SECOND-QUARTER USD GDP KEY POINTS:

- The U.S. economy grew at an annualized rate of 2.4% in the second quarter, well ahead of expectations of 1.8%

- Personal consumption expenditures, the main driver of economic activity, decelerated to 1.6%, but remained elevated by historical standards

- Better-than-expected data pushed U.S. Treasury yields higher, boosting the U.S. dollar

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths

The U.S. economy gained momentum and expanded well above its long-term trend over the past three months, bolstered by consumer resilience and robust capex spending despite extremely high central bank interest rates, which currently sit at their highest level in more than two decades.

According to the U.S. Department of Commerce, gross domestic product, the broadest measure of goods and services produced by the country, grew at an annualized rate of 2.4% in the second quarter, significantly ahead of expectations of 1.8% – a solid result that could help ease exaggerated recession fears.

Drilling down into the details of the report, personal consumption expenditures, which account for approximately 70% of GDP, increased by 1.6% after a 4.0% gain previously, a clear sign that households are not yet ready to close the money spigot, thanks in part to the strong and dynamic labor market.

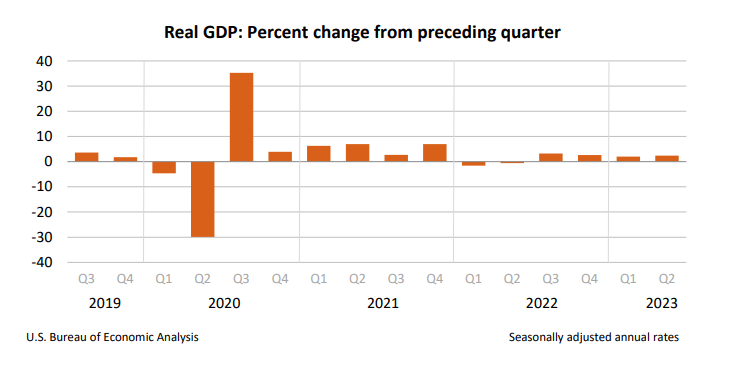

US GDP PERFORMANCE

Source: U.S. Bureau of Economic Analysis

Elsewhere, gross private domestic capital formation rose by 5.7%, with business fixed investment jumping by 4.9% and residential investment falling by 4.2%. With mortgage rates expected to remain high, the housing market may remain depressed, but there are other indications it may be starting to bottom out.

All in all, the solid GDP data suggest that the economy remains in incredible shape despite the FOMC’s aggressive measures to slow activity as part of its fight against inflation. Final sales to domestic producers, which rose sharply at a rate of 4.3%, confirm this assessment and signal that internal demand is holding up remarkably well.

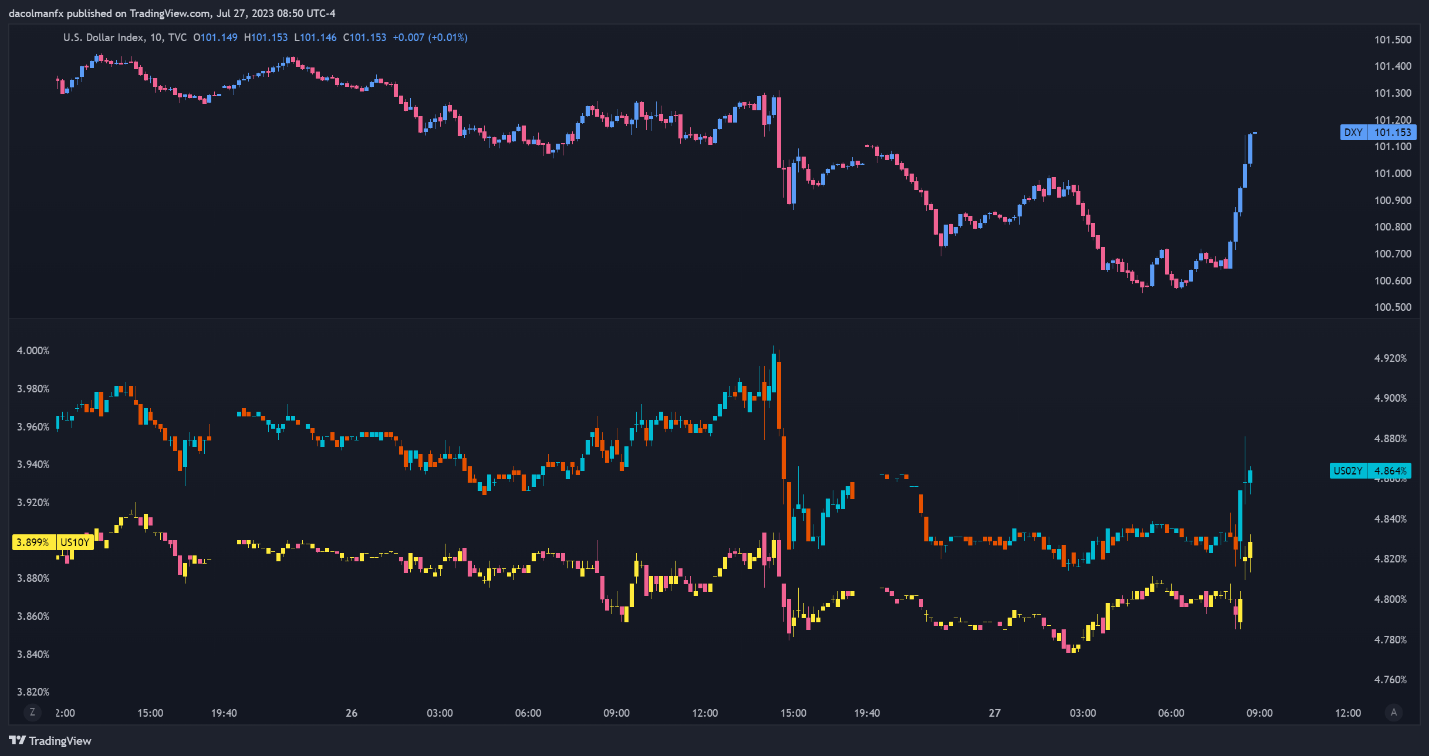

Immediately after the U.S. Bureau of Economic Analysis released the GDP report, Treasury yields moved higher, boosting the U.S. dollar in the process. If growth doesn’t moderate, the Fed may be compelled to deliver additional tightening later this year to prevent inflationary pressures from reaccelerating. These expectations could keep yields biased to the upside, especially if upcoming CPI and Core PCE results show price stickiness.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

US DOLLAR AND TREASURY YIELDS CHART

Source: TradingView

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0