US Dollar (DXY) Price, Chart, and Analysis

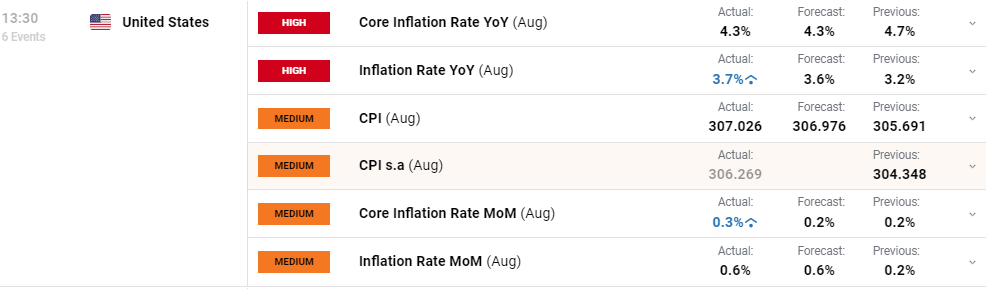

Annual US headline inflation rose for the second month in a row, while core inflation fell for the fifth consecutive month, leaving Fed officials caught between two readings.

Headline inflation rose due to higher gasoline prices (+10.6%) which accounted for over half the increase, while the shelter component rose for the 40th consecutive month.

US Bureau of Labor Statistics – Consumer Price Index Summary

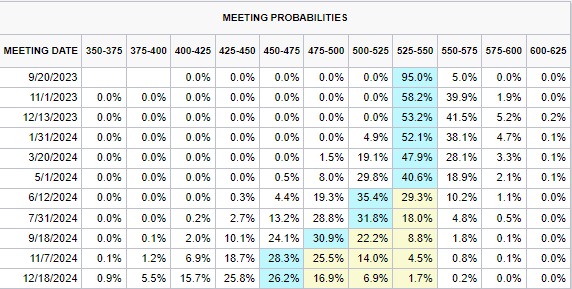

CME Fed Fund Probabilities are now indicating a slightly higher possibility of a Fed hike between November and January this year.

Recommended by Nick Cawley

Traits of Successful Traders

The US dollar barely moved on the release with a range of dollar-pairs brushing off the release. GBP/USD continues to change hands around 1.2470, marginally higher on the session after a weak GDP report earlier today fueled fears that the UK economy is stagnating.

GBP Breaking News: UK Growth Contracts Leaving the Pound on Offer

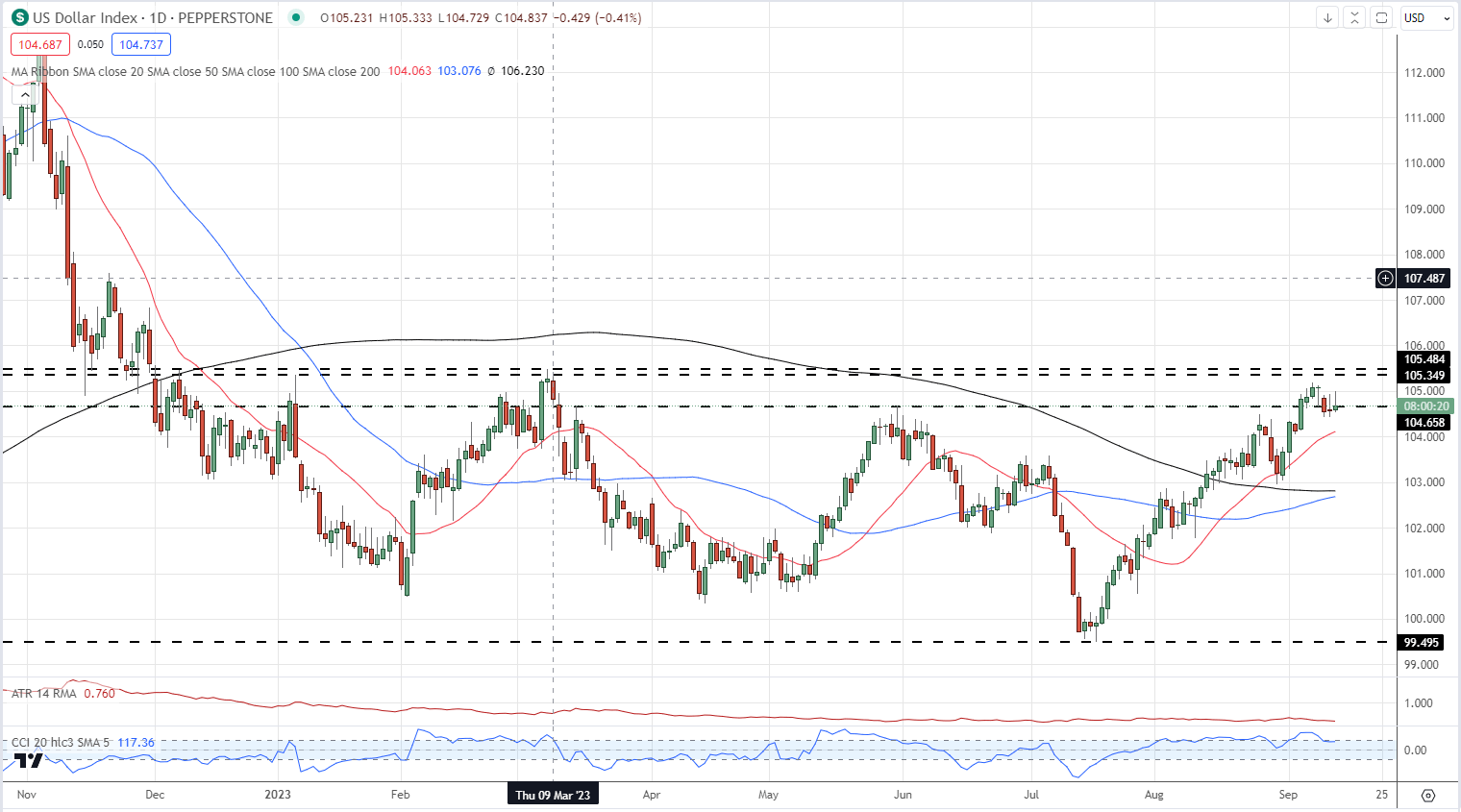

The US dollar is flat and stuck in a short-term trading range between 105.13 and 104.43. The greenback is closer to support and a break lower would open the way to 104.10 (20-dsma) and then 104.00 big-figure support. Neither of these is likely to hold a concerted push lower. Resistance is seen between 105.35 and 105.48.

US Dollar (DXY) Daily Price Chart – September 13, 2023

Chart via TradingView

The Federal Reserve will announce its latest policy decision next Wednesday and explain its decision further at the press conference afterward. The Fed is fully expected to leave interest rates untouched but the language used by chair Powell will likely be the main driver of any price action. If the Fed do ‘proceed carefully’ when looking at any additional rate hikes, as chair Powell remarked at last month’s Jackson Hole Symposium, then further hikes will be very data dependent.

For all market-moving data releases and economic events see the real-time DailyFX calendar

Recommended by Nick Cawley

Trading Forex News: The Strategy

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0