watch price movements closely. Look for signs from other technical indicators too. Remember, no single tool makes trading easy. But VWAP bands can help your analysis and decisions.

Essential Technical Indicators for VWAP Trading

VWAP trading gets better with other technical indicators. This mix helps make trading decisions clearer. Let’s look at important indicators that go well with VWAP.

Bollinger Bands Integration

Bollinger Bands work well with VWAP. They make a price envelope around a moving average. If the price hits the upper band, it might be overbought. If it hits the lower band, it might be oversold.

Pivot Points Analysis

Pivot points are key levels for market reversals. They pair well with VWAP. If the price is above the pivot, it’s bullish. Below the pivot, it’s bearish.

Combining pivot points with VWAP can make trade timing better.

Trend Line Implementation

Trend lines are simple but powerful. They show market direction and possible reversals. Used with VWAP, they confirm price movements and highlight support and resistance levels.

This combo can lead to more accurate trading decisions.

| Indicator | Key Signal | VWAP Integration |

|---|---|---|

| Bollinger Bands | Price touching upper/lower bands | Confirms overbought/oversold conditions |

| Pivot Points | Price above/below pivot level | Validates trend direction |

| Trend Lines | Price respecting drawn lines | Strengthens support/resistance levels |

By mixing these technical indicators with VWAP, traders can build a strong strategy. This mix offers clearer entry and exit points, stronger trend confirmation, and better risk management.

Advanced VWAP Trading Techniques

VWAP trading strategies are great for forex traders. They help improve trading skills. Using VWAP crossovers and multiple timeframe analysis gives traders a better view of the market.

VWAP crossovers are important for spotting trend changes. When the price moves above or below the VWAP line, it means a shift in market mood. Traders use these signs to enter and exit trades at the right time.

Using multiple time frames with VWAP makes trading even better. It lets traders see when different time frames agree on a signal. For example, a signal on both the 1-hour and 4-hour charts is stronger than one on just one chart.

- Use VWAP as a dynamic support/resistance level

- Identify overbought/oversold conditions with VWAP bands

- Combine VWAP with other indicators for confirmation

Markets trend only 20-30% of the time. When they do, the price moves above VWAP in up markets and below in down markets. In sideways markets, the price bounces off the VWAP line. Knowing this helps traders adjust their plans to fit the market.

While VWAP strategies are very useful, they don’t promise 100% wins. Always manage your risks well. Also, keep improving your methods based on how they perform in the market.

Multiple Timeframe Analysis with VWAP

VWAP, or Volume Weighted Average Price, is a key tool for timeframe analysis in forex trading. It helps traders see market trends. This makes it easier to make smart choices.

Daily VWAP Applications

Daily VWAP is important for understanding the market’s direction. If the price goes above the daily VWAP, it might mean the market is going up. Going below means it’s going down. Traders use this to match their moves with the market’s mood.

Intraday VWAP Strategies

For day trading, charts that update every hour or 15 minutes are very useful. They help traders know the best times to buy or sell. A common trick is to watch when a fast VWAP line meets a slow one. This can show when prices might change, giving traders a chance to make quick profits.

Long-term VWAP Analysis

Even though VWAP is mainly for day trading, it can also help with long-term plans. Looking at VWAP on weekly or monthly charts can show big market trends. This helps traders plan for longer periods and spot good places to buy or sell.

Using VWAP with other tools like RSI or MACD can make trading better. It’s important to look at all timeframes together. This gives a full picture of the market’s movements.

VWAP Band Trading Methodology

VWAP bands are great tools for traders. They help spot market trends and find good times to buy or sell. These bands use the Volume Weighted Average Price and add special methods to make them work well.

Standard Deviation Bands

Standard deviation bands show how much prices move around the VWAP. They get wider when markets are moving fast and narrower when they’re not. This helps traders know when prices might be too high or too low.

Percentage-Based Bands

Percentage-based bands add or subtract a set percentage from the VWAP. This makes it easier to see how prices are moving. It helps traders find where prices might stop going up or down.

ATR-Adjusted Bands

ATR-adjusted bands change with market volatility. They use the Average True Range indicator to show price changes better. This is very helpful in the fast-changing forex market. These bands help traders set better stop-loss and take-profit levels.

Each way of making VWAP bands gives different views of the market. By mixing these with other tools, traders can make strong plans for the forex market. But, to do well with VWAP bands, you need to keep practicing and getting better at analyzing.

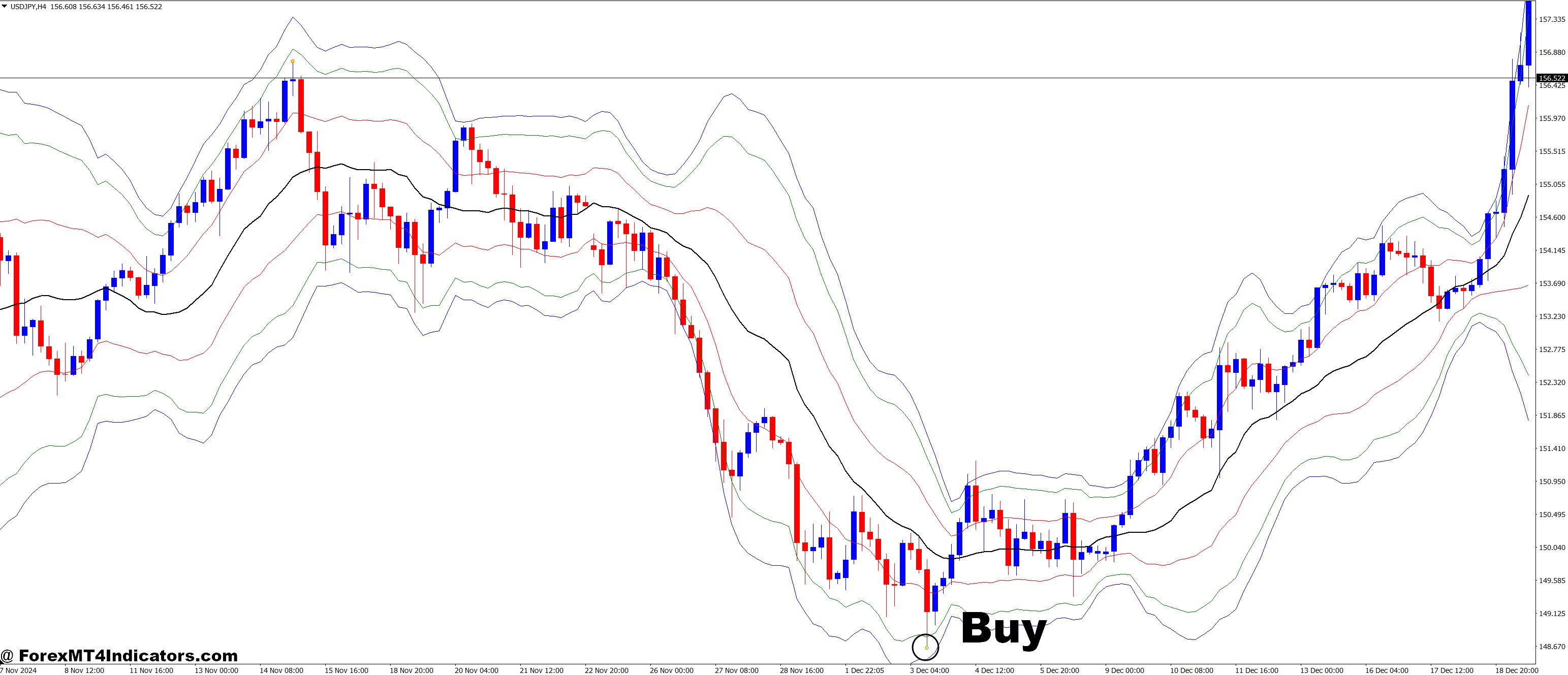

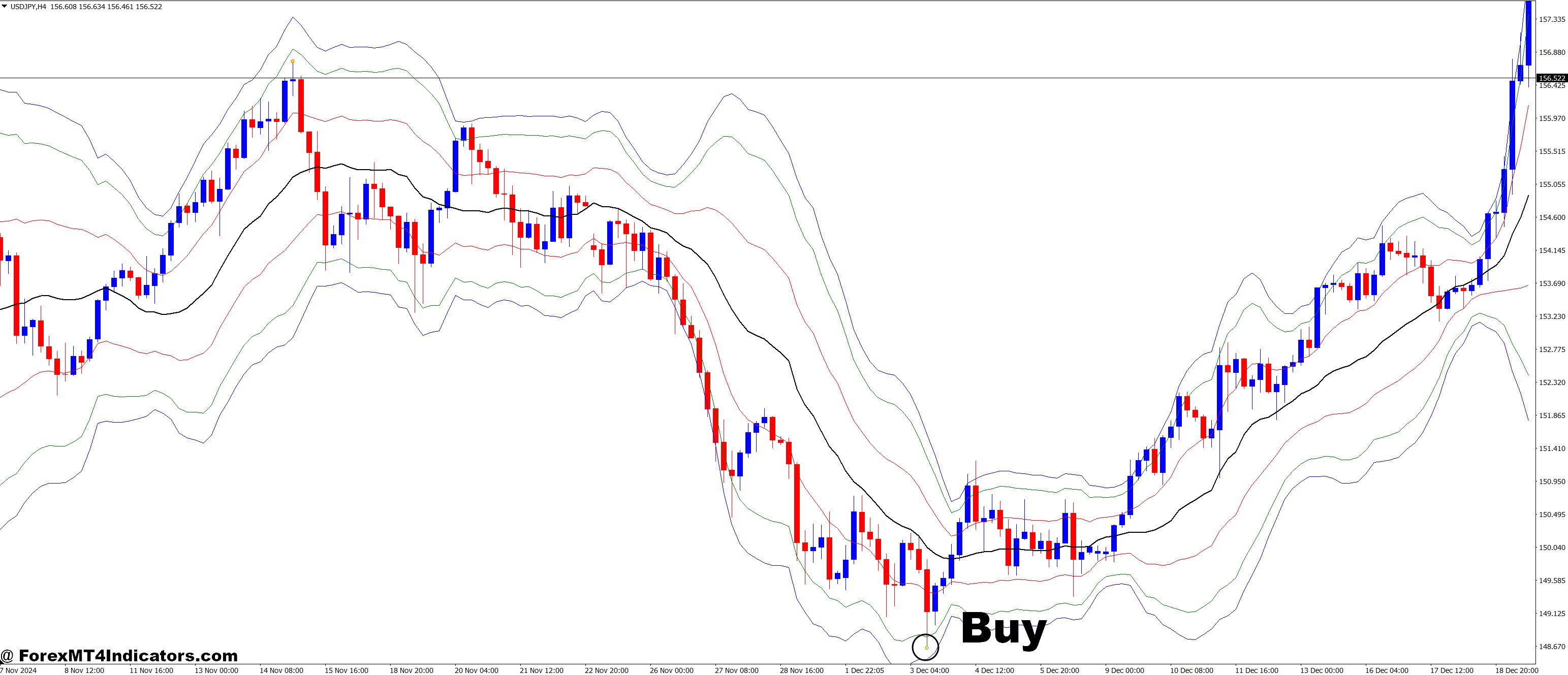

How to Trade with VWAP Bands and Forex Reversal Forex Trading Strategy

Buy Entry

- Wait for the price to approach or touch the lower VWAP band (indicating an oversold condition).

- Look for bullish reversal candlestick patterns near the lower VWAP band (e.g., Bullish Engulfing, Hammer, Pin Bar).

- Divergence: Confirm reversal with an RSI or MACD divergence (price makes lower lows, but RSI or MACD shows higher lows).

- Wait for the price to break above the VWAP line, confirming the shift in momentum.

- Buy when the price breaks above the VWAP line or when the bullish candlestick pattern forms near the lower VWAP band.

- Stop Loss: Place it just below the recent swing low or lower VWAP band.

- Take Profit: Set it near the upper VWAP band or a key resistance level.

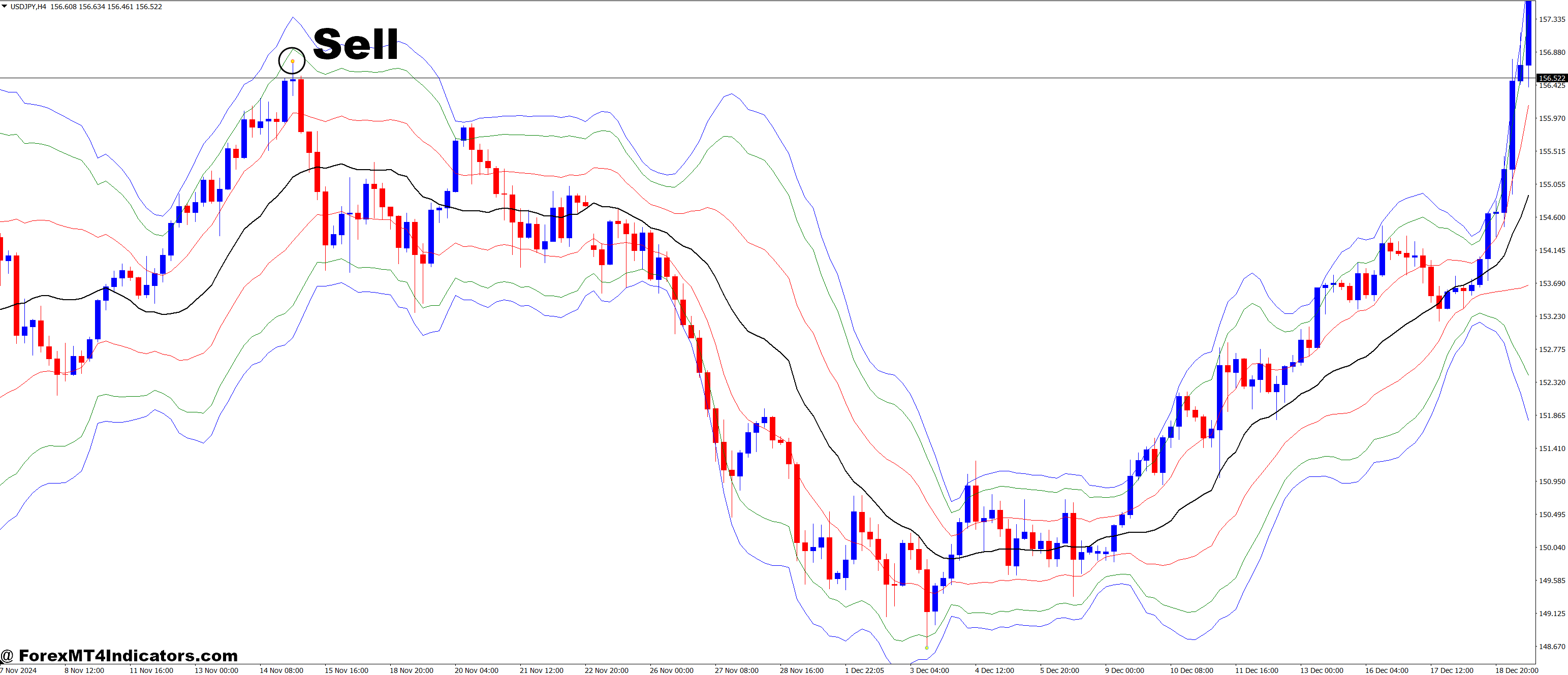

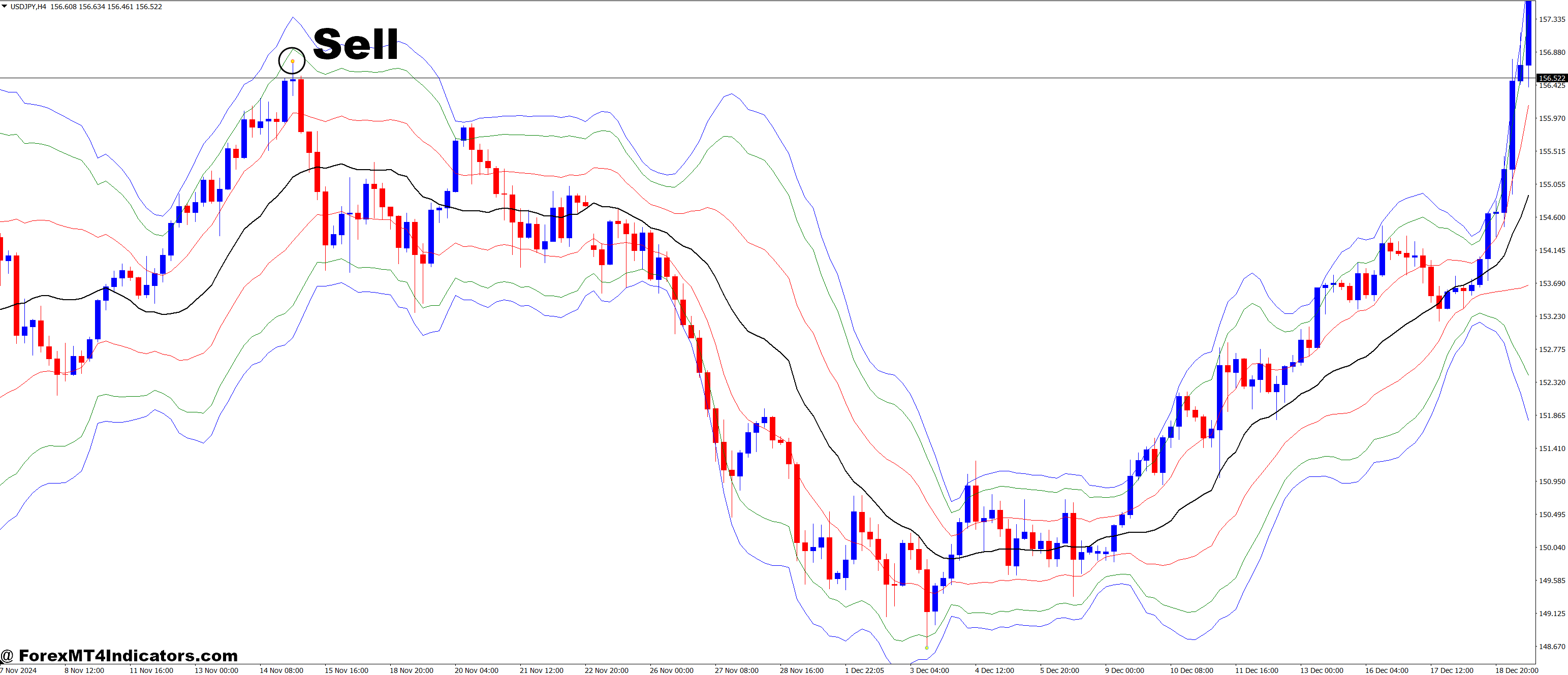

Sell Entry

- Wait for the price to approach or touch the upper VWAP band (indicating an overbought condition).

- Look for bearish reversal candlestick patterns near the upper VWAP band (e.g., Bearish Engulfing, Shooting Star, Doji).

- Divergence: Confirm reversal with an RSI or MACD divergence (price makes higher highs, but RSI or MACD shows lower highs).

- Wait for the price to break below the VWAP line, signaling a potential trend shift.

- Sell when the price breaks below the VWAP line or when the bearish candlestick pattern forms near the upper VWAP band.

- Stop Loss: Place it just above the recent swing high or upper VWAP band.

- Take Profit: Set it near the lower VWAP band or a key support level.

Risk Management and Position Sizing

Trading success depends on smart risk management and position sizing. These strategies protect your money and help you make more. Let’s look at key techniques for stop loss, take profit, and scaling positions.

Stop Loss Placement Techniques

Effective stop-loss placement is key for managing risk. A good method is using VWAP as a guide. For long positions, set your stop loss below VWAP. For short positions, set it above.

This helps limit losses and lets prices move naturally.

Take Profit Strategies

Setting realistic take profit levels is vital for steady gains. Use VWAP bands as targets. For long positions, take profits when the price hits the upper band. For short positions, aim for the lower band.

This method matches your exits with market trends.

Position Scaling Methods

Position scaling lets you adjust trade size based on market conditions. Increase your position size when prices favor you. Decrease it when prices go against you.

This strategy can help you make more while keeping losses small.

| Strategy | CAGR (5 days) | MDD (5 days) |

|---|---|---|

| Strategy 1 | 8.18% | -27.93% |

| Strategy 2 | 1.42% | -62.58% |

| Strategy 3 | 0.30% | N/A |

| Strategy 4 | 0.22% | N/A |

Successful trading balances risk and reward. By using these stop loss, take profit, and scaling methods, you’ll be ready for the forex market’s ups and downs.

Conclusion

The VWAP Bands and Forex Reversal Trading Strategy is a powerful tool for forex traders. It uses the VWAP indicator to understand fair value and trend direction. This strategy combines VWAP with other indicators for a complete trading approach.

VWAP trading benefits include showing market sentiment and reacting to key price levels. Day traders use VWAP as a dynamic support and resistance line. Swing traders anchor VWAP to big events to catch large market movements.

Optimizing forex strategies is essential for success. Using VWAP with Moving Averages, Bollinger Bands, and the Relative Strength Index gives deeper insights. These combinations help traders confirm price levels, and spot trend reversals, and find overbought or oversold conditions.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 1