USD/JPY Firm Despite Potential Intervention, NZD/USD at 3-Week Low

[ad_1] Market Recap The significant upside surprise in US job opening numbers for August (9.61 million vs 8.8 million expected) prompted another negative session in Wall Street overnight, with a resilient labour market deemed to be providing more room for the Federal Reserve (Fed) to keep rates high for longer. US Treasury yields continued with

[ad_1]

Market Recap

The significant upside surprise in US job opening numbers for August (9.61 million vs 8.8 million expected) prompted another negative session in Wall Street overnight, with a resilient labour market deemed to be providing more room for the Federal Reserve (Fed) to keep rates high for longer. US Treasury yields continued with their ascent, with the US 10-year yields at 4.8%. Aside, the VIX is at its four-month high, hovering just below its key 20 level – a general divide between more risk-on and risk-off territory.

Ahead, the US Automatic Data Processing (ADP) private payrolls data and US services purchasing managers index (PMI) will be on watch, with market participants potentially hoping to see a softer read on both fronts to give US policymakers some breathing room in terms of tightening. Current expectations are for the ADP data to moderate to 153,000 from previous 177,000, while the US services PMI is expected to soften to 53.6 versus the previous 54.5.

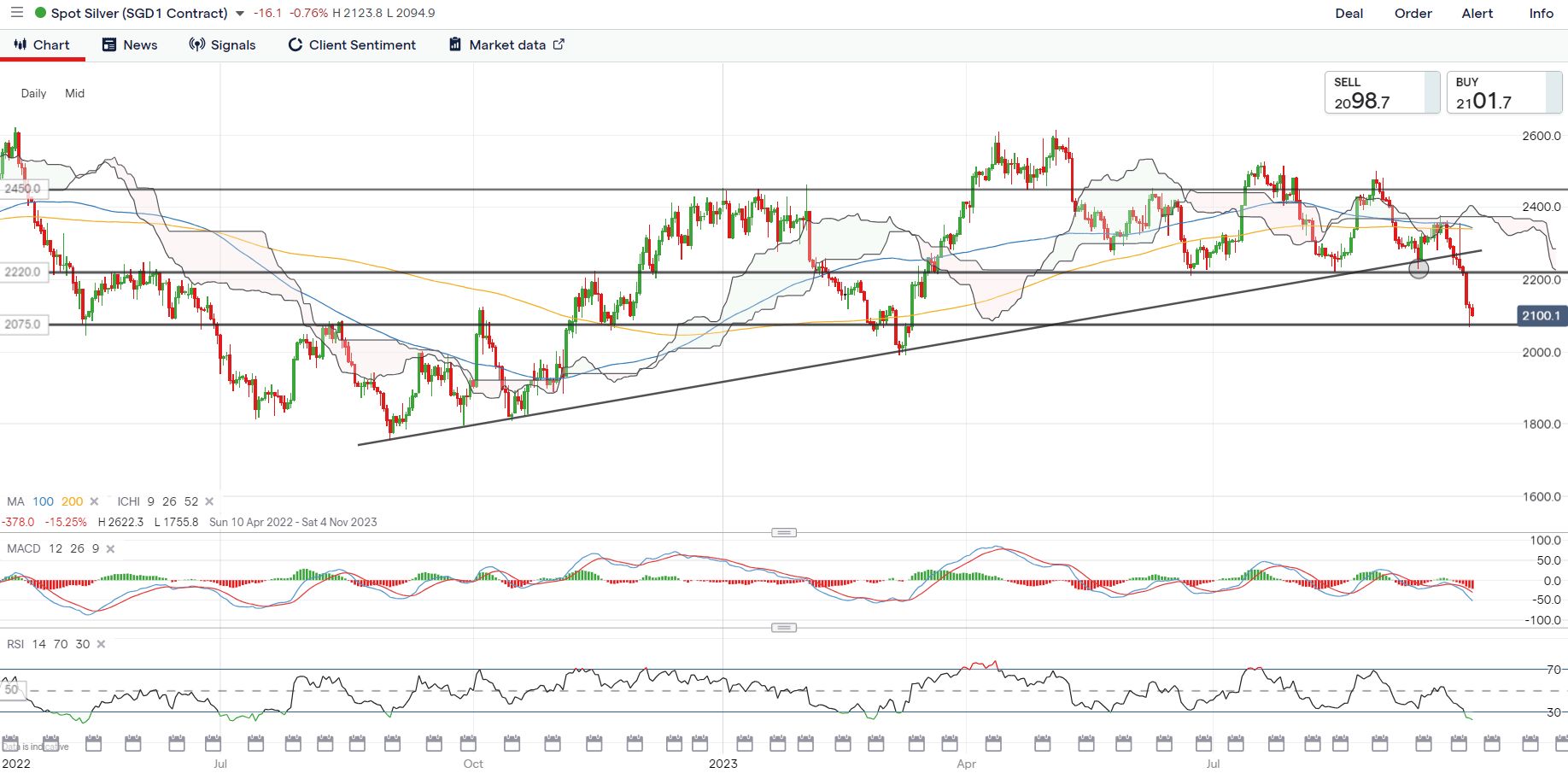

Higher Treasury yields and a firm US dollar have not been well-received by silver prices lately, but there is an attempt for prices to hold up around the US$20.75 level with the formation of a bullish pin bar on the daily chart overnight. A move above yesterday’s close may provide greater conviction for some short-term relief, as technical conditions tread in oversold territory while gains in the US dollar stalled overnight. Any near-term relief may find resistance at the US$22.20 level, while failure to defend the US$20.75 may pave the way towards the US$19.80 level next.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -13% | 1% |

| Weekly | 19% | -19% | 16% |

Source: IG charts

Asia Open

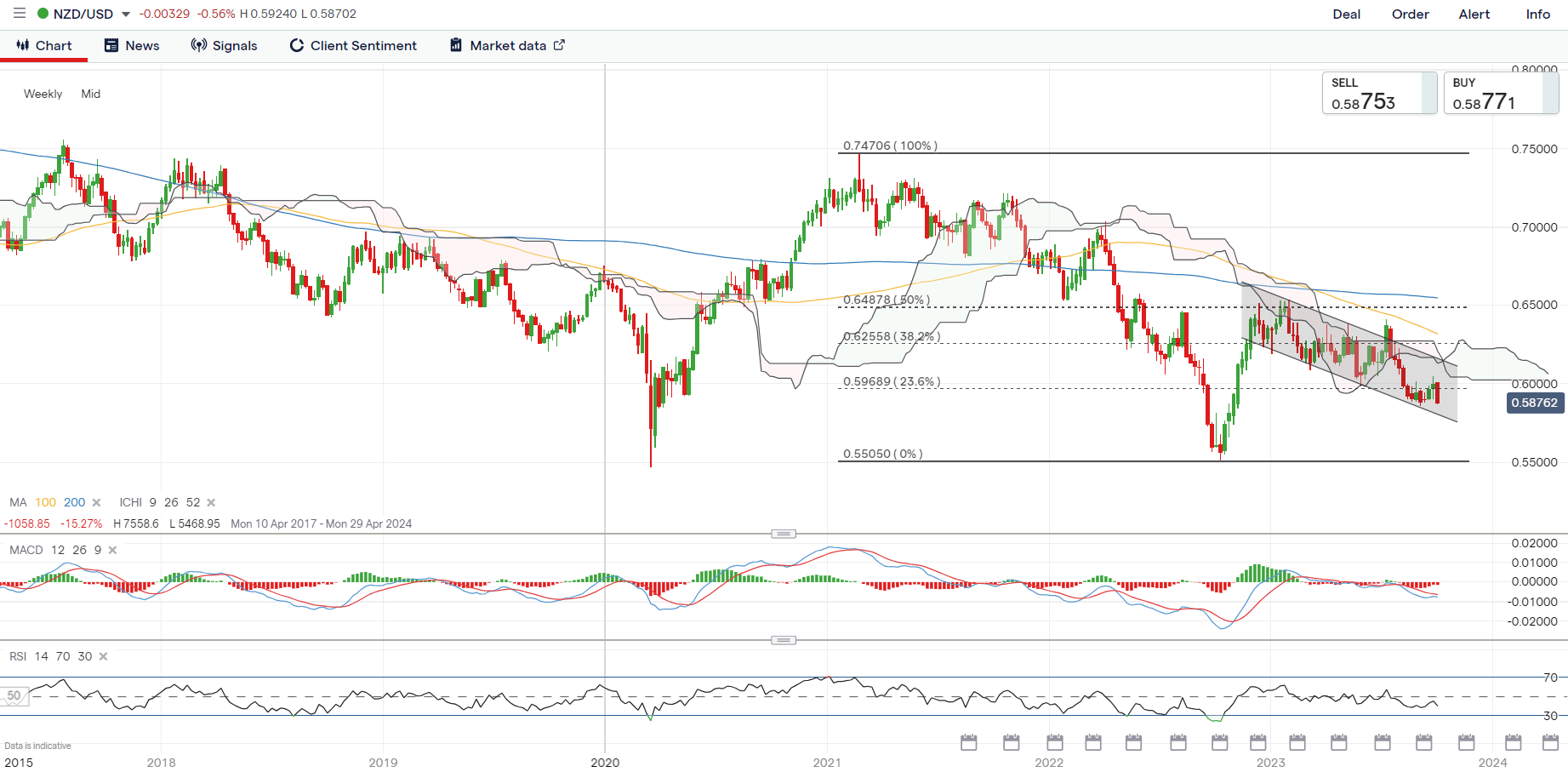

Asian stocks look set for a downbeat open, with Nikkei -1.65%, ASX -0.65% and KOSPI -2.08% at the time of writing. The Reserve Bank of New Zealand (RBNZ) has kept rates on hold at 5.5% as widely expected in today’s meeting, which prompted a dip in the NZD/USD to its three-week low – a case similar to the AUD/USD on the rate hold from the Reserve Bank of Australia (RBA) yesterday.

Guidance from the RBNZ that inflation is still expected to decline to within the target band by 2H 2024 and some emphasis on economic risks as a trade-off to restrictive monetary conditions may suggest that the central bank is leaning towards further wait-and-see, with the flexibility kept for one more rate hike towards the rest of the year.

For the week, the NZD/USD seems to be eyeing for a retest of its September low, as failure to sustain above its weekly Ichimoku cloud pattern continues to put a downward trend in place. Its weekly Relative Strength Index (RSI) is also trading below the key 50 level as a reflection of sellers in control, failing to defend recent gains on a firmer US dollar and broad risk-off sentiments. The lower channel trendline may be on watch next as potential near-term support, followed by its October 2022 low at the 0.550 level.

Recommended by Jun Rong Yeap

The Fundamentals of Breakout Trading

Source: IG charts

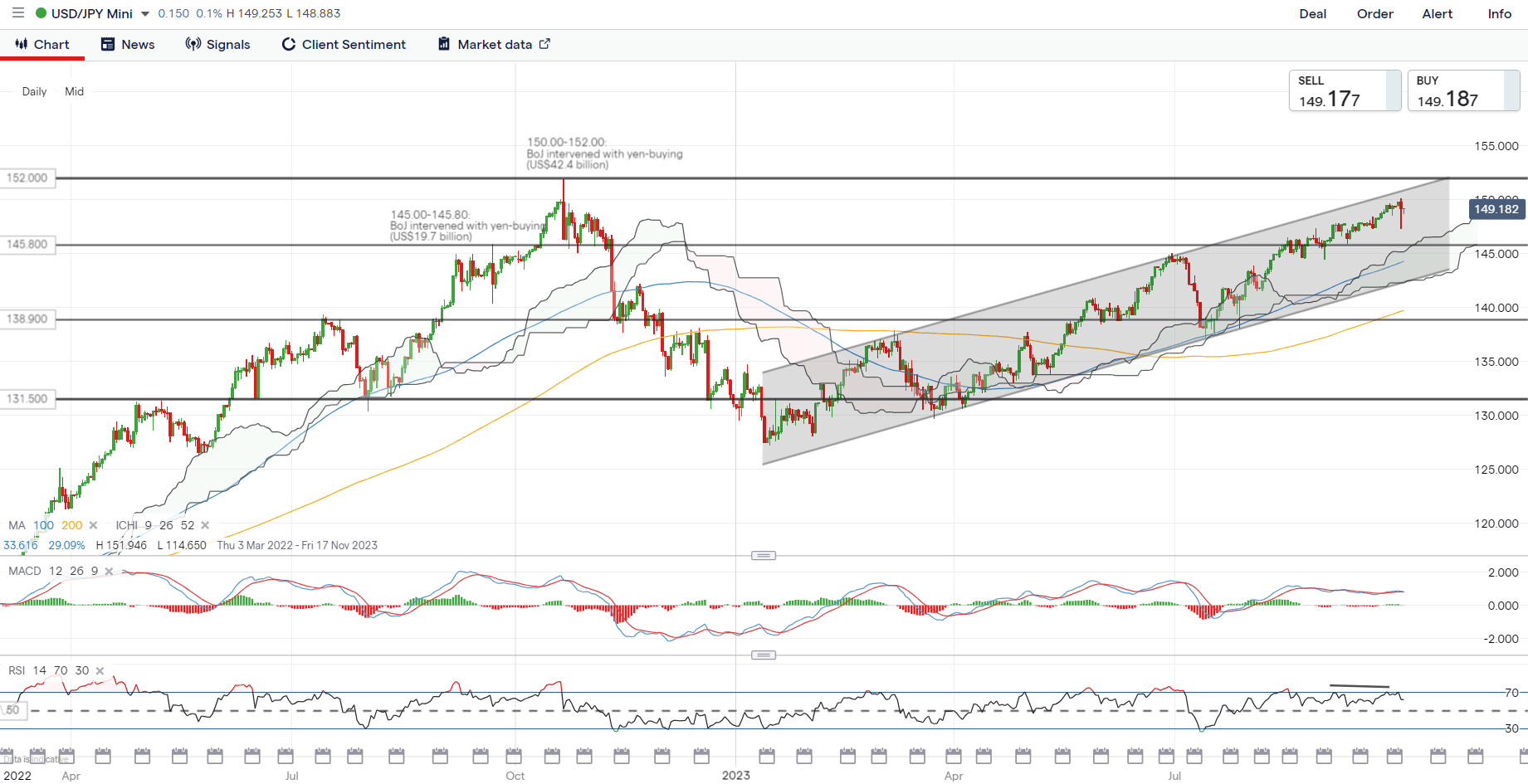

On the watchlist: Suspected intervention at the 150.00 level for USD/JPY met with dip-buying

There was a suspected FX intervention by Japanese authorities for the USD/JPY at the key psychological 150.00 level overnight, but dip buyers were quick to halt the weakness, which continued to see the pair hold around its 11-month high. The case seems similar to September 2022, where the first round of intervention by authorities failed to support the Japanese yen amid the policy divergence between the Fed and the Bank of Japan (BoJ).

Buyers may attempt to retest the key 150.00 level once more, with any failure for authorities to provide a more aggressive signal likely to challenge their credibility and could pave the way for the pair towards the 152.00 level next (October 2022 top formed on second round of intervention). On the downside, yesterday’s dip-buying at the 147.30 level will serve as immediate support to hold.

Recommended by Jun Rong Yeap

How to Trade USD/JPY

Source: IG charts

Tuesday: DJIA -1.29%; S&P 500 -1.37%; Nasdaq -1.87%, DAX -1.06%, FTSE -0.54%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0