US Dollar Up as Oil Soars, Nasdaq 100 Dips Pre-US CPI

[ad_1] US DOLLAR, NASDAQ 100 FORECAST: The U.S. dollar, as measured by the DXY index, rebounds after steep losses at the beginning of the week In contrast, the Nasdaq 100 takes a turn to the downside, unable to build upon its gains from Monday on fears higher oil prices will keep the Fed on its

[ad_1]

US DOLLAR, NASDAQ 100 FORECAST:

- The U.S. dollar, as measured by the DXY index, rebounds after steep losses at the beginning of the week

- In contrast, the Nasdaq 100 takes a turn to the downside, unable to build upon its gains from Monday on fears higher oil prices will keep the Fed on its toes

- The August U.S. CPI report will steal the spotlight on Wednesday, setting the tone for the U.S. dollar and risk assets in general the near term

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Forecast: How Will US Inflation Data Impact Yields and USD?

The U.S. dollar, as measured by the DXY index, rebounded moderately on Tuesday after suffering its biggest daily drop in nearly two months at the beginning of the week. In afternoon trading in New York, the greenback’s gauge was up about 0.3% to 104.75, threatening to return to multi-month highs just as sentiment started to sour.

The dollar’s gains were driven partly by rising oil prices. Early in the day, WTI futures rallied more than 2%, breaking above the $89.00 threshold and reaching their highest level since November 2022. Higher energy costs could keep the Federal Reserve on its toes, ensuring that monetary policy remains restrictive for an extended period to force inflation down to the target in a sustainable manner.

Elsewhere, the Nasdaq 100 fell more than 0.75% to 15,350, reversing part of its advance from the previous session, dragged down by a pullback in technology stocks, which have rallied strongly in recent months and currently command lofty valuations despite numerous macroeconomic headwinds.

Navigate the forex market with confidence. Download the U.S. dollar quarterly outlook for a longer-term view of market trends and for insightful trading tips!

Recommended by Diego Colman

Get Your Free USD Forecast

Related: Gold Price at Make-or-Break Point with Trendline Resistance Up Ahead, XAU/USD Levels to Watch

Focusing on inflation, a clearer picture of the broader trend in consumer prices will emerge on Wednesday when the U.S. Bureau of Labor Statistics releases data from last month. This event holds considerable significance, as it could inject volatility into the financial markets and offer crucial insights into the short-term trajectory of major assets.

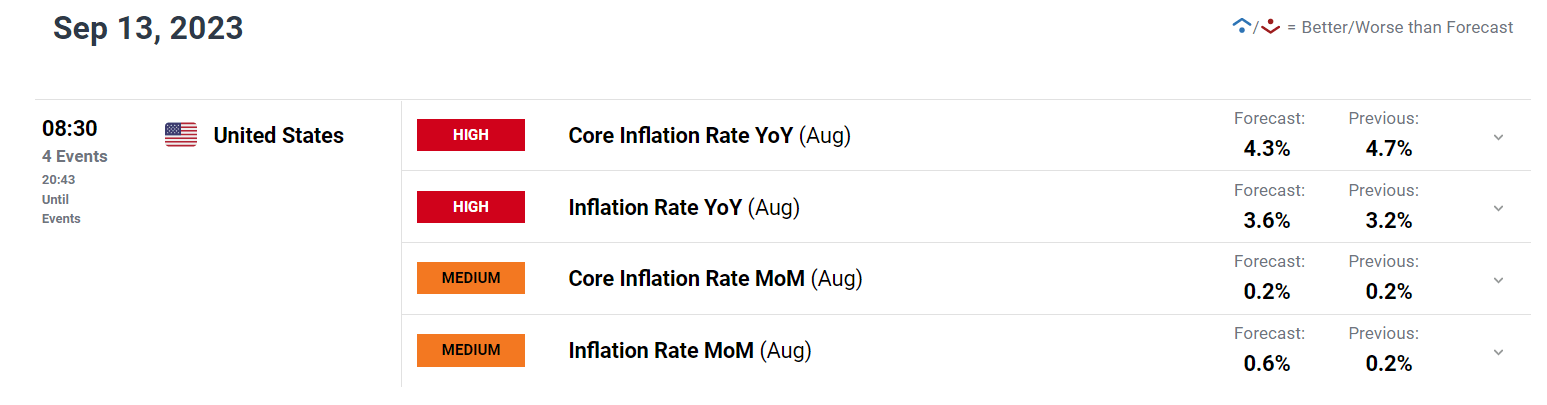

In terms of Wall Street’s projections, headline CPI is forecast to have risen 0.2% m-o-m in August, with the annual rate accelerating to 3.6% from 3.2% previously. Meanwhile, the core indicator, which excludes food and energy, is seen climbing 0.2% m-o-m, resulting in a 12-month reading of 4.3%, down from July’s 4.7%, a welcome development for the U.S. central bank.

UPCOMING US DATA

Master currency markets. Equip yourself with the knowledge you need for consistency. Download our guide for a comprehensive introduction to forex trading!

Recommended by Diego Colman

Introduction to Forex News Trading

Source: DailyFX Economic Calendar

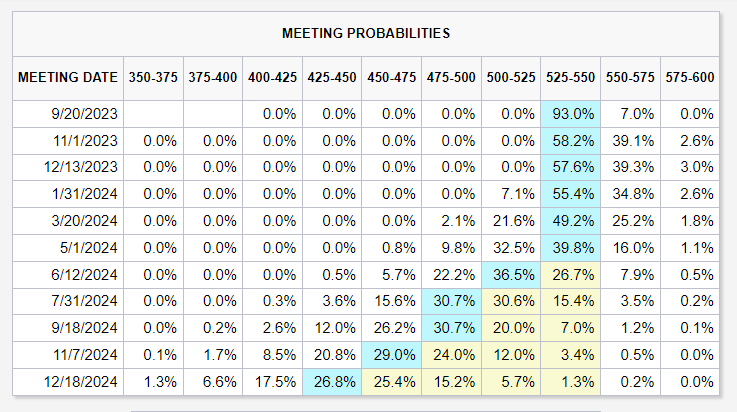

The Fed has embraced a data-centric stance and noted that it will “proceed carefully” after having already delivered 525 basis points of tightening since the start of the normalization cycle. This message has all but eliminated the likelihood of additional policy firming in September, but has left the door open for a quarter-point hike at the November FOMC meeting, with the probability of the latter event at ~40% (see table below).

FOMC MEETING PROBABILITIES

Source: FedWatch Tool CME

Given the Fed’s high sensitivity to incoming information, traders should carefully watch the CPI report, paying particular attention to underlying trend dynamics. That said, any upward deviation in the official data from consensus estimates could boost the U.S. dollar and undermine the Nasdaq 100 by pushing interest rate expectations in a more hawkish direction and reinforcing the case for “higher-for-longer”.

Conversely, in the event of muted inflationary pressures, the reverse scenario holds true. If the results for August inflation fall substantially below expectations, market participants might take action to unwind any remaining bets on further rate hikes in 2023, sending the greenback lower across the board and boosting the Nasdaq 100.

Stay ahead of important trends. Get the Nasdaq 100 quarterly outlook to start trading with more confidence and to improve your strategies!

Recommended by Diego Colman

Get Your Free Equities Forecast

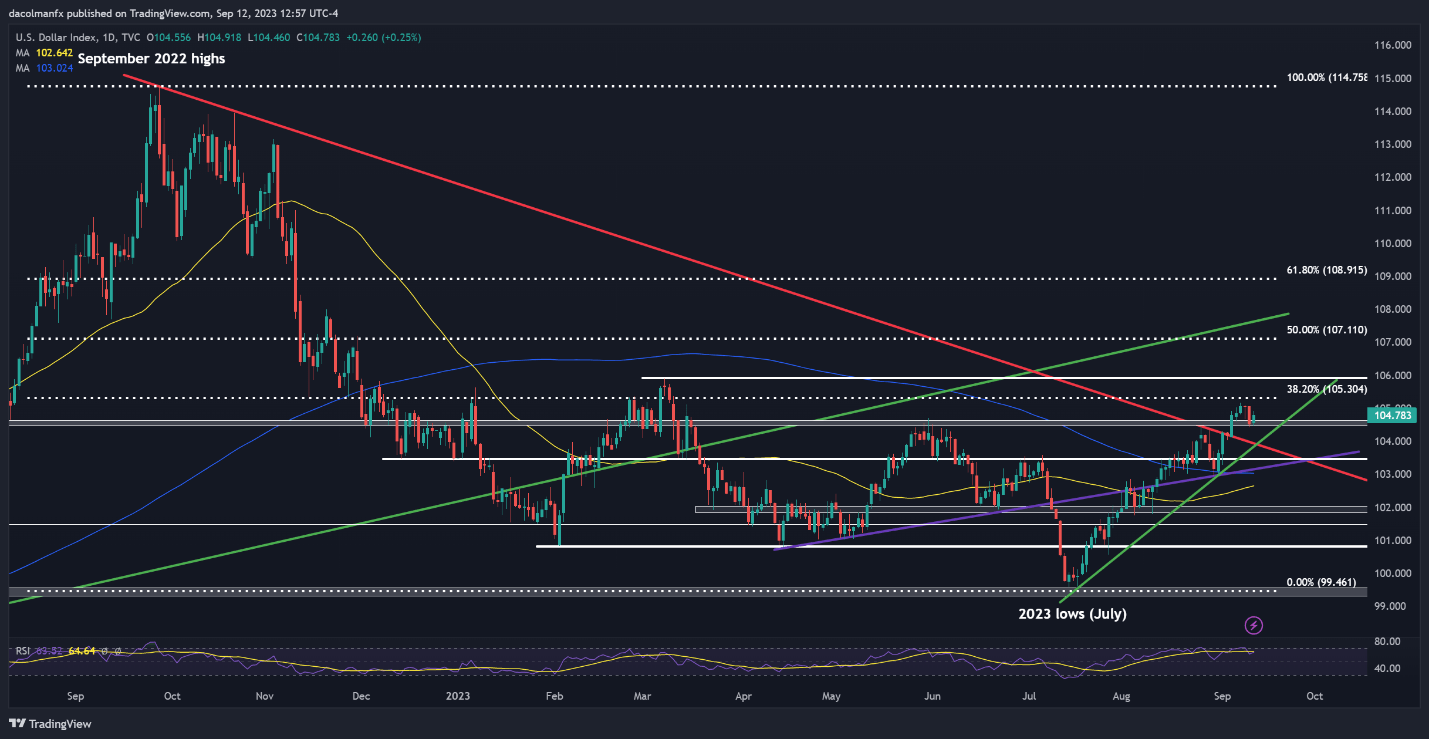

US DOLLAR INDEX (DXY) TECHNICAL ANALYSIS

The U.S. dollar broke out on the topside last week, breaching trendline resistance and besting its May peak decisively, before briefly setting a fresh multi-month high above the 105.00 handle.

With bullish momentum clearly dominating the market, the DXY index could sustain its upward trajectory for now, especially if it manages to stay above technical support at 104.50. Under this scenario, we might witness an advance toward 105.30, a noteworthy resistance created by the 38.2% Fibonacci retracement of the Sept 2022/July 2023 slump. Further strength could lead to a retest of the March highs.

On the contrary, if sellers regain control and trigger a retreat, initial support can be found at 104.50, followed by 103.95. On further weakness, the next significant support zone comes in at 103.50.

US DOLLAR (DXY) TECHNICAL CHART

U.S. dollar Index (DXY) Chart Prepared Using TradingView

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0