USD/ZAR OUTLOOK:

MOST READ: EUR/USD Slides as Euro Area Makes Progress on Core Inflation, Headline Steady

The South African Rand (ZAR) had been enjoying a nice run against the US Dollar this week. The move however came to an abrupt halt at a key support area yesterday before an aggressive bounce which has continued into today’s European session.

For Beginner Traders, Download Your Free Forex Guide Below

Recommended by Zain Vawda

Forex for Beginners

US DATA DISAPPOINTS

US data has been on a poor run over the past week and a half as it appears the tightening cycle may finally be bearing fruit. Having made positive strides on inflation we are starting to see signs of a slowdown in the labor market but more so on in the US economy.

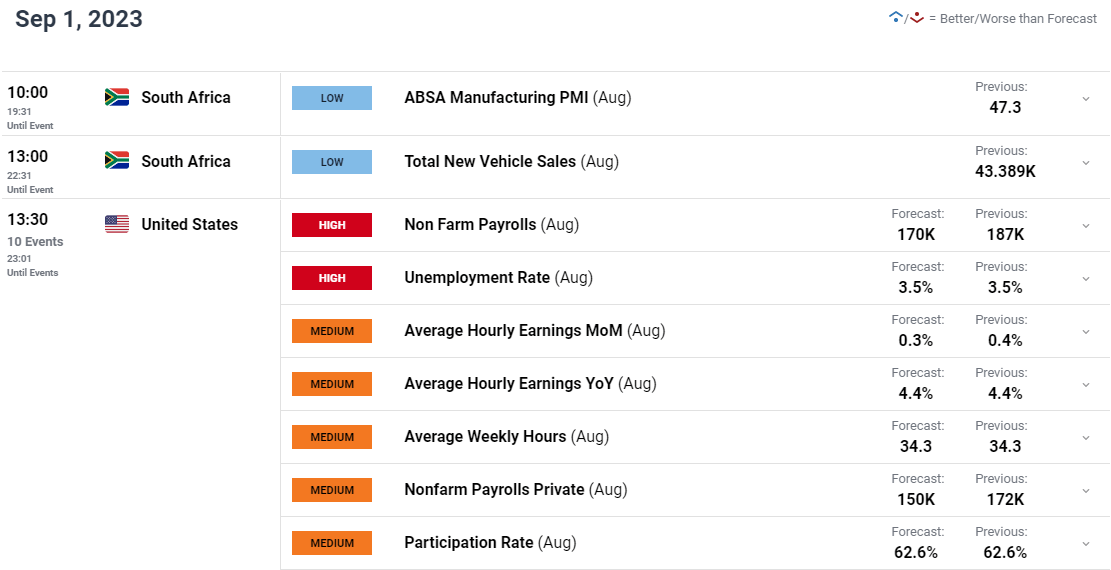

The issue which remains a sticking point for the Fed remains consumer spending something which analysts believe may continue for a while longer. Savings are still being used to support spending and this is having a knock-on effect by keeping demand elevated and this could lead to a resurgence in inflation once more. The tight labor market and low unemployment rate as well are sticking points for the Fed at the moment with Fed Chair expressing as much at the Jackson Hole Symposium. This makes tomorrows NFP report, and the unemployment rate even more important and market participants will be hoping for a sign that the Fed may end their rate hike cycle.

MOST READ: US Dollar (DXY) Little Changed After the US Inflation Report, NFPs Still Key

Recommended by Zain Vawda

Traits of Successful Traders

US, SOUTH AFRICA DATA AHEAD

South Africa has seen a significant drop-off in inflation and with GDP and PMI data ahead, locals will be hoping for more positive news. Loadshedding which was earmarked as a key issue to combat for positive GDP growth to occur has been a bit better in Q# but still remains a long-term problem. US data tomorrow will be massive and could have a significant impact on where the US Dollar heads next and thus USD/ZAR as well. This should be interesting heading into the weekend and into next week.

For all market-moving economic releases and events, see the DailyFX Calendar

FINAL THOUGHTS AND TECHNICAL OUTLOOK

USDZAR from a technical standpoint has always fascinated me as we tend to trend for a sustained period of time. Looking back historically and trends seem to run for 3-4 months at a time before we see a significant change in the overall trend of the pair. This is something which has continued this year but does seem to have shifted of late as we have seen a lot of choppy price action since the beginning of July.

Looking ahead and USDZAR printed an ominous double bottom pattern just below the key 18.50 handle. A bullish engulfing daily candle close has been followed up by another bullish run today thanks to a stronger US dollar. Key data lies ahead and could be key to the direction of the pair over the next week or so.

Key Levels to Keep an Eye on:

Support Levels:

- 18.63 (100-day MA)

- 18.50 (50-day MA)

- 18.14 (200-day MA)

Resistance Levels:

USD/ZAR Daily Chart, August 31, 2023

Source: TradingView, Prepared by Zain Vawda

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0