Using Fibonacci Retracement in Forex Trading Strategies

[ad_1] Forex traders often find it hard to know when to buy or sell. This can lead to missed chances and big losses. Fibonacci retracement helps by showing where prices might bounce back or stop. By using Fibonacci retracement in your trading, you can make better choices. This could lead to better results in your

[ad_1]

Forex traders often find it hard to know when to buy or sell. This can lead to missed chances and big losses. Fibonacci retracement helps by showing where prices might bounce back or stop.

By using Fibonacci retracement in your trading, you can make better choices. This could lead to better results in your trading.

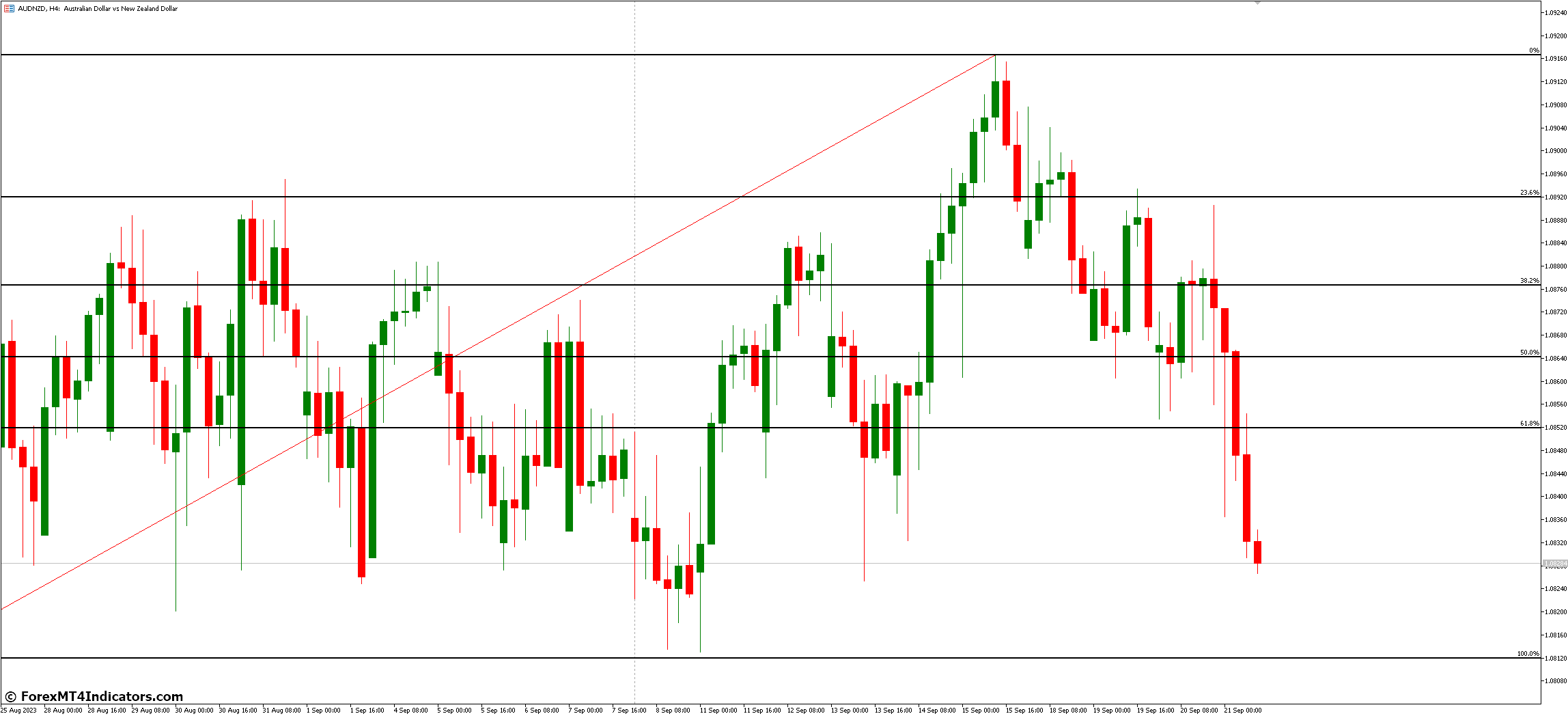

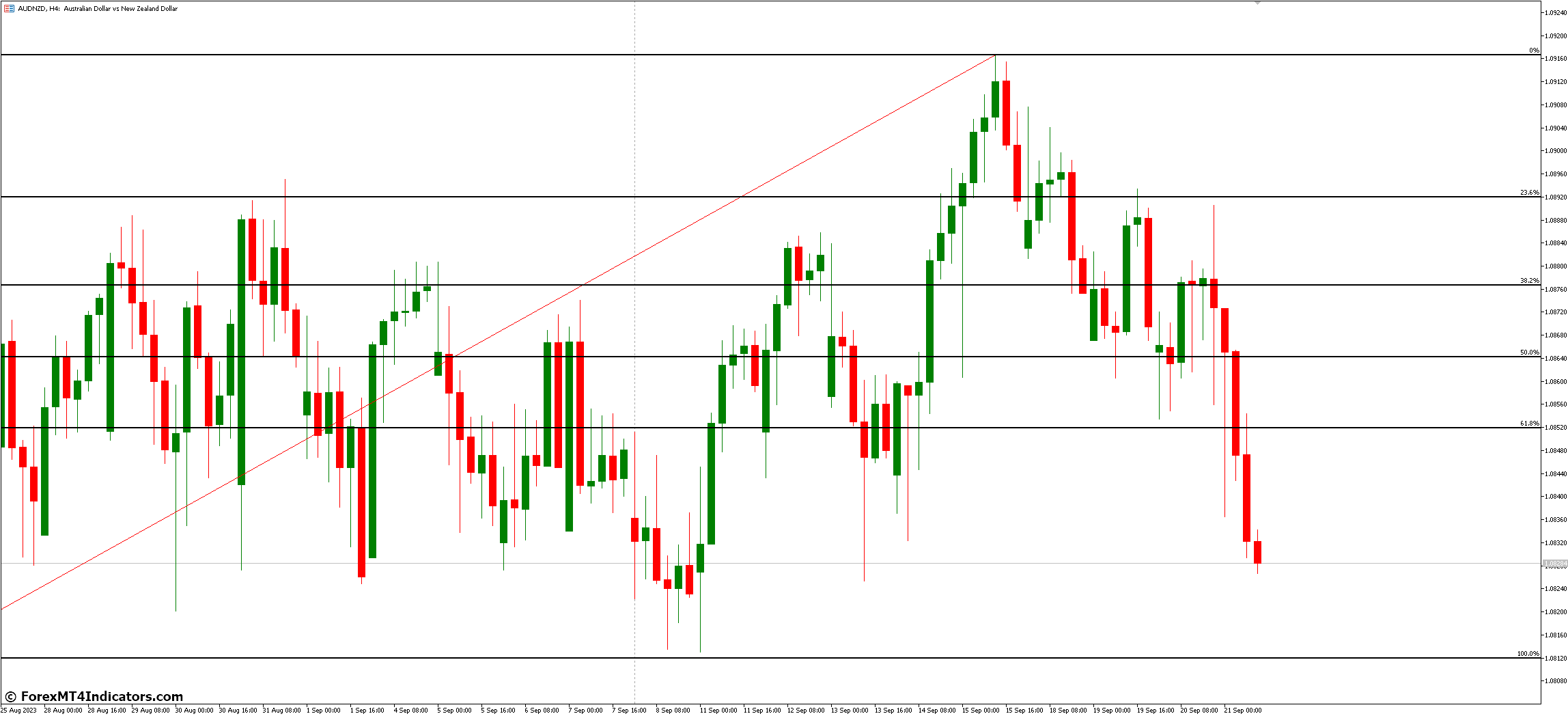

Fibonacci levels are more than just ideas. They work in real trading situations. For example, in an AUD/USD trade, the price hit the 38.2% level, showing strong support.

EUR/USD showed resistance at the 38.2% and 50% levels. These examples show how Fibonacci retracements help find important market changes.

Key Takeaways

- Fibonacci retracement helps identify support and resistance levels.

- Key Fibonacci levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

- Use Fibonacci with other technical indicators.

- The 50% and 61.8% levels are often key reversal points.

- Market volatility can affect Fibonacci levels’ effectiveness.

Understanding the History of Fibonacci Numbers and Trading

The Fibonacci sequence is key in trading today. It goes back to ancient times. Now, it’s a big help in the financial world, guiding how traders make choices.

The Origin of the Fibonacci Sequence

The sequence starts with 0 and 1. Each number is the sum of the two before it. This pattern (0, 1, 1, 2, 3, 5, 8, 13, 21…) is found in nature and has caught the eye of mathematicians for ages.

Leonardo Pisano’s Mathematical Legacy

Leonardo Pisano, known as Fibonacci, brought this sequence to the West in 1202. His book “Liber Abaci” changed the game. Born in Pisa in 1170, Fibonacci’s work also influenced art, architecture, and finance.

The Golden Ratio in Nature and Markets

The golden ratio, about 1.618, comes from the Fibonacci sequence. In trading, it’s linked to the 61.8% retracement level. Traders look at these levels to spot support and resistance in charts.

The golden ratio’s impact on trading is clear. For example, the EUR/USD pair has seen big price swings based on these levels. In 2015, it often hit the 61.8% retracement level, showing how Fibonacci analysis works in trading.

The Mathematics Behind Fibonacci Retracement Levels

Fibonacci retracement levels are key in forex trading. They come from the famous Fibonacci sequence. Knowing the math behind them helps traders use them better.

Calculating Key Fibonacci Ratios

The main Fibonacci ratios used in trading come from dividing numbers in the sequence. Important retracement percentages are 23.6%, 38.2%, 61.8%, and 78.6%. For example, 38.2% is 89 divided by 233. And 23.6% is 89 divided by 377.

Important Retracement Percentages

Traders use Fibonacci levels of 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These percentages show where the price might reverse or pause. A $2.36 pullback after a $10 rise is a 23.6% retracement.

The Significance of the 50% Level

The 50% level is very important in Fibonacci analysis. It’s not from the Fibonacci sequence but is key in Dow Theory. Many see the 50% retracement as a key point for trend reversals or continuations.

| Fibonacci Level | Percentage | Calculation |

|---|---|---|

| First | 23.6% | 89/377 |

| Second | 38.2% | 89/233 |

| Third | 50% | N/A (Dow Theory) |

| Fourth | 61.8% | Golden Ratio |

Using Fibonacci Retracement in Forex Trading Strategies

Fibonacci trading strategies are key in forex. They help traders find when trends might change. The levels 23.6%, 38.2%, 50%, 61.8%, and 78.6% are important for this.

The 23.6% level shows a small correction. The 38.2% level is a strong support or resistance. The 50% level is a big correction point.

The 61.8% “golden ratio” shows deep retracements. Trends often start strong again here. The 78.6% level marks the end of a correction.

Let’s use the EUR/USD pair as an example. With a low of 1.1000 and a high of 1.2000, the Fibonacci levels are:

| Fibonacci Level | Price |

|---|---|

| 23.6% | 1.1236 |

| 38.2% | 1.1382 |

| 50% | 1.1500 |

| 61.8% | 1.1618 |

| 78.6% | 1.1786 |

Traders might buy near the 38.2% level. They use a stop-loss below 50%. Or, they might enter at 50% with a stop-loss below 61.8%.

These strategies get better with other tools like RSI or moving averages. This makes forex analysis stronger.

Identifying Support and Resistance with Fibonacci Tools

Fibonacci tools are great for finding support and resistance in forex trading. They use the golden ratio to show where prices might change direction. This helps traders make better choices.

Drawing Fibonacci Lines Correctly

To use Fibonacci tools well, first, find important swing highs and lows on your chart. For downtrends, click on the swing high and drag to the recent swing low. In uptrends, do the opposite. This shows key levels at 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

Finding Swing Highs and Lows

Finding the right swing points is key for good Fibonacci analysis. Look for clear price peaks and troughs in your chosen timeframe. These points help you place your Fibonacci retracement lines. They show where prices might find support or resistance.

Price Action at Retracement Levels

Watch for price action signals at Fibonacci levels to see if prices will change direction or keep going. Candlestick patterns, like doji or engulfing candles, are good clues. The 38.2% level often acts as strong support in downtrends. The 61.8% level frequently serves as resistance in uptrends.

| Fibonacci Level | Common Use | Price Action Significance |

|---|---|---|

| 23.6% | Minor retracement | Weak support/resistance |

| 38.2% | Moderate pullback | Strong support in downtrends |

| 50% | Midpoint Reversal | Psychological level |

| 61.8% | Deep retracement | Strong resistance in uptrends |

| 76.4% | Deep correction | Last line of support/resistance |

Trading Uptrends with Fibonacci Retracement

Uptrend trading with Fibonacci retracement is popular in forex. It finds entry points during price pullbacks in an uptrend. Fibonacci levels on a chart show support areas where prices might reverse and go up again.

The key Fibonacci levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. The 61.8% level, or the Golden Ratio, is key for spotting reversals. Traders look to buy when prices hit these levels if other indicators also show it’s a good time.

Let’s look at a real example with the AUD/USD pair:

| Fibonacci Level | AUD/USD Price | Significance |

|---|---|---|

| 23.6% | 0.7955 | Shallow pullback |

| 38.2% | 0.7764 | Moderate retracement |

| 50.0% | 0.7609 | Halfway point |

| 61.8% | 0.7454 | Golden Ratio |

| 78.6% | 0.7263 | Deep retracement |

A retracement to 38.2% at 0.7764 was a good long-term trade. Using Fibonacci in uptrend trading needs other indicators and good risk management.

Mastering Downtrend Trading Using Fibonacci Levels

Downtrend trading with Fibonacci levels is a smart way to make money when prices fall. Traders use these levels to find good times to buy, set stop losses, and aim for profits in bearish markets.

Entry Points in Downtrends

Look for selling chances when prices hit key Fibonacci levels. The 0.236, 0.382, and 0.618 levels are important. They might signal a price drop.

Daily downtrends show lower highs and lows. They help traders find these entry points.

Stop Loss Placement Strategies

Good stop-loss strategies are key in downtrend trading. Set stops above recent highs or the next Fibonacci level. This keeps your money safe while prices move.

Successful trading needs a careful risk management plan.

Profit Target Selection

Choose profit targets at Fibonacci extension levels or old support zones. The 0.618 ratio is often a good target. Use different time frames to check your targets and boost your strategy.

| Fibonacci Level | Usage in Downtrends |

|---|---|

| 0.236 | Minor resistance, possible entry |

| 0.382 | Moderate resistance, stop loss area |

| 0.618 | Major resistance, key reversal point |

By learning these Fibonacci techniques, traders can get better at downtrend trading. They might make more money in bearish markets.

Combining Fibonacci with Other Technical Indicators

Fibonacci retracement gets stronger when used with other technical indicators. This mix helps traders see market trends better. It also shows when to enter or leave the market.

Moving Averages and Fibonacci

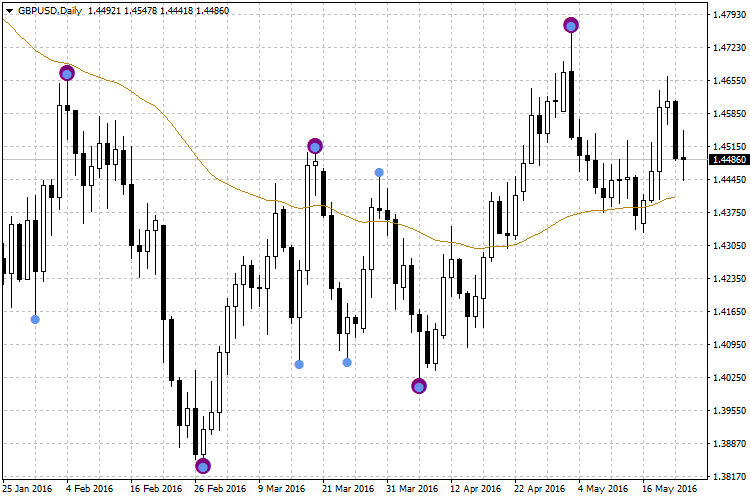

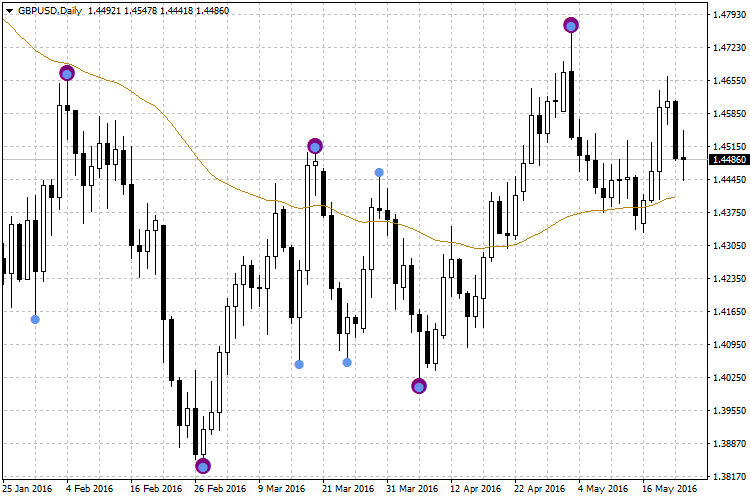

Moving averages and Fibonacci levels work well together. Traders often use Fibonacci numbers like 55, 89, or 144 for their averages. When the price meets a Fibonacci level and a moving average, it’s a strong sign.

For example, a 50% retracement and a 55-period EMA meeting could be a good entry point.

RSI and Fibonacci Confluence

The Relative Strength Index (RSI) pairs well with Fibonacci retracement. Many use a 21-period RSI, a Fibonacci number. When RSI is oversold (below 30) at a Fibonacci level, it might be time to buy.

On the other hand, overbought (above 70) at a Fibonacci resistance could mean it’s time to sell.

Candlestick Patterns at Fibonacci Levels

Candlestick patterns add visual clues to Fibonacci analysis. A bullish engulfing pattern at a 61.8% retracement could be a strong buy signal. A bearish harami at 38.2% resistance might show a trend reversal.

| Indicator | Fibonacci Synergy | Trading Signal |

|---|---|---|

| Moving Averages | Price at 50% + 55 EMA | Strong trend continuation |

| RSI | Oversold at 38.2% support | Potential long entry |

| Candlesticks | Doji at 61.8% resistance | Possible trend reversal |

Using Fibonacci with moving averages, RSI, and candlestick patterns makes a strong trading system. This multi-indicator method confirms signals. It also lowers the chance of false signals in forex trading.

Advanced Fibonacci Extension Techniques

Fibonacci extensions are key tools for traders. They help set profit targets and manage trades. These techniques project price levels beyond the 100% mark. The main levels are 161.8%, 261.8%, and 423.6%.

Traders use 161.8% and 261.8% to spot support and resistance. These levels show where a trend might keep going or change. For example, in an uptrend, a trader might sell near the 161.8% level.

Advanced traders mix Fibonacci extensions with other tools. Fibonacci clusters are very useful. They show where prices might bounce back or keep going.

Some traders also use volume-by-price graphs. This adds more proof to their strategies. Darker marks in clusters mean stronger support and resistance.

| Extension Level | Common Use | Trading Application |

|---|---|---|

| 161.8% | First major extension | Initial profit target |

| 261.8% | Secondary extension | Extended profit target |

| 423.6% | Extreme extension | Long-term trend target |

Fibonacci channels are another advanced method. They can be used vertically or diagonally. This adds more proof of key levels.

When combined with RSI or MACD, Fibonacci extensions boost trade accuracy. They help find high-probability setups.

Risk Management When Trading with Fibonacci Levels

Trading with Fibonacci levels is powerful but needs strong risk management. Good strategies mix Fibonacci analysis with smart position sizing and stop loss placement. This way, traders can handle market ups and downs while keeping their money safe.

Position Sizing Guidelines

Smart position sizing is key to risk management. A good rule is to risk only 1-2% of your trading capital on one trade. This rule helps keep your account safe from big losses if a trade fails.

Setting Appropriate Stop Losses

Stop losses are very important when trading with Fibonacci levels. Set your stop loss just below a key Fibonacci support level in an uptrend. Or, place it above a resistance level in a downtrend. This method lets the market move a bit while keeping losses small.

| Fibonacci Level | Common Use | Risk Management Application |

|---|---|---|

| 23.6% | Shallow pullbacks | Tight stop loss for strong trends |

| 38.2% | Moderate retracements | Conservative entry point |

| 61.8% | Golden Ratio, critical reversal | The key level for stop-loss placement |

Managing Multiple Time Frames

Looking at multiple time frames helps with risk management. Longer time frames are more important – a 38.2% retracement on a weekly chart is bigger than on a 5-minute chart. Match your trades with the big trend for better risk-reward ratios.

Remember, Fibonacci levels are just part of a full trading plan. Use them with other technical indicators. Always put capital safety first, along with making profits.

Common Mistakes to Avoid in Fibonacci Trading

Fibonacci trading is powerful but comes with challenges. Many traders make costly mistakes. One big error is relying too much on Fibonacci levels without looking at other market factors.

Another mistake is not correctly identifying Fibonacci retracement levels. This can lead to bad trading choices and uneven results. Using a Fibonacci calculator can help avoid this. Remember, Fibonacci levels work best in trending, high-volume markets, not sideways ones.

Ignoring fundamental analysis is another mistake. Fibonacci levels are more effective when used with other technical indicators and a good grasp of market basics. Traders often use fixed Fibonacci levels without adjusting for current market conditions. This can cause them to miss important opportunities.

- Over-reliance on Fibonacci levels

- Incorrect identification of retracement levels

- Ignoring market fundamentals

- Failing to adjust levels for current conditions

- Poor risk management and position sizing

Good risk management is key in Fibonacci trading. Set stop-loss orders based on Fibonacci levels to limit losses. Calculate your position sizes based on your risk tolerance and the distance to your stop-loss. By avoiding these common mistakes, you can do better in the forex market.

Real-World Trading Examples and Case Studies

Let’s look at some trading examples and case studies. They show how Fibonacci retracement works in real life. You’ll see how traders use it in EUR/USD trading and other markets.

EUR/USD Fibonacci Trading Example

Recently, the EUR/USD price went from 1.1000 to 1.2000. Traders watched the 61.8% Fibonacci level at 1.1382 for support. It was key, as buying started there, making a good long entry.

Successful Trade Analysis

A swing trader saw a chance when the price hit the 38.2% level in an uptrend. This level was also a previous resistance zone, now support. The trader bought, set a stop-loss below 50%, and aimed for the high. This strategy led to a successful trade, showing Fibonacci’s strength in forex.

Failed Trade Learning Points

Not every trade is a win, and that’s fine. In one case, a trader shorted at the 50% retracement level, seeing resistance and a bearish pattern. But the market turned, hitting the stop-loss. This teaches us to use Fibonacci with other indicators and manage risk well.

Conclusion

Fibonacci trading is a strong tool for trading in the forex market. It uses levels like 23.6%, 38.2%, 50%, 61.8%, and 100% to find support and resistance. The 61.8% Golden Ratio is key for spotting possible reversals.

Fibonacci levels are very accurate but work best with other tools. Using moving averages and RSI with Fibonacci can make analysis better. Remember, Fibonacci trading results can change based on the time frame.

Learning Fibonacci trading takes time and effort. Traders should manage risks well, analyze them in different time frames, and keep improving. Adding Fibonacci retracements to a trading strategy can help make better decisions and timing.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Fibonacci ، Forex ، Retracement ، Strategies ، Trading

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0