Japanese Yen Prices, Charts, and Analysis

- USD/JPY remain above 145.00 stirring fears of official intervention.

- GBP/JPY prints eight green candles in a row.

Recommended by Nick Cawley

How to Trade USD/JPY

The Japanese Yen remains at levels against the US dollar that sparked a round of official intervention but the Japanese currency is even weaker against a range of other currencies, including the British Pound. Yen traders will need to be alert to any talk coming out of the Bank of Japan (BoJ) or the Ministry of Finance (MoF) to see if current Yen levels are going to be officially tolerated.

The weakness of the Yen has helped Japanese exports and growth. Tuesday’s preliminary Q2 data showed external demand (exports) beating expectations and the prior quarter, while annualized Q2 GDP growth hit 6%, beating estimates of 3.1% and a prior, revised higher, 3.7%. While good for the Japanese economy, other countries may soon start to complain that the weak Yen is giving Japan an unfair advantage.

Bank of Japan (BoJ) – Foreign Exchange Market Intervention

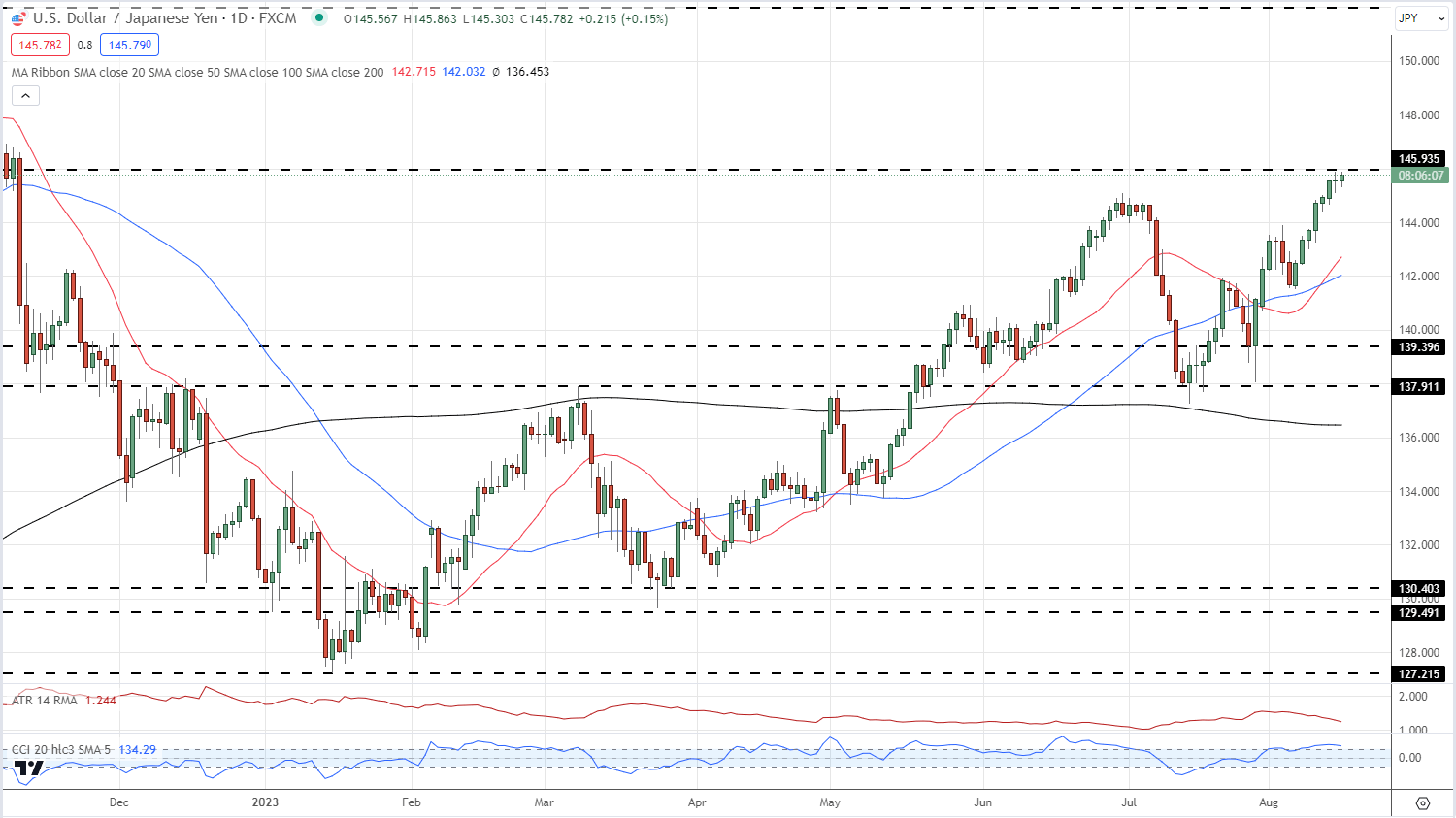

USD/JPY is back at September 2022 intervention levels but as yet there is no official talk of any intervention. The pair are touching 146.00 and traders now need to be wary of official talk. The technical outlook shows USD/JPY retains a bullish outlook although the CCI indicator shows the pair heavily overbought. Any official ‘noise’ or action could see the pair fall sharply and traders should use a stop loss, either rigid or movable if the pair rally further, to protect against any sharp sell-off.

USD/JPY Daily Price Chart – August 16, 2023

Retail trade data shows traders are quite heavily short USD/JPY

Download the Full IG USD/JPY Retail Report to See How Daily and Weekly Changes Affect the Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 3% |

| Weekly | -15% | 21% | 10% |

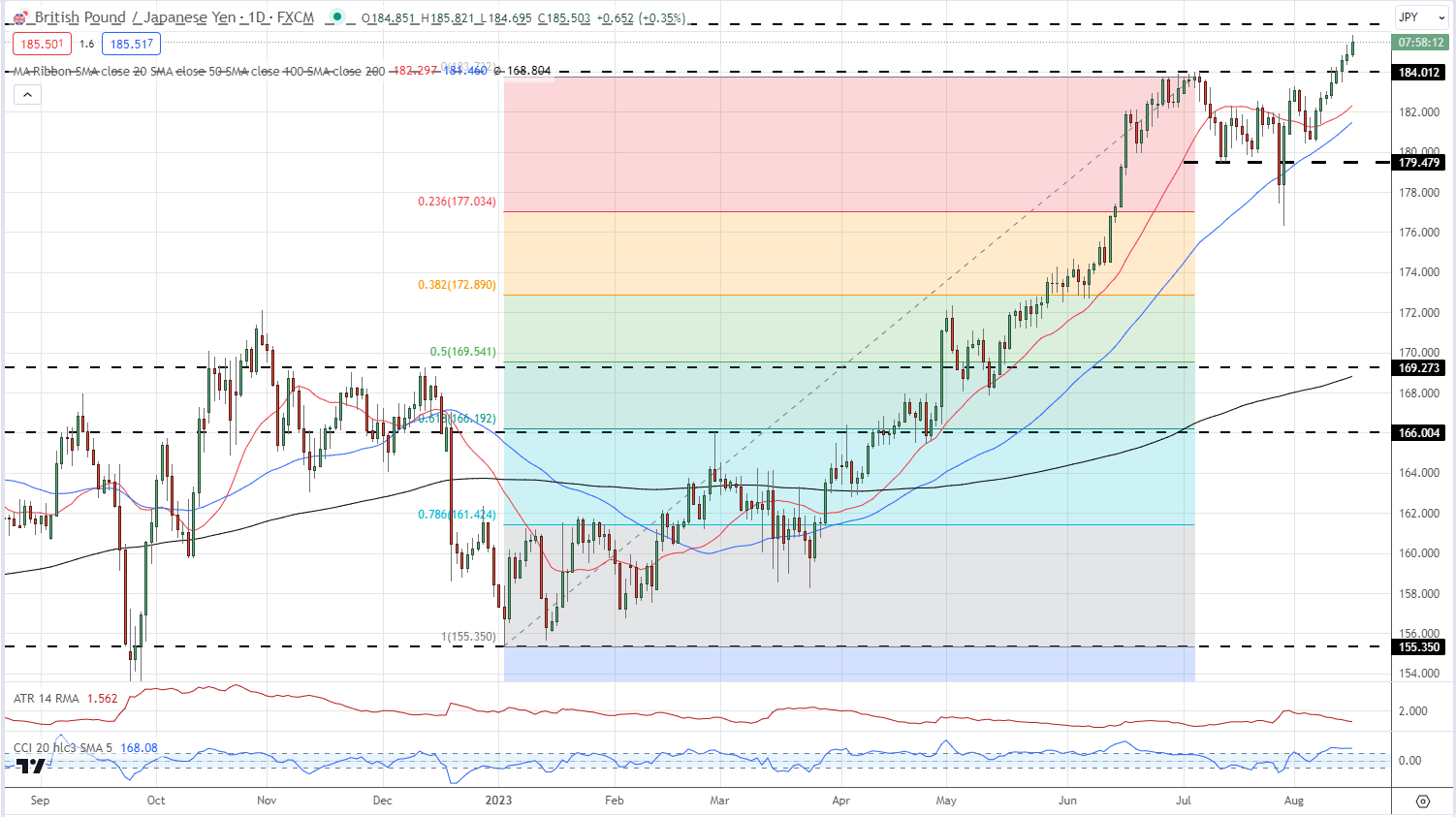

While USD/JPY has retraced all the way to September 2022 levels, GBP/JPY is roughly 17 big figures higher than the last bout of intervention. Sterling in itself has been strong over the last few months as the Bank of England continues to hike interest rates. Recent UK economic data suggests that the UK central bank will hike again next month, widening the UK/Japan interest rate differential further in the British Pound’s favor. Again care needs to be taken, although any downside should be buffered by the level of UK rates.

GBP/JPY Daily Price Chart – August 16, 2023

Recommended by Nick Cawley

The Fundamentals of Breakout Trading

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0