USD/JPY, EUR/JPY Delicately Poised Ahead of Central Bank Week

[ad_1] USD/JPY, EUR/JPY PRICE FORECAST: FX Intervention Remains a Factor but Central Banks are Likely to Drive Price Action on Yen Pairs. Japanese Cabinet Office Lifted its Views in Business Sentiment. The First Time in 7-Months. EUR/JPY Retreats from YTD High with Double Top Pattern Hinting at a Deeper Retracement. To Learn More About Price

[ad_1]

USD/JPY, EUR/JPY PRICE FORECAST:

- FX Intervention Remains a Factor but Central Banks are Likely to Drive Price Action on Yen Pairs.

- Japanese Cabinet Office Lifted its Views in Business Sentiment. The First Time in 7-Months.

- EUR/JPY Retreats from YTD High with Double Top Pattern Hinting at a Deeper Retracement.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Recommended by Zain Vawda

FREE Q3 FORECAST ON THE YEN

Most Read: Japanese Yen Forecast: USD/JPY, EUR/JPY at the Mercy of Intervention Talk

FUNDAMENTAL BACKDROP

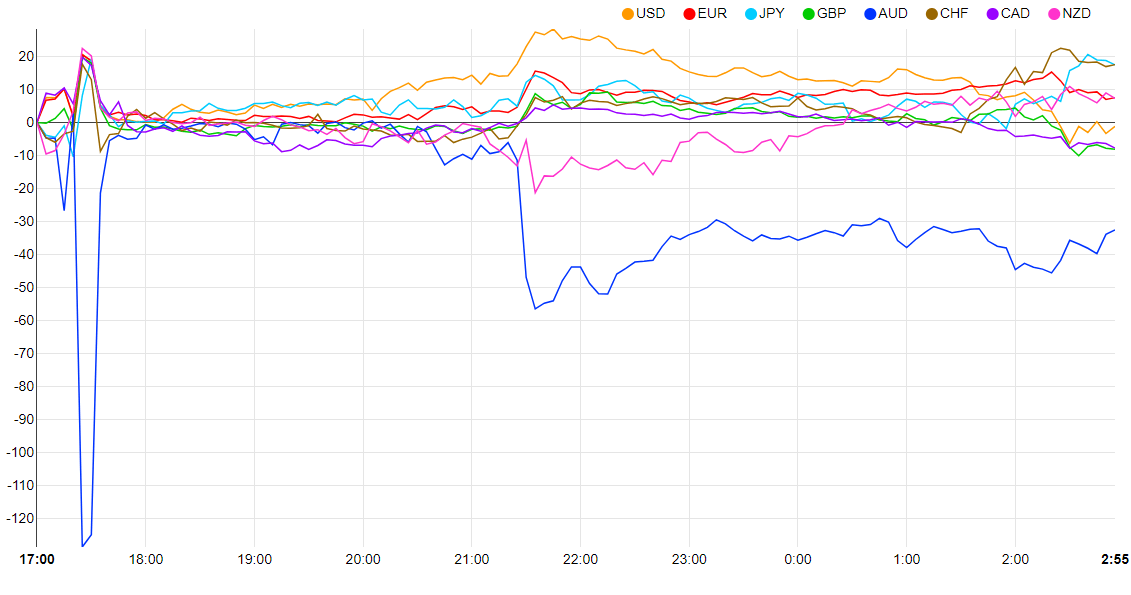

The Japanese Yen has enjoyed a positive start to the week as both EURJPY and USDJPY continued their retreat from last week’s highs. Not much has changed from a Yen perspective with a slew of Central Bank meetings likely seeing investors adopt a more cautious approach as well as cutting positions in order to limit exposure. Looking at the currency chart below and we can see how closely matched the currencies are as we approach the beginning of a busy 2-week period for markets and monetary policy which could shape the rest of 2023.

Currency Strength Chart Strongest: CHF Weakest: AUD

Source: FinancialJuice

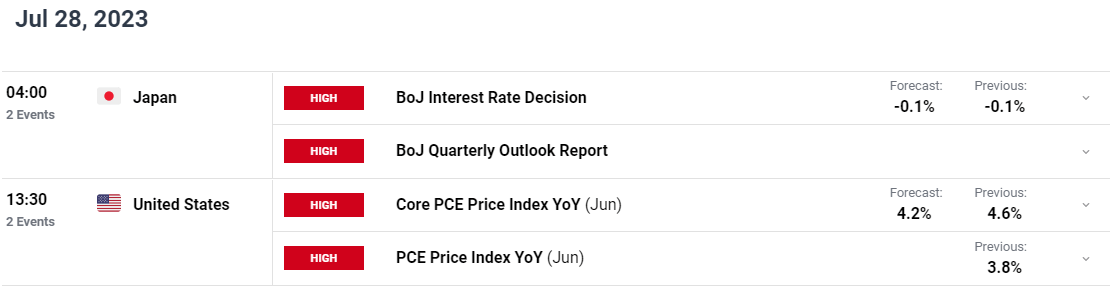

This morning the Japanese Cabinet Office published their monthly assessment on the economic conditions, noting a rise in business sentiment for the first time in 7 months. The Cabinet office were quick to stress that the economy is picking up something that was evident with the recent trade surplus in June which bodes well for the BoJ as they look to improve wage growth.

The talk around FX intervention as well continues to rumble on and is likely to keep the yen supported in the interim. Governor Ueda this morning reiterated his support for accommodative monetary policy for firms while noting the improvement in overall sentiment. The Governor did touch on the topic of Yield Curve Control noting that the long-term yield rate remains stable while attributing the volatility in USDJPY to interest rate differentials. Not a lot of change as mentioned ahead of the Central Bank meetings.

Recommended by Zain Vawda

How to Trade USD/JPY

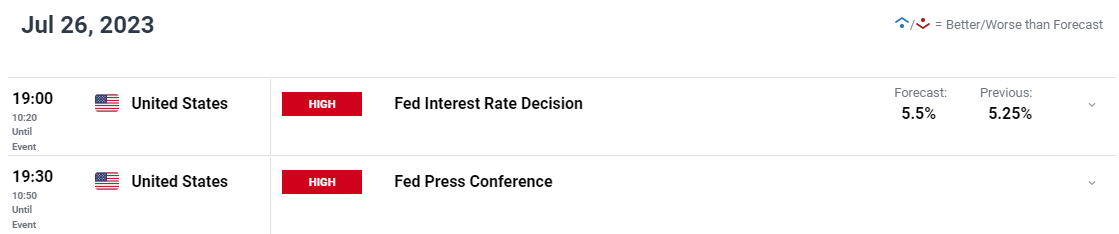

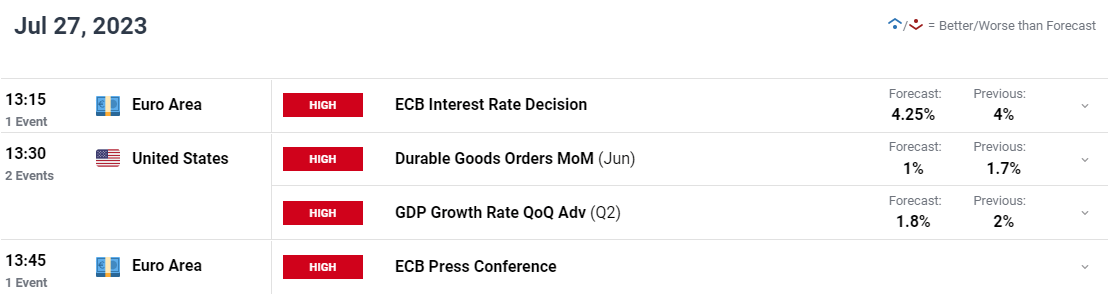

Looking at the Euro and the US Dollar and things become a bit more interesting with both Central Banks expected to deliver 25bp rate hikes this week. However, the question on the lips of market participants is “one and done”? Will we finally see a more dovish European Central Bank (ECB) as policymakers have hinted at of late or will the ECB maintain a hawkish rhetoric in a bid to keep the Euro higher for now. The recent signs of a slowdown in the Euro Area economy may present the ECB with some food for thought in this regard as inflation appears to be on its way down.

The US Federal Reserve (Fed) faces a similar challenge with market participants leaning toward the idea that this will be the end of the hiking cycle. The Dollar has been on a downward trajectory for much of 2023 with any dovish signs likely to weigh on the dollar and could be the start of a new leg to the downside which should help the Yen recover some recent losses against the greenback.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

EURJPY

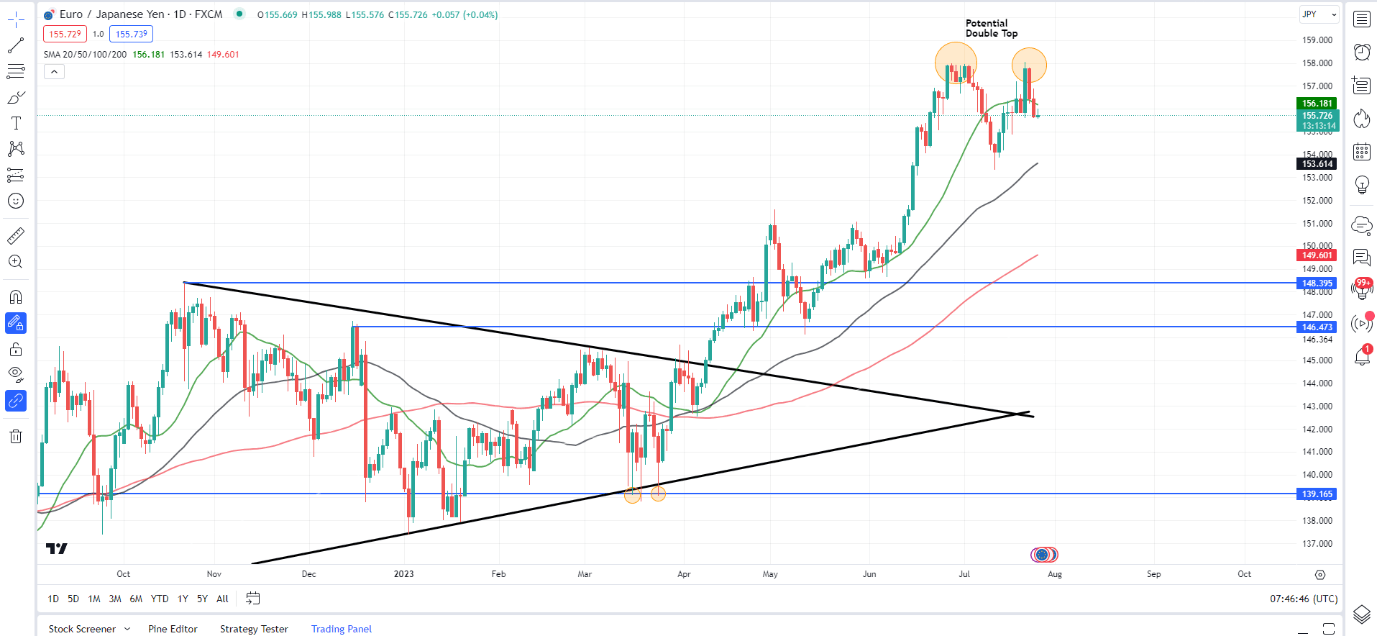

Analysis of EURJPY at present is tricky as we trade at levels last seen in 2008. EUR/JPY has however printed a double top pattern with yesterday’s daily candle closing below a key support area around the 155.80 and below the 50-day MA.

Further downside appears to be the path of least resistance at this stage with flows into the Euro likely to remain limited ahead of the ECB meeting. A continuation of the downward momentum could bring the 100-day MA resting at 153.600 into focus as we have yet to test the breakout area around the 151.00 mark.

EUR/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Key Levels to Keep an Eye On:

Support levels:

- 155.00 (psychological level)

- 153.60 (100-day MA)

- 151.00

Resistance levels:

- 156.18 (50-day MA)

- 157.00

- 158.00 (YTD high)

- 159.00 (price gap all the way back to 2008)

USDJPY

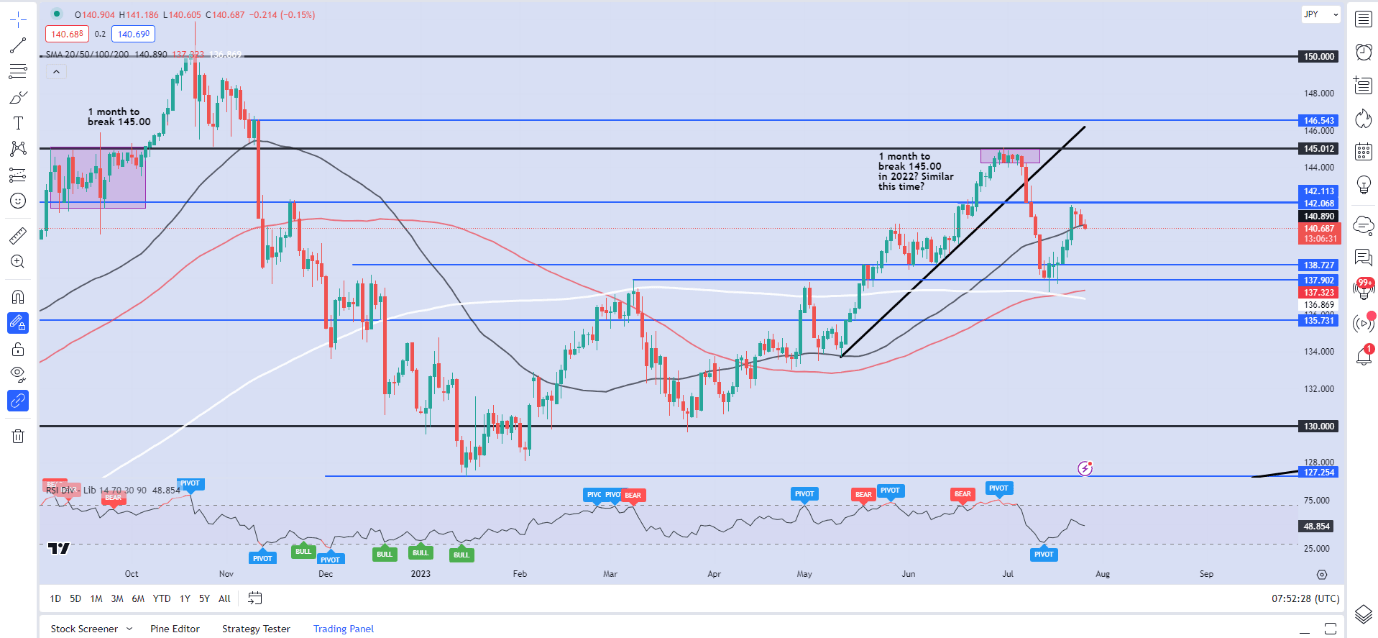

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY is currently making its way below the 50-day MA with the 140.00 psychological level firmly in sight. The rally to the upside at the back end of last week found resistance at the 61.8% fib retracement level and the 142.00 resistance area. Given the macro backdrop and barring a hawkish Fed surprise I could see a push below the 140.00 on USDJPY toward the 100 and 200-day MAs resting at 137.30 and 136.85 respectively.

Taking a look at the IG client sentiment data and we can see that retail traders are currently net SHORT on USDJPY with 63% of traders holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment meaning we could see USDJPY prices continue to rise following a short pullback.

Key Levels to Keep an Eye On:

Support levels:

- 140.00

- 137.30

- 136.85 (200-Day MA)

Resistance levels:

- 140.90 (50-day MA)

- 142.00

- 143.50

Foundational Trading Knowledge

Find Your Trading Style

Recommended by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0